Introduction to J.O.I.T (1)

Jayce's Options Intraday Trade(J.O.I.T)

Who is this for?

■For beginners who want to learn the basics of intraday options trading

■For experienced traders who are still struggling to trade the open or intraday

Not recommended for:

■Traders who already have success in their own trading style*

*Every trader trades differently and I will just go over my own method and strategy on how I plan and execute trades, the reason for taking the trades, and when I exit the trades. For those who want to learn my trading style, please adjust accordingly to your own risk management and stress tolerance. Traders who are already making profits from their own style is not recommended to copy mine because it might affect what is already working for you.

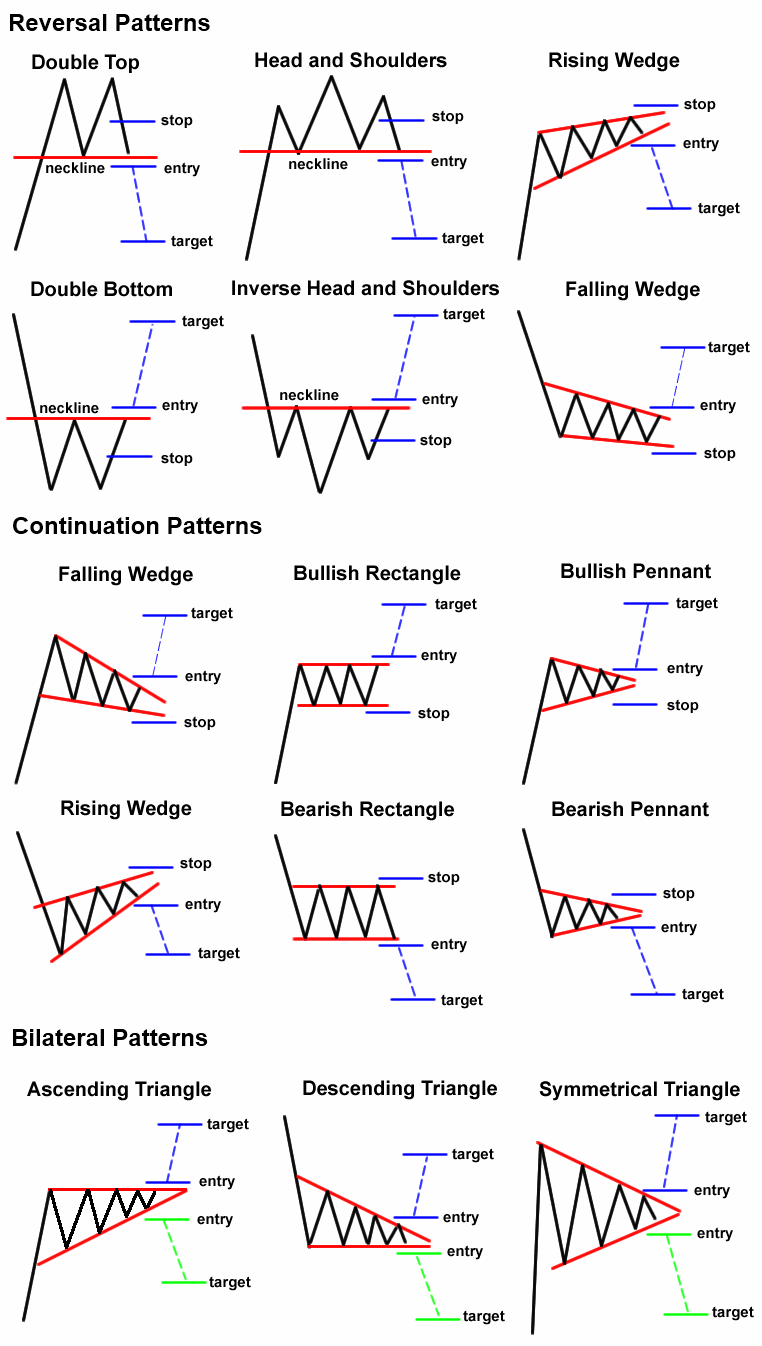

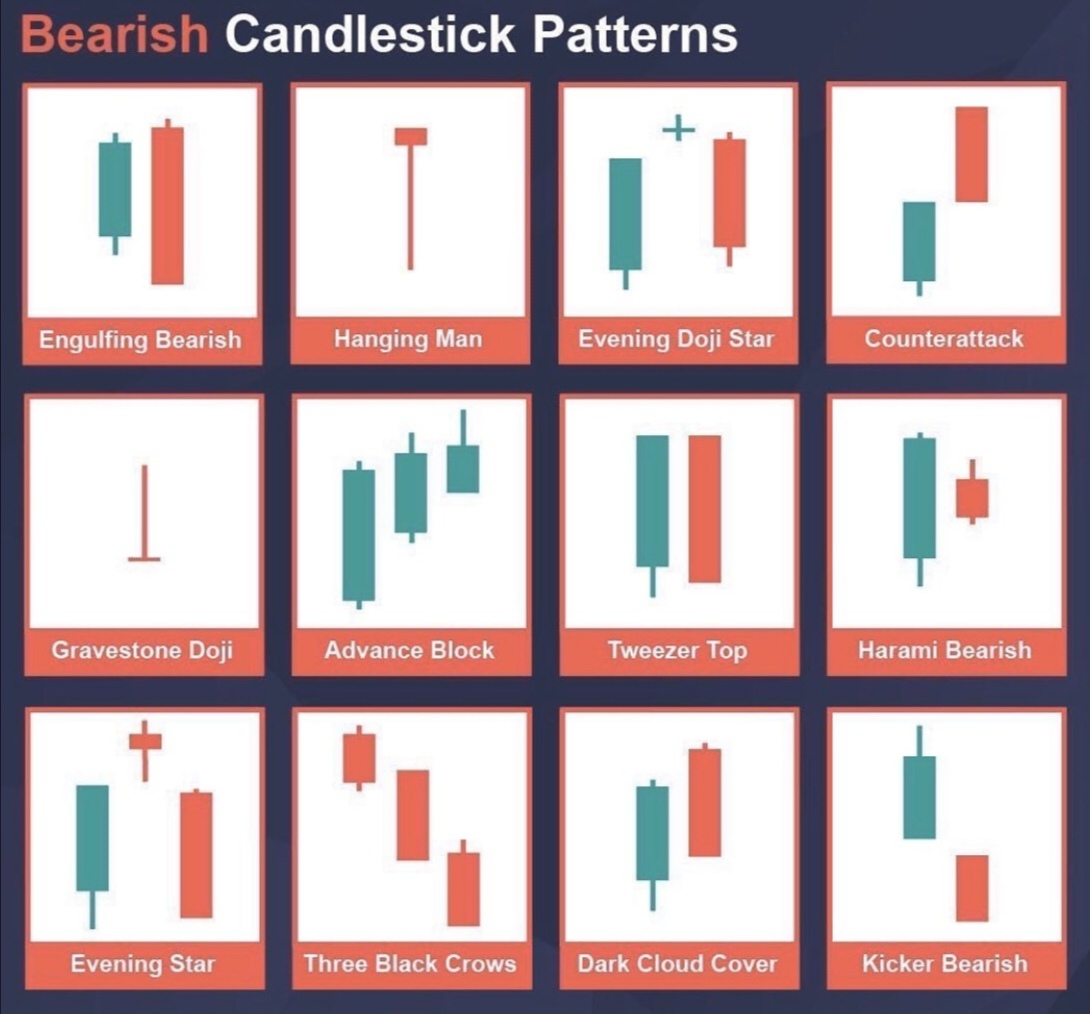

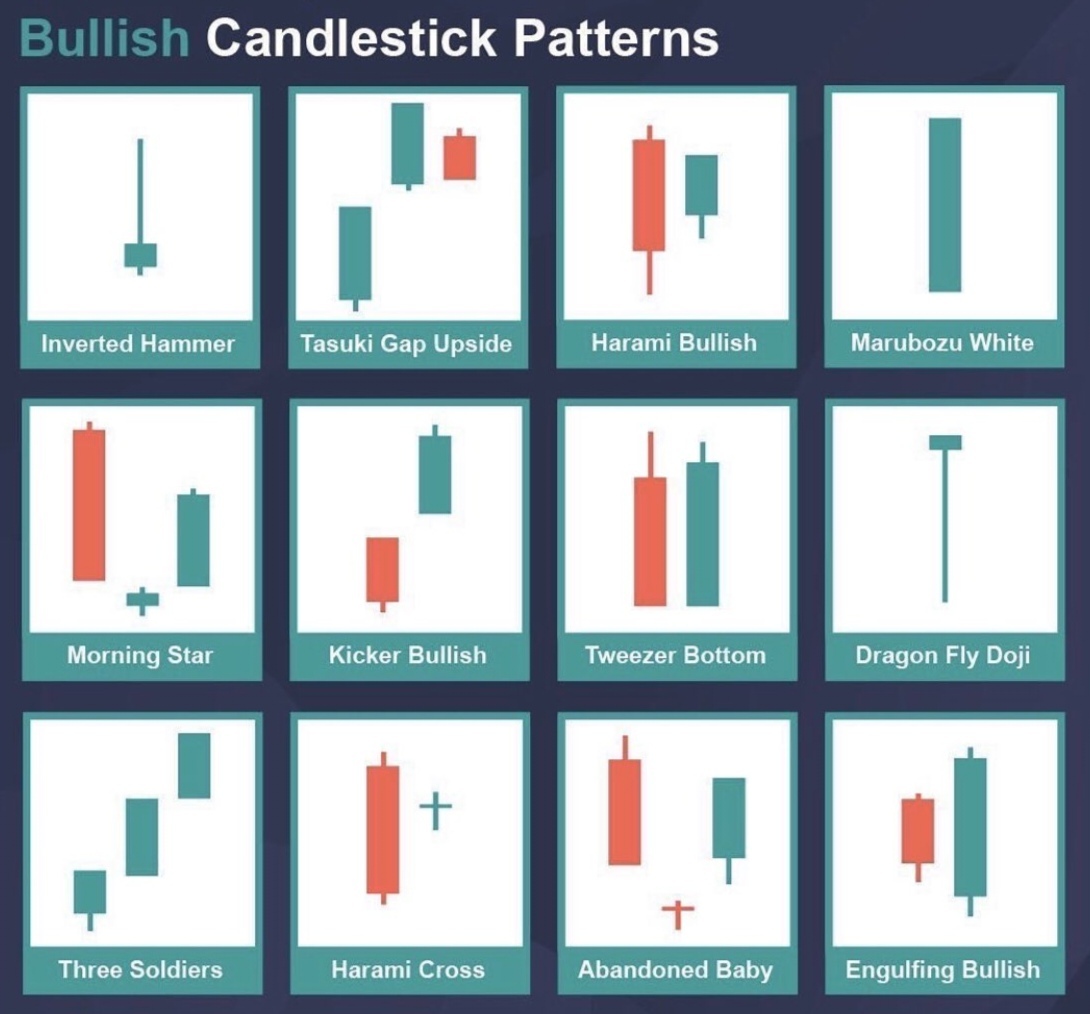

- I. Chart And Candlestick Patterns

Recognising patterns are the fundamentals of technical analysis trading. These are just a quick list to look out for if you want to be a successful trader.

