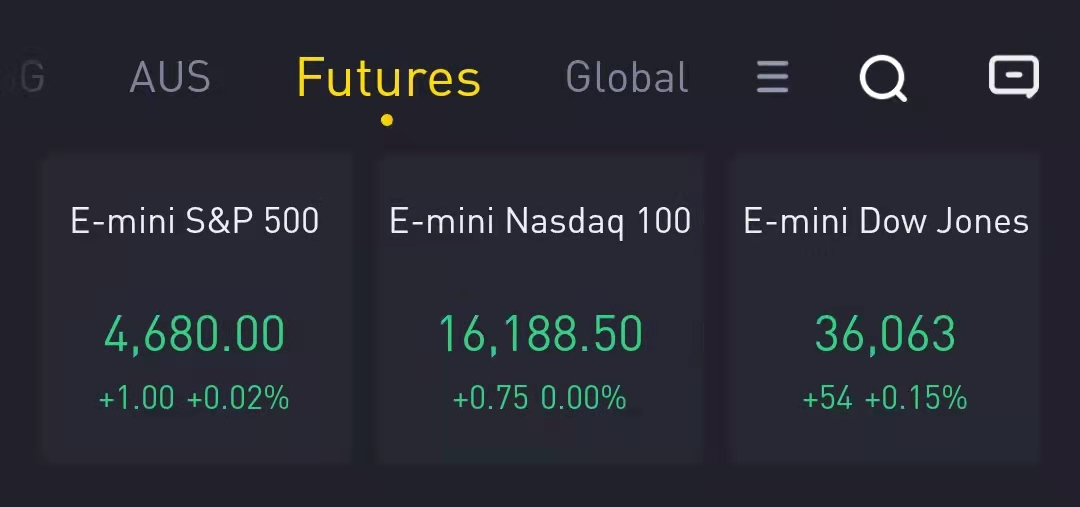

Stock futures gained Tuesday morning, with traders awaiting key new economic data on the state of the consumer after a couple of major retailers topped quarterly earnings results.

Investors are set to receive monthly retail sales data from the Commerce Department later Tuesday morning, which will help show how much momentum consumers had heading into the holiday shopping season. The print is expected to show retail sales rose by 1.5% in October compared to September, accelerating from the previous month’s 0.7% clip, according to Bloomberg consensus data.

As usual, the report will be closely monitored as an indicator of overall economic strength, given consumption comprises about two-thirds of U.S. economic activity.

Earnings results from retail juggernaut Wal-Mart underscored solid shopping trends among American consumers. The company's closely watched U.S. comparable same-store salesgrew 9.2% over last year in the third quarter, and by 15.6% compared to the same period in 2019, to exceed estimates for growth of 7%, according to Bloomberg consensus data. E-commerce sales also held up and grew by a better-than-expected 8%, compared to the 1.9% rise expected, even as more consumers returned to in-person shopping. Shares of Walmart rose in early trading following the report, and shares of peers including Target and Costco rose in sympathy.

Home Depot, meanwhile, also posted better-than-expected sales and earnings results as the company continued to see "elevated home improvement demand," CEO Craig Menear said in Home Depot's earnings statement. Comparable sales grew 6.1% compared to the 1.5% rise anticipated, and the stock closed in on a record high in pre-market trading.

These reports came at the tail end of what has already been an exceptionally strong earnings season. As of Friday, 92% of S&P 500 companies had reported actual results, and of these, 81% of them had reported better-than-expected earnings results,according to FactSet.

Stocks making the biggest moves in the premarket:

Rackspace Technology – Rackspace Technology beat estimates by a penny a share, with quarterly earnings of 25 cents per share. The cloud computing company’s revenue also topped Wall Street forecasts. It was Rackspace’s eighth consecutive quarter of revenue growth, and the company said it was well-positioned in a booming market. its shares surged 8.3% in the premarket.

Axon Enterprise, Inc. – Axon Enterprise, Inc. soared 23.5 % in premarket trading, after the maker of Tasers, body cameras and other public safety equipment reported much-better-than-expected sales and revenue for its latest quarter.

Royalty Pharma plc – Royalty Pharma plc rallied 7.8% in premarket trading, following news thatBerkshire Hathaway(BRK.B) took a new $475 million stake in the drug royalty purchaser.

Home Depot – The home improvement retailerreported third-quarter profit of $3.92 per share, 52 cents a share above estimates. Revenue also beat Street forecasts. Comparable-store sales were up a better-than-expected 6.1%, driven by demand for household tools and building materials. The stock rose 1.1% in the premarket.

Wal-Mart – Wal-Mart jumped 2% in premarket trading after beating on the top and bottom lines, and raising its full-year forecast. Walmart earned $1.45 per share for the third quarter, 5 cents a share above estimates, with comparable-store sales topping forecasts as well.

Advance Auto Parts – Advance Auto Parts earned $3.21 per share for its latest quarter, beating the $2.87 a share consensus estimate. The auto parts retailer beat on revenue and other key metrics. Advance Auto said it was seeing higher-than-expected inflation headwinds, however, and the stock fell 2% in premarket action.

Diageo PLC – Diageo PLC rose 2.4% in premarket trading after it issued stronger-than-expected profit and sales guidance for 2023 through 2025, reversing the spirits maker’s prior stance of abandoning specific numerical guidance.

Tesla Motors –Tesla Motors CEO Elon Musk sold $930 million in shares to meet tax obligations after exercising options to buy 2.1 million shares. Separately,JPMorgan Chase(JPM) is suing Tesla, accusing it ofbreaching a contract related to stock warrants.

Autoliv –Autoliv rallied 4.4% in the premarket, following the announcement of a new stock repurchase program of up to $1.5 billion. The maker of automotive safety systems also updated its growth target, expecting 4% to 6% growth per year in 2024 and beyond.

Lucid Group Inc – Lucid Group Inc surged 5.8% in premarket action after the electric vehicle maker reported more than 17,000 reservations for its “Air” sedan, up from 13,000 in the prior quarter. Lucid also confirmed its 2022 production targets.

Workday – The human resources software company added 2.4% in the premarket after UBS upgraded the stock to “buy” from “neutral,” on indications of stronger HR systems spending.