Should you Really be Investing in the Stock Market Right Now?

Last week, I mentioned we might be witnessing a potential market top because of the 3 signs showing up. However, confirmation via a change of character bar and spike of supply did not appear.

As the S&P 500, Nasdaq and the Dow Jones are all at all time high while the earnings reports from Apple and Amazon disappointed investors, should you jump in the stock market right now?

The short answer is it depends and I will show you what you might want to consider before making a decision.

Market Recap

First, let’stake a look at S&P 500 futures $SP500指数主连 2112(ESmain)$ and what’s happening last week.

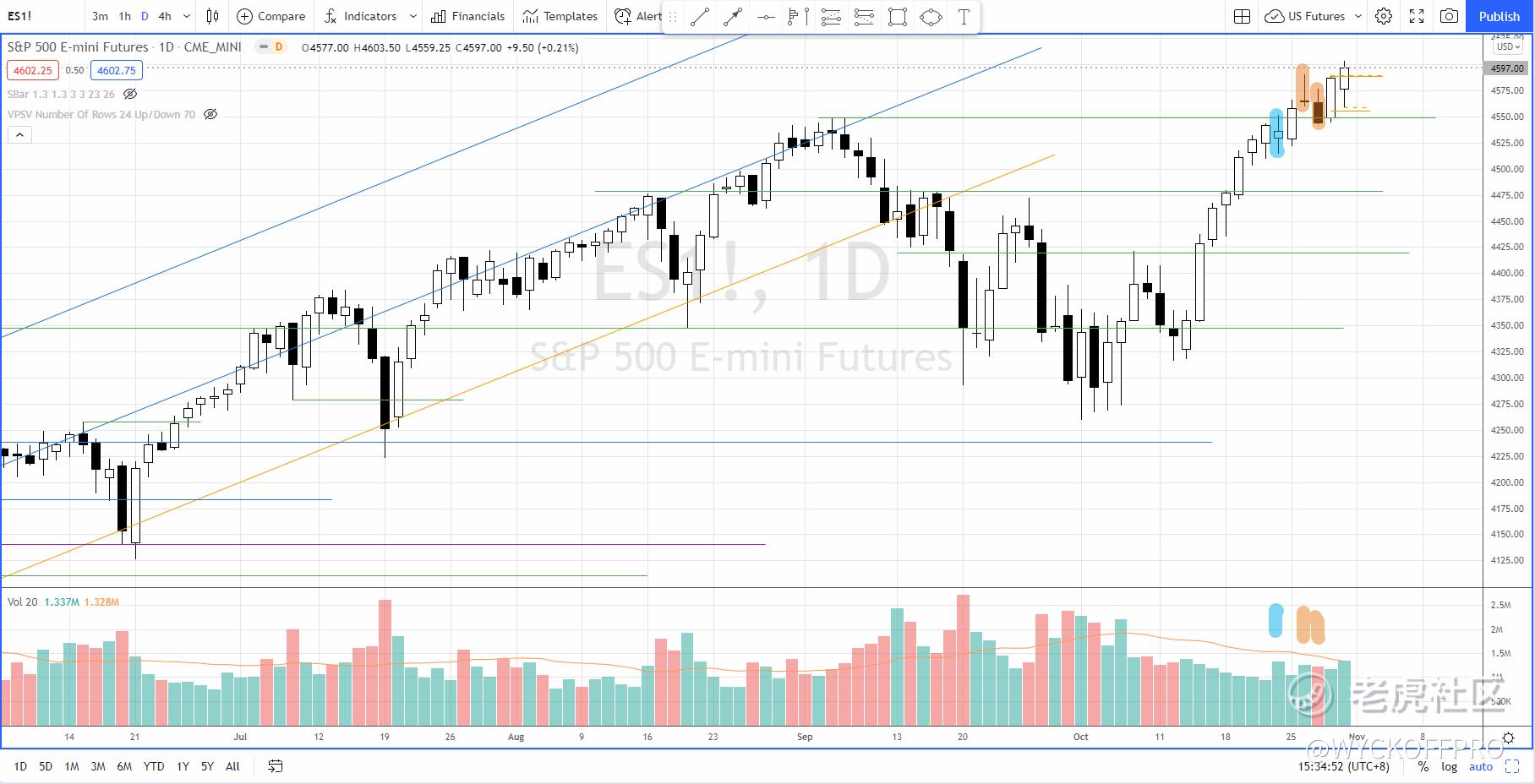

The first sign of emerging supply was on 22 Oct, as highlighted in blue where there is increasing of volume without upside progress as S&P 500 was testing the previous all-time high resistance at 4550.

