U.S. stock futures fell Wednesday morning to give back some gains from the previous session, as investors further considered remarks from Federal Reserve Chair Jerome Powell that the central bank was set on using its policies to bring down inflation still running at multi-decade highs.

Market Snapshot

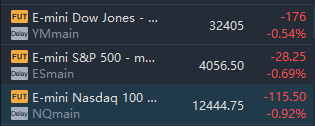

At 7:50 a.m. ET, Dow e-minis were down 176 points, or 0.54%, S&P 500 e-minis were down 28.25 points, or 0.69%, and Nasdaq 100 e-minis were down 115.5 points, or 0.92%.

Pre-Market Movers

Target – Target plummeted 22.1% in the premarket after the retailer reported an adjusted quarterly profit of $2.19 per share, below the $3.07 consensus estimate. Revenue and comparable-store sales beat forecasts, but like rival Walmart yesterday, higher costs ate into Target’s bottom line.

Lowe's – Lowe’s fell 2.9% in the premarket after the home improvement retailer’s quarterly comparable-store sales fell more than expected and revenue come in slightly below Street forecasts. Lowe’s beat bottom-line estimates by 29 cents with quarterly earnings of $3.51 per share.

Wal-Mart – Walmart fell another 1.9% in premarket action after tumbling 11.4% yesterday following its earnings miss. The retailer’s stock suffered its worst one-day loss since 1987.

Carrier Global Corporation – Carrier fell 2.7% in the premarket after Bank of America Securities downgraded the stock to “neutral” from “buy.” The firm said it is now more bearish on the residential HVAC market following a recent industry conference and said Carrier has the highest relative exposure of its peers to that market.

Penn National Gaming – The casino operator’s shares rallied 3.2% in the premarket after Jefferies upgraded the stock to “buy” from “hold,” noting the current stock price only assigns minimal value to Penn’s digital operation. Jefferies feels the unit could demonstrate good returns over time.

Shoe Carnival – The footwear retailer reported a quarterly profit of 95 cents per share, 9 cents above estimates, with revenue also beating consensus. Shoe Carnival also raised its full-year outlook. Shoe Carnival added 1% in premarket trading.

Analog Devices – The chipmaker earned an adjusted quarterly profit of $2.40 per share, 29 cents above estimates, and reported better-than-expected revenue. The company said it was able to increase output despite supply chain challenges, with demand remaining strong. Analog Devices added 1.9% in premarket trading.

Warby Parker Inc. – Warby Parker slid 2.1% in premarket trading after the stock was downgraded to “neutral” from “buy” at Goldman Sachs. Goldman said it sees a longer path to growth for the eyewear retailer, which reported lower-than-expected quarterly earnings earlier this week.

Container Store – Container Store surged 8.2% in the premarket after reporting better-than-expected profit and revenue for its latest quarter. The storage and organization products retailer also said it aimed to achieve $2 billion in annual sales by 2027.

Doximity, Inc. – Doximity plunged 14.5% in premarket action after the cloud-based platform for medical professionals issued a weaker than expected current-quarter revenue forecast. Doximity also reported better-than-expected quarterly profit and revenue.

Market News

According to iDropNews, Apple has finalized the date of its autumn launch event, which is scheduled for Tuesday, September 13.The most important product of the event will be the iPhone 14 series, including the 6.1-inch iPhone 14, 6.7-inch iPhone 14 Max, 6.1-inch iPhone 14 Pro and 6.7-inch iPhone 14 Pro Ma, which has been further confirmed by leaked cases and stickers.

Microsoft is launching a new initiative that will make it easier for European cloud companies to host Microsoft products like Windows and Office 365 apps. The company will also provide greater licensing flexibility for customers.

Tesla Motors has scheduled its second AI Day for Aug. 19, Musk said on Twitter, promising "many cool updates" at the event. The agenda will also include canvassing for great artificial intelligence, software, and chip jobs at Tesla, Musk said in response to a tweet.

The Russian subsidiary of Alphabet has filed for insolvency, according to a message posted on Russia's official registry Fedresurs on Wednesday. The subsidiary was "submitting a notice of the intention to declare itself insolvent (bankrupt)", the note said.

TENCENT posted revenue of to 135.5 billion yuan ($20.08 billion)in the quarter ended March, versus 135.3 billion yuan in the same quarter last year, and below an average analyst estimate of 141 billion yuan drawn from 16 analysts, according to Refinitiv. Profit attributable to equity holders of the company also fell 51%.

Boeing is about to test its reusable space capsule dubbed Starliner.The uncrewed launch is scheduled for Thursday, May 19, at 6:54 p.m. ET. As always with space launches, that timeline is weather permitting. If all goes according to plan, the craft will leave Earth from Space Launch Complex-41 on Cape Canaveral Space Force Station.

Target reported Q1 EPS of $2.19, $0.88 worse than the analyst estimate of $3.07. Revenue for the quarter came in at $24.83 billion versus the consensus estimate of $24.47 billion. Comparable sales grew 3.3 percent, on top of 22.9 percent growth last year.

Lowe's net earnings edged higher to $2.33 billion, or $3.51 per share, from $2.32 billion, or $3.21 per share, a year earlier. Same-store sales decreased 4% in the first quarter, compared with Wall Street expectation of a 2.5% fall.