U.S. stock futures were mixed in pre-market trading Thursday following a hawkish readout of minutes from the Federal Reserve’s last policy-setting Wednesday that hinted officials were poised to intervene more aggressively to curb inflation, sending the major indexes tumbling in the previous session.

Market Snapshot

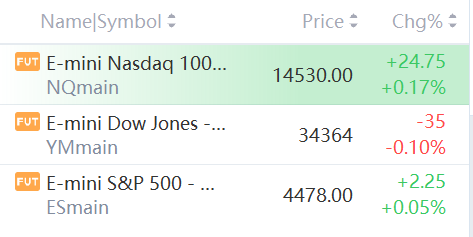

At 8:15 a.m. ET, Dow e-minis were down 35 points, or 0.10%, S&P 500 e-minis were up 2.25 points, or 0.05%, and Nasdaq 100 e-minis were up 24.75 points, or 0.17%.

Conagra – The food producer’s stock tumbled 5.5% in the premarket after issuing a weaker-than-expected forecast for the fiscal year ending in May. Conagra’s results are being hit by higher transportation and raw materials costs.

Levi Strauss – Levi Strauss beat estimates by 4 cents with an adjusted quarterly profit of 46 cents per share, and the apparel maker’s revenue also topped Wall Street forecasts. The company saw strong demand for its jeans, tops and jackets while successfully raising prices and cutting down promotions. Levi Strauss rose 3% in premarket trading.

HP Inc. – HP is surging 12.29% in premarket trading following news that Warren Buffett’s Berkshire Hathaway took an 11.4% stake in the maker of personal computers and printers.

Rite Aid – The stock tumbled 18.3% in premarket action after Deutsche Bank downgraded the drugstore operator to “sell” from “hold.” Deutsche Bank said Covid hastened the decline of the retail pharmacy segment, and there’s a possibility that Rite Aid may not be able to generate enough earnings to continue as an operating company.

Wayfair – Wayfair slid 4.1% in the premarket after Wells Fargo downgraded the stock to “underweight” from “equal weight.” Wells Fargo said the high-end furniture retailer will be hurt by waning demand, overly optimistic consensus estimates and other headwinds.

Rent the Runway – Rent the Runway stock jumped 3.9% in the premarket after the fashion rental company announced a price hike for its subscribers.

CDK Global – The provider of automotive retail technology agreed to be bought by Brookfield Business Partners for $54.87 per share in cash. The price represents a 12% premium over CDK’s Wednesday closing price.

SoFi Technologies – The online personal finance company’s shares slid 3.09% in the premarket after cutting its full-year outlook. The cut follows the White House announcing a student loan payment moratorium will be extended.

Teladoc Health – The provider of virtual doctor visits saw its stock gain 1.5% in premarket action after Guggenheim initiated coverage with a “buy” rating. Guggenheim said health care access is moving more toward digital interactions and that Teladoc has a broader service portfolio than other providers.

Market News

Buffett's Berkshire Hathaway Takes Stake Worth $4.2 Billion in HP

Berkshire Hathaway has accumulated an 11.4% stake worth $4.2 billion in HP Inc., the maker of personal computers and printers, according to regulatory filings late Wednesday.

The Berkshire holdings in HP were disclosed in two regulatory filings. A Form 3 filing as of April 1 showed that Berkshire owned 10% of HP, some 109.8 million shares.

Tesla Will Increase the Price of Some Model 3 By at Least $1,000

Tesla Inc on Wednesday raised the prices of some of its electric vehicles for the third time in less than a month in the United States, as the company grapples with inflationary pressure and logistical snarls.

The Model 3 Performance and the Long Range are now priced at $55,990 and $62,990. Elon Musk-led Tesla has left the price of the entry-level Model 3 unchanged at this time.

Meta Plans Virtual Currency, Creator Coins for Its Apps

Meta Platforms Inc is readying plans to introduce virtual tokens and cryptocurrencies to its family of apps with an aim to use such virtual tokens for rewarding creators and lending and other financial services, the Financial Times reported on Wednesday.

The move, which is reported to be in its early stages, comes as Meta grows its focus on services centered around the metaverse, a virtual environment where people interact, work and play.

Walmart's Flipkart Raises IPO Valuation Target To $60-70 Bln, Eyes 2023 Listing

Walmart's Indian e-commerce company Flipkart has internally raised its IPO valuation target by around a third to $60-70 billion, and now plans a U.S. listing in 2023 instead of this year, two sources with direct knowledge of the plan told Reuters.

Flipkart, which competes with Amazon.com Inc in India's booming e-commerce space, had earlier set an IPO valuation goal of $50 billion, Reuters has reported.

SEC Is Investigating How Amazon Disclosed Business Practices

Federal securities regulators are investigating how Amazon.com Inc. has disclosed some details of its business practices, including how it uses third-party-seller data for its private-label business, according to people familiar with the matter.

The Securities and Exchange Commission is probing how the technology giant—the largest U.S. e-commerce retailer and cloud-computing company—handled disclosures of its employees’ use of data from sellers on its e-commerce platform

Oil Tanker Groups Euronav And Frontline Agrees To Merge In $4.2b In All Stock Deal

Belgian oil tanker group Euronav and Oslo-listed rival Frontline have agreed to merge in an all-stock transaction valuing the combined firm at $4.2B on a potential stock-for-stock combination between the two companies.

Euronav's shareholders will own 59% of the combined tanker group while Frontline's owners will hold the remaining 41%, they said in a statement.