Fighting the Fear

By Thomas Poh - 18 Mar 2020

The world is being caught up in an unprecedented turmoil. What sparked off as a localised outbreak and turned into a global pandemic. Back on the 5th of March, I had highlighted in my market update to some on my assessment of the outbreak and its potential global impact. At that point, the Fed had already did their first 50bps cut. To re-cap, at that time,

1.The virus had turn epidemic, it would be a matter of time before it spreads globally.

2.And the countries that had witnessed the spread will impose a lock-down as a knee-jerk reaction.

3.The economic activities in those areas will nose-dive

4.Financial markets will crash

5.As a result, the respective governments/regulators will announce fiscal and monetarymeasures to try to alleviate the impact. (The Fed had already done their first 50bps cut)

All these had come true but at the point of the earlier commentary, what we did not know was the magnitude, pace and timing of the expected chain of events.

www.pzhconsultants.com

www.linkedin.com/in/thomaspoh/

Fast forward 2 weeks later, it is clear that this latest Black Swan event has surpassed even the Global Financial Crisis (GFC) in terms of its escalation speed, the breathe of industries that it has affected and the degree of the fear factor that it has created. Basically economic activity is a function of human activity and not much of that can happen in a lock-down scenario.

Going forward, what are the factors and considerations that we would need to monitor while we navigate the wild 5-10 percent swings in markets?

Going forward, what are the factors and considerations that we would need to monitor while we navigate the wild 5-10 percent swings in markets?

“the fear of the virus itself is something harder to manage”

1.The success in the containment of the virus.

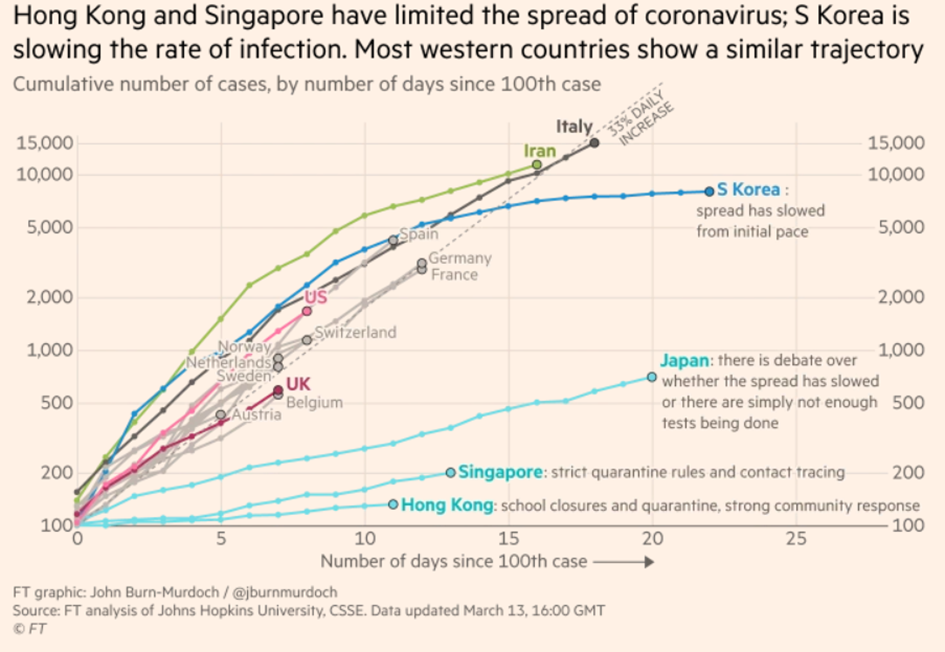

Thus far the mortality rate of the outbreak is still very low as compared to other known outbreaks. However, the fear of the virus itself is something harder to manage. So people need to know that the spreading uptrend has stopped before confidence can resume. From the experiences of what Asia has gone through so far, it has been a combination of testing, quarantine/segregation and legislative measures that worked to stem the spread. Therefore, we have to see if the other countries are able to follow suit.

Source : Financial Times

2.The search for a vaccine.

There are already a few reports of a vaccine being found, however, testing and bringing them to operational use may have to wait till Apr-Jun. This seems to be an eternality away but if/when such an OPERATIONAL vaccine does get announced, it will have an immediate impact on the psychic of the masses and the market. Keep an eye out on this news thread.

