Eventual Recovery, Compelling Valuation; BUY

Target Price (Return): SGD1.20

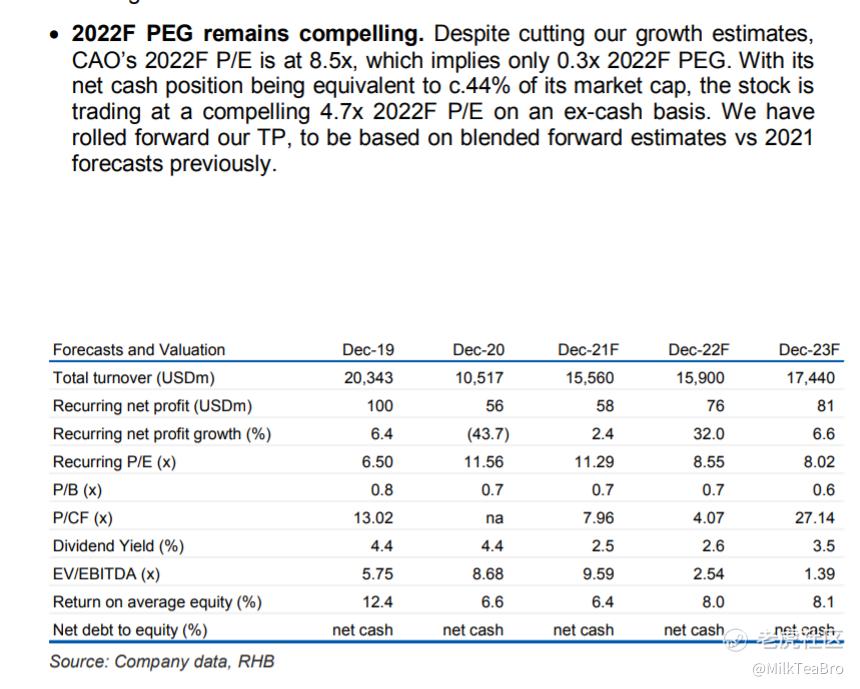

Significant recovery now pushed to 2022F. In China, amidst a rise in COVID-19 cases, the 7-day traffic average for commercial flights has now dropped below 2019 and 2020 levels (Figure 1). Now expect 2H21 earnings grow by a modest 2% YoY, as expect some improvement in GPM. While now expect 2022 profit to grow by 32% YoY to USD76m, Maintain the view that a return to pre-pandemic earnings could take 2-3 years, in line with the anticipated recovery in global aviation traffic.

炒股策略之:守株待兔,以逸待劳。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- MilkTeaBro·2021-10-11Hi Buddies, I got luck recently. $WILMAR INTERNATIONAL LIMITED(F34.SI)$ $SIIC ENVIRONMENT HOLDINGS LTD.(BHK.SI)$ $CHINA AVIATION OIL(S) CORP LTD(G92.SI)$ $HUTCHISON PORT HOLDINGS TRUST(NS8U.SI)$点赞举报