Critical Trading Strategy Components – Part 1b

By Thomas Poh - 30 Mar 2020

上周,我向大家强调,成功的交易策略不单是判断正确的交易方向(请到此回顾上节课)。我运用了SHCOMP和HSCEI在2014-2016年之间的相对表现来说明选择正确的的标的产品会直接影响我们的交易策略结果。在以下解释产品的后续部分中,我将解释对股票做多(或做空)的方式不止一种。

Last week I had highlighted to everyone that there is a lot more to a winning trading strategy than just determining the direction of the trade (click here for link to Part 1a). The relative performances between SHCOMP and HSCEI from 2014-2016 were used to illustrate how the underlying product chosen can determine the outcome of the trade strategy.In this follow up section on Product, I will illustrate that there is also more than one way to go long (or short) on a stock.

www.pzhconsultants.com

The most obvious way to express one’s bullish view on a stock is to buy it.This is what we called a physical or cash trade.However, depending on the circumstances, this may not always be the best way to express one’s bullish view.Again, the choice of the Product is important here.So what are the other ways to have a long position?Using the purchase of S&P index ETF to go long the S&P index as an example, I will illustrate are 3 other ways to be go long S&P index besides buying the ETF.

表达对股票看涨观点的最明显方法是购买该股票。这就是我们所谓的实物或现货交易。但是,视情况而定,这不一定是表达看涨观点的最佳方法。同样地,产品的选择在这里很重要。那么拥有多头头寸的其他方式是什么?以购买标准普尔指数(S&P)ETF做多S&P指数为例,我将说明除了购买ETF以外,其实还有三种其他方法可以创造做多标准普尔指数的部位。

1) Buying the S&P Index Futures

"使用期货比购买现货股票有它的一定优势" - "There are quite a few advantages of using futures over the purchase of physical shares"

There are quite a few advantages of using futures over the purchase of physical shares. The lower futures margining allows us a much higher leverage factor than normal shares margining.Brokers normally allows only up to 50% margining for shares but for futures the leverage factor can be a lot higher because margin requirements can be as low as 7%.

Futures also tend to have longer trading hours which is important as it does means we can manage our risks and capitalise on news events generated opportunities even when the stock market are closed.For example, equities index ETFs can only be traded during the normal stock market trading sessions.However, equities index futures such as the S&P index futures are literally open for trading 24 hours 5 days a week.You can understand more about futures trading from my previous Tiger webinar here.

1)购买标准普尔指数期货

使用期货比购买现货股票有它的一定优势。较低的期货保证金使我们的杠杆率比普通股票交易高得多。经纪商通常只允许最低50%的保证金。但在期货交易,杠杆率可高得许多。这是因为期货的保证金要求可以低至7%。

期货的交易时间通常也比现货长。这让我们在新事件发生时,即使股市休市,还是可做风控与投机交易。例如,股票指数ETF只能在正常的股票交易时段内进行交易。但是,股票指数期货(例如,S&P指数期货)实际上每周5天,每天24小时开放。您可以从我以前的Tiger网络研讨会上了解有关期货交易的更多信息。

2) Buying S&P index ETF Call options on the stock

“期权提供了无限的上行利润,除了支付溢价之外,没有任何下行损失” - “Options ... offers unlimited upside profits with no downside losses”