On 25 Oct (Monday), S&P 500 broke and close at all time high. However, increasing of supply hit on Tuesday and Wednesday as highlighted in orange where bearish price action was in sync with increasing of volume.This was the time where the bear can take initiative to overwhelm the bull.

Yet, there was no follow through and commitment to the downside. Just after a test of the axis line (where the resistance-turned-support), S&P 500 absorbed the supply on Thursday and once again close at all time high on Friday.

In short, there is still no excessive supply to kick start a pullback yet.

How far can S&P 500 go?

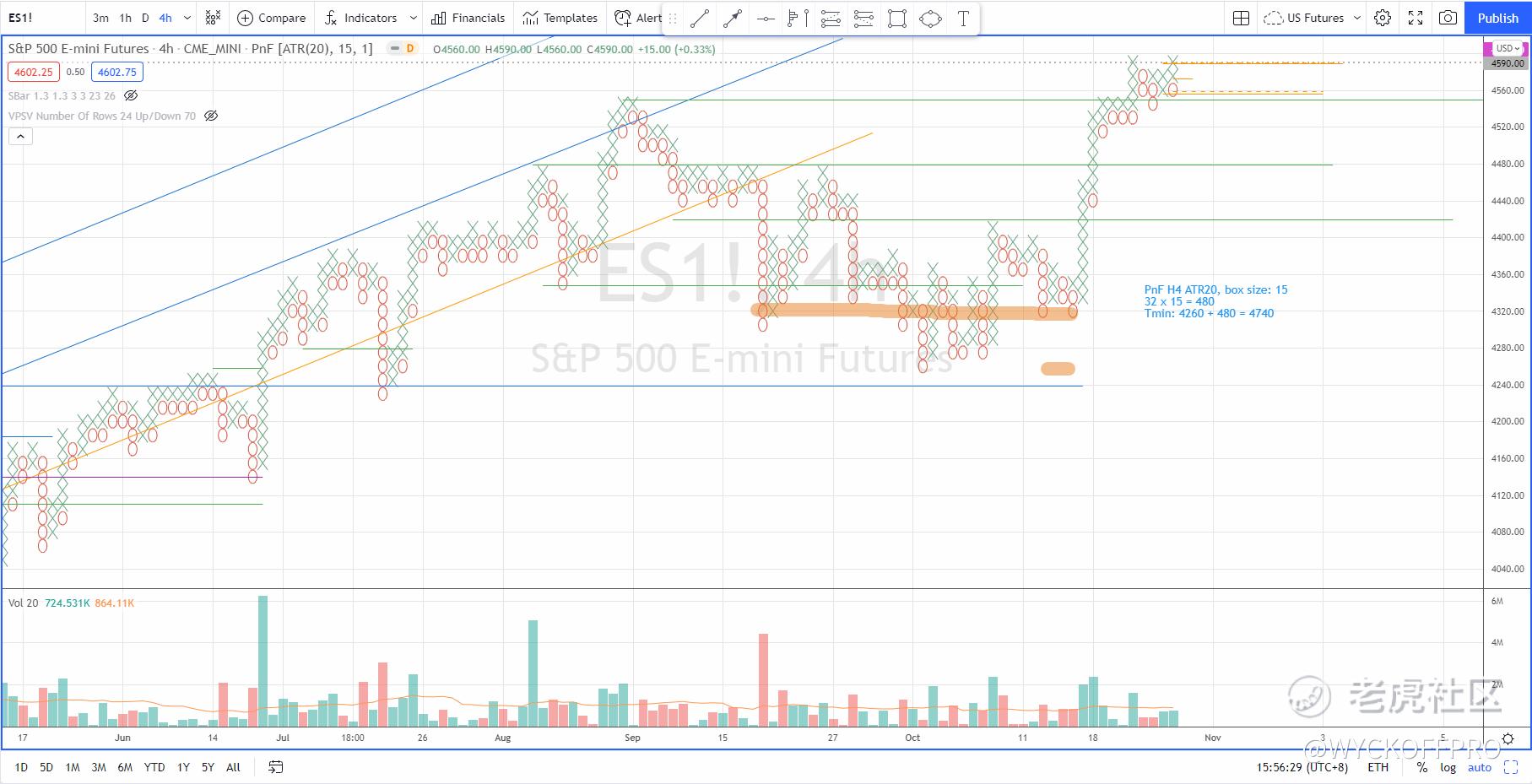

Based on Point & Figure price target projection as shown above, there is a minimum target of 4740, suggests that there is still enough fuel in the tank for more upside ahead for S&P 500.

From the analysis, the bias of the market direction is still up until emergence of excessive supply and a change of character shows up.

Ready to buy? Things you need to consider

Every successful trader or investor have a plan and they do stick to it. If you are an investor who only pay attention to the intrinsic value of a stock, market timing might not be that relevant to you since the investing thesis is likely to buy the stock at price with a safety margin and wait till the stock materializes at least to its intrinsic value (and beyond).

For traders (both short and long term), the trend of the broad market is up and it is time to focus on outperforming sectors (e.g. XLK, XLY, XLF, XLE) and stocks in order to beat the market.

Follow your trading plan (including entry, stop, % of risk taken and position size) and execute when the setup is triggered. Next, you can just sit back, relax and manage your trade according to your trading plan to maximize the profits and limit the losses.

If you are wondering what if your analysis, execution or trade management was wrong? No matter which part goes wrong, you are at least protected by the risk you have set before you enter a trade, which is the amount you are willing to lose when you are wrong. So, risk management is the key and you will especially appreciate it during bad time.

Do think about your trading style, timeframe and risk appetite before you consider to start trading or investing in the stock market now.

