Will The Rising Interest Rate Crash the Stock Market?

Last Friday the US 10 year treasury yield (TNX) spiked to 1.60, the highest since July 2021.

Based the daily chart above, $微型10年美债收益率主连 2110(10Ymain)$ broke out from the accumulation structure 2 weeks ago and tested the axis line (where the support-turned-resistance) at 1.5 followed by a shallow reaction.

Last week, TNX was on the move again and broke the swing high resistance at 1.5 and close at the recent high at 1.60.It is likely to test the previous swing high formed in March 2021 at 1.7 (as shown in the blue box).

While the10 year yield is on the rise, how does it affect the stock market? Let’s look at the NASDAQ 100 futures (NQ).

NASDAQ 100 Futures (NQ)

Firstly, why look at NASDAQ? While the 10 year yield (TNX) is rising, NASDAQ (plus other growth stocks) is generally under pressure as they tend to have an inversely proportional relationship.

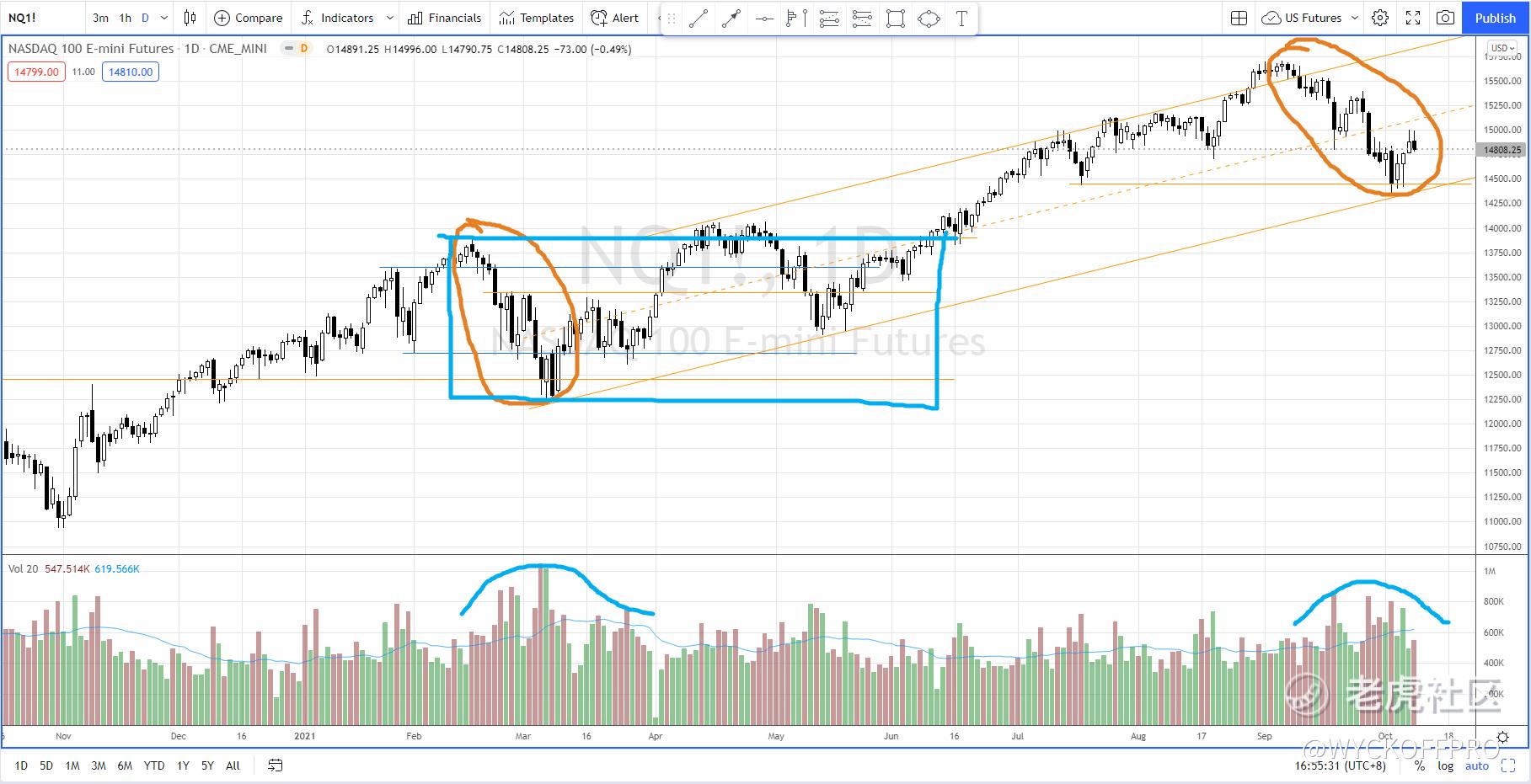

As shown in the daily chart above, Nasdaq is still in a very well defined long term up channel since Mar 2021. So long term trend is still up.

The down wave started in 20 Sep coincided with the breakout of the 10 year treasury yield (TNX) confirmed the inversely proportional relationship between Nasdaq and the TNX.

The characteristics of the the current down wave (which is still unfolding) is similar to the one in Feb 2021 while the supply level is slightly lower (as circled in orange). Last Wednesday (6 Oct) the bull finally showed some serious action which is reflected in the hammer price action and the spike of the demand. This is further confirmed on the next two days.

The bull is now given a chance to rally up to at least testing the supply zone at 15000–15200. We need to judge the quality of the coming rally. If the bull can take over from here on, we can expect a potential re-accumulation range like Feb-Jun 2021 (as boxed up in blue).

