消费股暴涨:可口可乐创历史新高!还有谁在涨?

同时,周一收盘,可口可乐逆势走强,创出历史新高:

据了解,近期不只是美股的消费股在走强,港股和A股的消费版块表现也不俗。

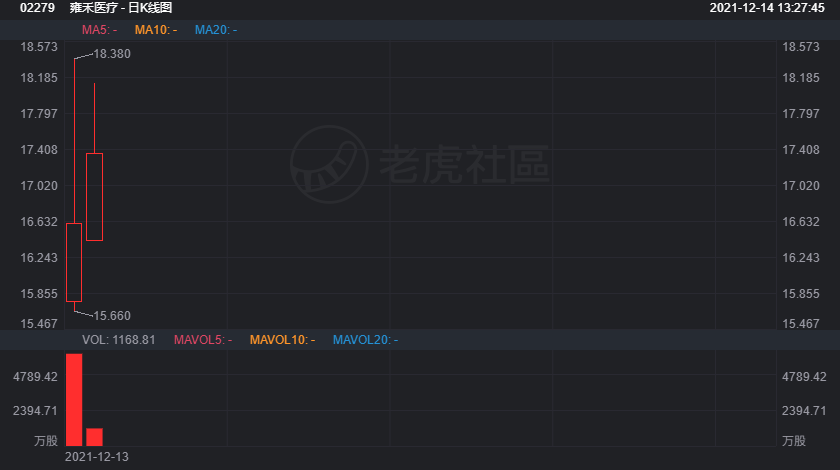

比如,弱市行情下,$农夫山泉(09633)$ 一直表现强劲:

本轮消费股上涨的主要逻辑还是疫情、产业链紧张、货币超发等问题导致的通胀。近日,美联储否定了此前的“通胀暂时论”,更是加强了这个逻辑。

……

最后,大家聊一聊:

- 你是否看好消费股的行情?你觉得可以买哪些?

精彩留言用户可获得888社区积分噢!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

827

举报

登录后可参与评论

In times of volatility, consumer stocks like Coca Cola are great buys! Coca-Cola is Warren Buffett's favourite stock for over 40 years! However if you have a limited budget, you can consider $Consumer Staples Select Sector SPDR Fund(XLP)$ which includes Coca-Cola, Pepsi, Walmart, Costco and Procter & Gamble. It is diversified and all wrapped up in a neat little bundle just like a Christmas present. Best of luck! 🎊🎉🎊

Nongfu Springs and Kweichow Moutai are market leaders in beverages in China. They are much loved and very popular. Most of all they are profitable. Buy them to keep long term as they have a wide moat and a long runway. 🚀🚀🚀🌙🌙🌙

没有买什么。

观望着