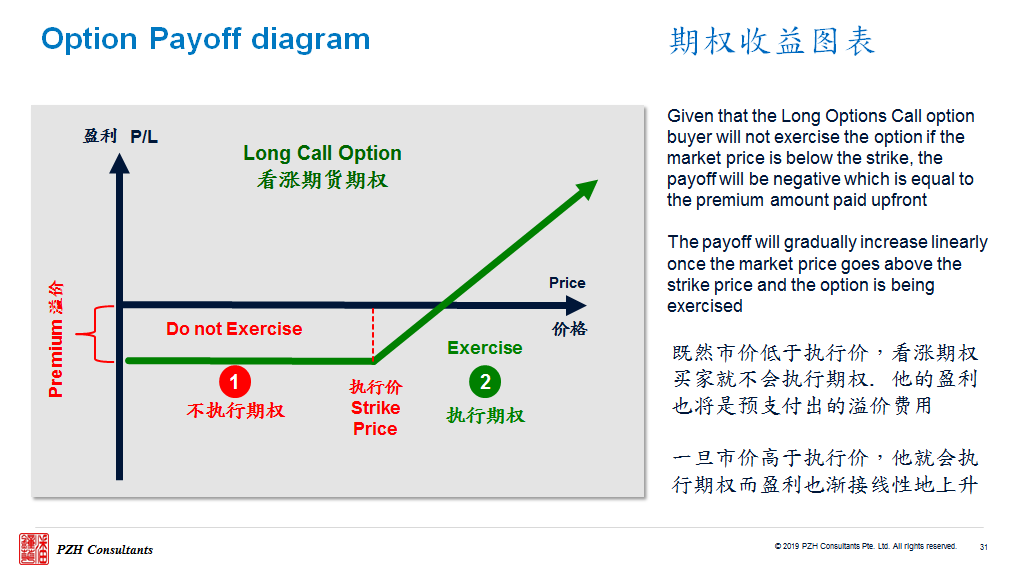

Buying call options gives us the right but not the obligation to own a stock at a pre-determined strike price on or before the option expiry.In return we will have to pay a premium for this right.In the event that the market is lower at the time of our option expiry, we can simply walk away and let the option contract expires.This is when the contract expires out-of-the-money.However, if the market is higher at expiry, we can purchase at the pre-determined lower price (the option is in-the-money).The advantage of owning an option is obvious especially when the market is very volatile and un-predictable as it did during this outbreak crisis.Therefore, options become very valuable as it offers unlimited upside profits with no downside losses except for the fixed option premium that we have paid for the option.

2)购买股票的标准普尔指数ETF看涨期权

购买看涨期权给了我们权利,但没有义务在期权到期日或之前以预定的执行价格拥有该股票。要享受该期权的权利,我们就必须偿还期权的溢价来购买该期权。如果市场在期权到期时,低与执行价,哪我们就不执行期权,让期权合约作废(称为价外状况)。但是,如果在期权到期时,市场价格高与执行价,哪我们可以以预定的较低价格购买该股票(称为价内状况)。期权提供了无限的上行利润,除了支付溢价之外,没有任何下行损失。所以拥有期权的优势显而易见,尤其是在高度波动性的市场情况下。

3) Selling S&P index ETF Put Options

“当市场经历极大波动时(如过去几周),此策略效果最佳” - “This strategy works the best when market is the most volatile”

We can also go long a stock by Selling Put options. Selling the put option gives the buyer the right but not the obligation to sell the stock to you at the pre-determined price on or before the option expiry. So you might ask why would you, with the intention of buying the stock want to give someone this optionality?How can this strategy be beneficial for you?The answer lies in the fact that as the seller of the option, you receive the option premium as compensation.As mentioned earlier, option prices go up dramatically during periods of high volatility.This means the premium receives from selling options are a lot higher.So selling Put options when the market is selling off allows you to own a stock at a pre-determined level (if it gets exercised) PLUS gaining the extra premium.Comparing this to just buying the stock outright, you do not enjoy that premium which could have reduce the breakeven cost of owning the stock.This strategy works the best when market is the most volatile as it was the last few weeks.Option prices went to historical highs.Seller of options executing this strategy collected high premiums while at the same time bought in the S&P index ETFs at levels which they were intending to buy in the first place.