Instead of having a market crash, a re-accumulation is what I anticipate while the rotation is on-going to benefit the small cap (Russell 2000) as I mentioned in the past 3 weeks.

Let’s pay close attention to the characteristics of the price action (with the volume) in the coming week and to trade accordingly. Meanwhile, we canfocus on the Financial ETF as the 10 year yield is risingbecause there are quite a number of the stocks in a great position to start the markup phase.

Safe trading :) If you are day trading the US futures or swing trading for Malaysia and US stocks, do check out my YouTube Channel: Ming Jong Tey for additional videos and resources. $苹果(AAPL)$ $阿里巴巴(BABA)$ $特斯拉(TSLA)$ $英伟达(NVDA)$ @Tiger Stars

Further Reading

Failed Breakout in AAPL — Change is coming for Apple Stock (What should Investor and Trader do?)

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- stomachooo·2021-10-11Basically, most of the time, there's a crash, a rise in risk-free interest rates that hits the highly valued DCF stocks.28举报

- JuanJohnson·2021-10-11Not necessarily. U.S. interest rates rose earlier this year, and the stock market didn't crash much.25举报

- SidneyMike·2021-10-11我讨厌利率上升。真烦人。投资将是困难的。14举报

- catielover·2021-10-11利率上市肯定会让股市崩盘,看看年初发生了什么就知道了。9举报

- chenobserver·2021-10-12没有市场崩溃。只是一个应对通胀的策略,这将使市场更加健康。3举报

- YoungYun·2021-10-11it depends on the level of the rising and the market6举报

- Julio堂·2021-10-19股市总是新人和容易健忘的,但今年三月发生的事目前场内的人都还有印象,浇将也不会造成太大影响,而且随着疫情缓解和生息步进这也正常吧3举报

- 深情地与她对视了一眼·2021-10-14利率升,成本增,天台高,落地重。6举报

- catandbull·2021-10-11主要取决于哪个国家,美国肯定不是。5举报

- RaymondReed·2021-10-11Everyone's putting their money in the bank, and of course the stock market isn't doing well.5举报

- 云懿Red·2021-10-13总有办法的5举报

- senray·2021-10-13利率上浮肯定会影响投资人的心情,从而达到影响行为的目的2举报

- 平常心心·2021-10-25发发发1举报

- Ydy3000·2021-10-24好2举报

- 飞车手·2021-10-236663举报

- zjmting·2021-10-21已阅3举报

- In_s·2021-10-20will it?4举报

- 塔希提岛·2021-10-19..3举报

- 靓鸽·2021-10-19好2举报

- 锐哥来了·2021-10-18阅2举报