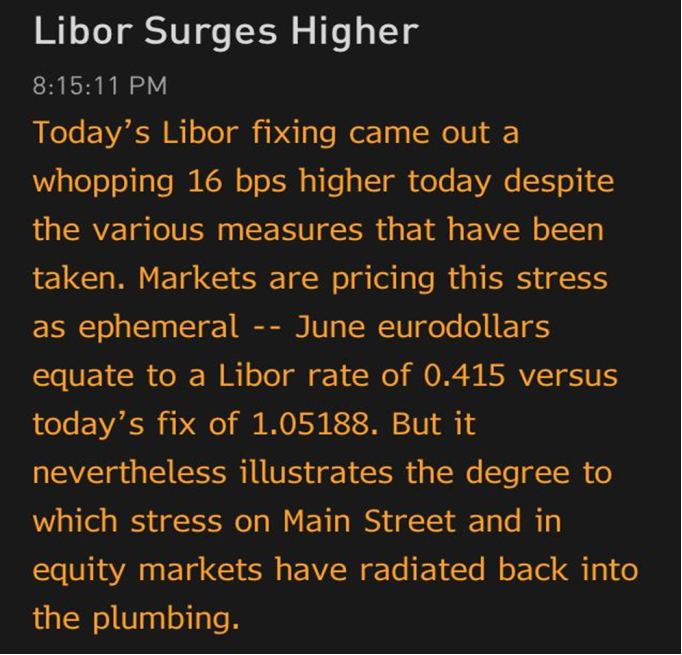

3.Liquidity and bankruptcy of companies

As with all crises, the companies that have poor balance sheets will be the first to feel the brunt. AB Inbev (the world largest brewery) drew down their entire USD9bio of credit lines this week. But not many corporations have that kind of life lines to tap on. The Fed has gone onto extending assets purchases covering the entire Treasury curve, commercial papers and even repos backed by certain stocks.

France is toying with the idea of nationalising key industries. However, not all companies can benefit from these measures. Therefore, we would need to really look under the hood to assess which company would have a better survival rate than the rest. Credit spreads are telling us things are going to get a lot worse before it becomes better.

“the measures will be even more extremes and they will err on the side of caution by keeping them around longer”

4.No moral hazards this time round

As highlighted above, governments and regulators are pulling all stops to quell these wild bush fires. The good news here is that unlike GFC, the measures will be even more extreme and they will err on the side of caution by keeping them around longer. In twist of fate, the central bankers got their wish granted when they were clamouring for governments to do more with fiscal measures as their monetary measures had been sorely over-extended prior to the outbreak.

5.Potential of an economic nuclear winter

The longer it takes to calm the panic, the longer the lock down will be. With that, mortal wounds will be dealt to many sectors of the economy. Given that it is so broad based and unprecedented, we should not rule out a sustained period of recession. If nothing else, we can expect Capex to slow to a grind toa halt as corporations go on the defensive.

So what are the trades and possible strategies?

“Stagger your entry levels and sizes, then let the market come to you”

1.Stagger your trades.

We do not know where the bottom will be but we know for sure that wild swings are here to stay. So stagger your entry levels and sizes, then let the market come to you.But be prepared to sit through at least 12-24 months.. From the lessons of GFC, valuations can come down a lot cheaper. The market can stay irrational longer than we stay liquid. Plan your entries accordingly

Above : Chart of S&P 500 index 1993-2020 (Source : TD Ameritrade - ThinkorSwim)

2.Go with equities indices.

This reduces the need to scrutinise individual companies’ balance sheet. This benefit is even more crucial than ever under the current scenario. Technology indices might be the preferred ones given that the immediate alternative for a lot of the activities is to go on-line.

3.Look under the hood and buy the good stuff

If you insist to go for single name stocks, look for companies with strong franchises and balance sheets. They will be the ones that are most likely to sit through this. As what Warren Buffet says, when the tide recedes, we will know who is swimming naked. Speculative stocks that look like a stretch during the best of times will be a struggle to gain supporters under current climate. Just because they are a lot cheaper now does not mean they will not be worthless next.

“Keep your trades simple”

4.Keep your trades simple

Avoid basis and spread trades. In fact these are the ones that will continue to tear as the original assumptions that support those strategies had evaporated.

Finally, I would like to offer a prayer to all that are fighting the disease. A salute to the men and women on the front line that are helping us to contain the spread, the medical staff that are literally risking their lives with every breath they take.

This too shall pass.

https://www.pzhconsultants.com/disclaimer.html

$SP500指数主连(ESmain)$$标普500(161125)$$纳指ETF(QQQ)$$NQ100指数主连(NQmain)$$道琼斯指数主连(YMmain)$$道指两倍做空ETF(DXD)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

好

You can download the PDF version on my website

www.pzhconsultants.com