3)做空标准普尔指数ETF看跌期权

我们还可以通过卖出看跌期权来操作做多股票的头寸。卖出看跌期权给与买方权利,但没有义务在期权到期时或之前以预定价格向您出售股票。因此,您可能会问为什么以想购买股票做出发点的目的,我们要给他人这种选择权?这个策略对您有什么好处?答案在于,作为期权的卖方,您会收到期权溢价作为补偿。如前所述,在高波动时期,期权价格会急剧上涨。这意味着从卖出期权获得的权利溢价要高得多。因此,在市场抛售时出售看跌期权可以让您以预定水平(如果指令被行使)拥有股票,并获得额外的溢价。与仅购买股票相比,您没有享受到该溢价。该溢价会降低拥有股票的收支平衡成本。当市场经历极大波动时(如过去几周),此策略效果最佳。期权价格创历史新高。执行该策略的期权卖方获得了较高的溢价,同时他们也在设定的价位买进了所想拥有的标准普尔指数ETF。

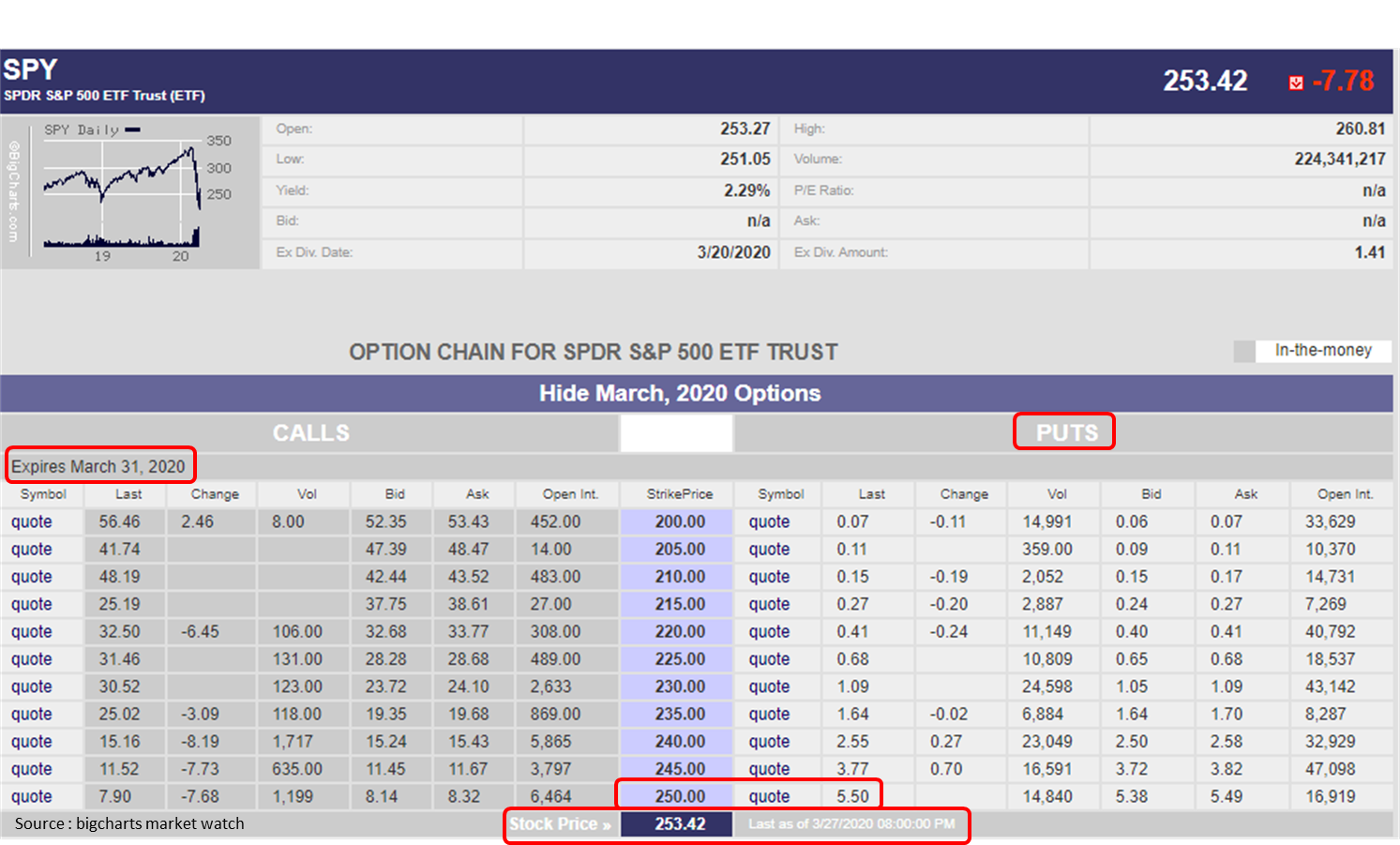

Using the last Friday’s closing prices to illustrate, selling a S&P ETF Put Option with a strike of $250 and expiring on 31Mar2020 will yield the seller a premium of $5.50.If at expiry, the market is lower than $250, the seller will be long the S&P ETF at $250 but at the same time collected an additional premium of 5.50.This effectively reduces his cost of buying the S&P ETF from $250 to $245.50.

以上周五的收盘价为例,2020年3月31日到期,250美元执行价的标准普尔ETF看跌期权的市场溢价是5.50美元。如果到期时市场价格低于250美元,卖方将以250美元的价格买入标准普尔ETF,也同时收取额外的5.50溢价。这有效地将他购买标准普尔ETF的费用从250美元降低到245.50美元。

Of course there is the chance that the market will be higher than $250 on 31 Mar 2020.In this situation, the seller will not own the S&P ETF and would have only collected the premium.However, as we have seen in the price action of the market over the last 4 weeks, a lot of buy orders were filled during the sell offs. Therefore, such a Sell Put Option strategy will result in having the same long ETF position but with an extra premium kicker collected.