Safe trading. If you are day trading the US futures or swing trading for Malaysia and US stocks, do check out my YouTube Channel: Ming Jong Tey for additional videos and resources.$阿里巴巴(BABA)$ $小鹏汽车(XPEV)$ $英伟达(NVDA)$ $苹果(AAPL)$ @Tiger Stars

Further Reading

3 Signs That the Stock Market could be Topping Out

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- BrienD·2021-11-01Could you just tell me what stocks to buy? 😂😂 Not an option trader, no use to know which direction the market will go1举报

- dropppie·2021-11-01For people like me with a very high risk appetite... just YOLO in the Trump stocks! 😂😂😂🔥🔥1举报

- Leoopl·2021-11-01So what do you think will the market react to Federal Reserve tapering? 🤔1举报

- Tracccy·2021-11-02Risk management is indeed very important, but it is difficult for individuals to establish a reasonable risk management system, so do you have any good suggestions?🧐4举报

- AdamDavis·2021-11-04I will learn investment all my life. trade what I see, not what I think. making plans before trading. stable, hungry, profit. 💎👋2举报

- Tiger_story·2021-11-02quite a lot of reasonable analysis. but i always think that investment need some luck, maybe 40% which is not a small number. so i do not like too much anaysis. just follow the trend and wish me good luck 🤞2举报

- LesleyNewman·2021-11-02Your analysis makes a lot of sense. I used to focus on the intrinsic value of stocks and prefer long-term investment. Now I have new ideas and look forward to your update.2举报

- JackPowell·2021-11-02Why not, bro, now that inflation is getting worse, it is a good choice to invest in some high-tech industries, but it is not a wise choice to put it in your hands.🤔1举报

- extractoi·2021-11-02I am a short-term trader and rarely look at the intrinsic value of a stock, depending on the market timing to decide whether to buy or not.1举报

- BlancheElsie·2021-11-02That's right. I like APPL, but it's falling recently. Do you think I should go short? Are there any good stocks to recommend?😊1举报

- pangngk·2021-11-01Thanks for the well-written article. Very informative. Everyone should have a plan and stick to it! 👍👍1举报

- stomachooo·2021-11-01"risk management is the key", very well said 👍 the market should not be a casino1举报