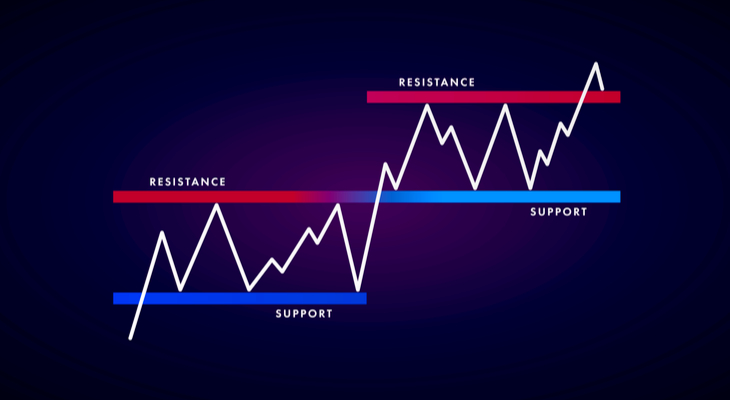

- II. Horizontal Support and Resistance

Stocks are just like humans. When humans overcome obstacles and push past our limits, we become better. Likewise, the stocks need to breakthrough resistance in order to grow. This resistance come from the sellers. Strong selling pressure will keep the price from rising, forming resistance level. Rising above this level means the buying pressure is stronger and more buying will take place as the short sellers try to close their positions.

When humans are feeling down, we need emotional support from other humans. Without the emotional support, we go into depression. For stocks, when they drop to certain price range, buyers start to step in, forming support level. Losing this level means the selling pressure is stronger and more selling will take place as the previous buyers cut their losses. Identifying the price ranges where buyers and sellers step in will help you tremendously in your trading.

- III. Premarket Trendline

The key trendline I look at for opening plays and I am surprised I have never seen anyone mentioned this before. Why this trendline works is because most of the volume in premarket and after hours are usually institutional trades. Some of these big money trade based on algorithms, which form patterns or trendline. This trendline can be used as resistance for put entry or breakout trigger for call entry. During the last 15 minutes before the market opens, we can determine if the price action is bearish or bullish.*

- When the price is far below the trendline, it is generally considered bearish.

- When the price is near the trendline, it is generally considered neutral.

- When the price is over the trendline, it is generally considered bullish.

*Note that this method only determine the opening, and not for the entire day.

- IV. Opening Range (OR)

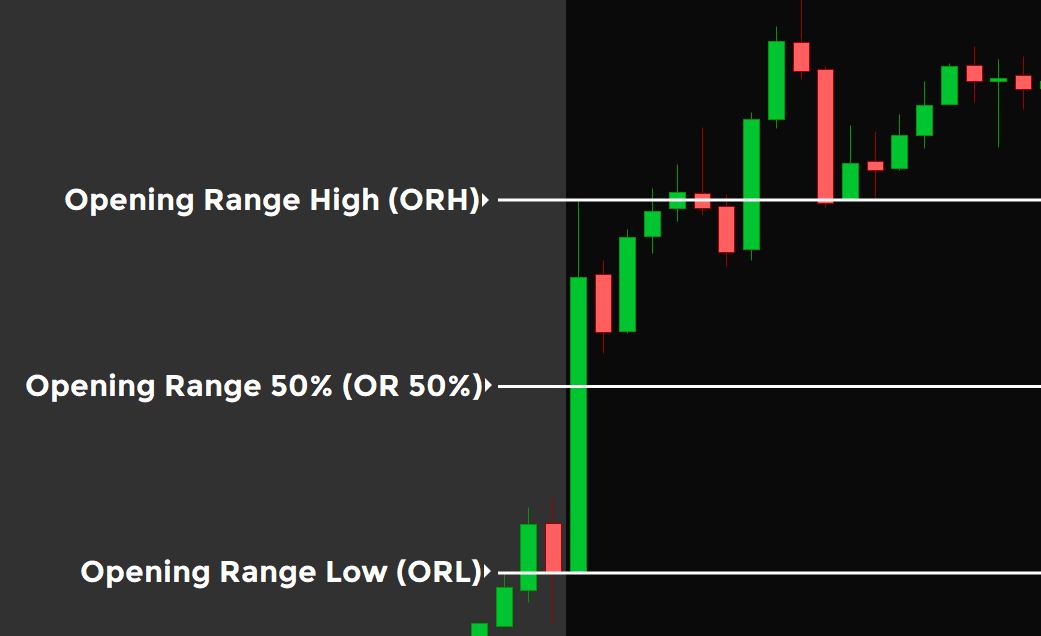

The opening range shows a stock's high and low price for a given period after the market opens. You can experiment with different number of minutes as the opening range and find what works best for you. As for me, I use the first 30 minutes.