The key here is to realise that there are more than one way to skin the cat.As traders, we must be able to use the most suitable product to express our view.It can related to choosing the correct underlying stock/index or using the correct trading product for any particular given stock.This in turn emphasizes the need for traders to constantly increase our product knowledge so that we will understand the functionalities, risks and rewards of each product.

In my next session, I will go on to explain the next Critical Trading Strategy Component after Direction and Product.To know what it is, stay tuned to my channel!In the meantime, good luck and happy trading!

当然,在2020年3月31日期权到期时,市场也可能会高于250美元。在这种情况下,卖方将不会拥有S&P ETF,而只会收取溢价。但是,正如我们在过去4周的市场价格走势中所看到情景,在抛售期间有很多买单被执行。因此,这种卖出看跌期权策略将导致拥有相同的多头ETF头寸,但也同时收取了额外的溢价。

这里的关键是要大家认识到有很多种方式来表达我们的市场观点。作为交易商,我们必须能够使用最合适的产品来表达我们的观点。这可能关系到选择正确的股票/标的指数或采用正确的交易产品来购买特定的股票。这又强调了交易商需要不断增加我们对的产品的意识,来解每种产品的功能,风险与回报。

在下节课,我将继续和大家介绍“交易策略的必备关键要素”。除了“方向”与“产品”之外,还有些什么?要知道,请继续锁定关注我的频道!同时,祝您好运,交易愉快!

$SP500指数主连(ESmain)$ $标普500ETF(SPY)$ $黄金矿业ETF(Market Vectors)(GDX)$ $黄金主连(GCmain)$ $WTI原油主连(CLmain)$ $道指反向ETF(DOG)$ $道琼斯指数主连(YMmain)$ $纳指ETF(QQQ)$ $NQ100指数主连(NQmain)$

$VIX波动率主连(VIXmain)$ $白银ETF(iShares)(SLV)$ $白银主连(SImain)$

******更多精彩文章来这里点阅:期货相关文章专题*****

All rights reserved - PZH Consultants Pte Ltd

www.pzhconsultants.com/disclaimer.html

精彩评论