Opening Range High (ORH) - The highest price of the opening range.

Opening Range 50% (OR 50%) - The middle of the opening range, usually acts as a pivot to determine if the stock is bullish or bearish.

Opening Range Low (ORL) - The lowest price of the opening range.

Opening Range Breakout (ORB) - When the price breakout of the opening range.

The OR is like a battle between the bulls and the bears. When the price breakout from the OR, it indicates that one side is stronger than the other. When it is above ORH, the bulls are in control and the general sentiment is bullish. When it is below ORL, the bears are in control and the general sentiment is bearish.

- V. Mindset/Belief

An important factor to make profitable trades is our mindset/belief. Everyone should hear before if you believe in something, you can achieve it. How then do you convince yourself to believe that you can do it?

Here's my method inspired from Atomic Habits by James Clear. My goal is not to make a profitable trade, my goal is to become a successful trader. Identify who you want to become. Once you give yourself the identity, you do not need to convince yourself to do what is needed. You are no longer pursuing behaviour change and you are simply acting like the type of person you already believe yourself to be. As you repeat the behaviour of trading with the identity of successful trader in mind, you will start forming habits of a successful trader, you will start to think and act like one. With this belief, it's no longer hard to do what is needed for a profitable trade. Focus on becoming that type of person and not getting a particular outcome.

In my next post, I will be covering 3 major types of trades I like to take.

- 1. Three Major Types of Trades

1.1 Premarket Trendline Breakout (PMTB)

1.2 30min ORB (Opening Range Breakout)

1.3 10% Reversal (10R)

$Facebook(FB)$ $Apple(AAPL)$ $Amazon.com(AMZN)$ $Netflix(NFLX)$ $Alphabet(GOOG)$ $Microsoft(MSFT)$ $Tesla Motors(TSLA)$ $NVIDIA Corp(NVDA)$ $AMD(AMD)$ $PayPal(PYPL)$ $Twitter(TWTR)$ $NASDAQ-100 Index ETF(QQQ)$ $S&P500 ETF(SPY)$ $Autodesk(ADSK)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 尔维斯肌肤·2021-09-26我上周赔了不少钱,昨天去算了一命,算命 的说我没有偏财运。2举报

- 老夫追涨杀跌·2021-09-26我一直很相信自己,但是就是一直赚不到钱。2举报

- 刀哥拉丝·2021-09-26就喜欢你这种稳稳的性格,做事踏实,赚确定的钱比较让人有安全感。2举报

- 搞钱树·2021-09-26嗯,进行盈利交易的一个重要因素,是我们投资人都应该有的的信念。2举报

- wltan7·2021-09-26Thanks for sharing! Keeping into my pocket list! And try it soonest :)1举报

- 福斯特09·2021-09-26非常棒的文章,有宏观有微观,有结果有方法,谢谢你。2举报

- 再涨一点点·2021-09-26看得出来大神的经验丰富啊,分析得很透彻1举报

- 不焦虑的小亨·2021-09-26自信不一定能赚到钱,但不自信一定赚不到1举报

- koolprofit·2021-09-26it's really a good share1举报

- bobohaha·2021-09-26谢谢大神的分享!收藏学习

![[正经]](https://c1.itigergrowtha.com/community/assets/media/emoji_035_zhengjing.133d7ee6.png) 1举报

1举报 - 帕特里克99·2021-09-27感谢分享,一看作者就是实操经验丰富的大牛,希望以后能多读到这样专业的文章1举报

- tamira·2021-11-11An excellent introductory article! Useful for beginners点赞举报

- MelChen·2021-11-09Great article... thanks alot点赞举报

- YCLim·2021-11-09good sharing thanks点赞举报

- Samluo·2021-09-26Thanks!2举报