3 September 2021: Chinese Markets Update. Bears attempt! Will they succeed?

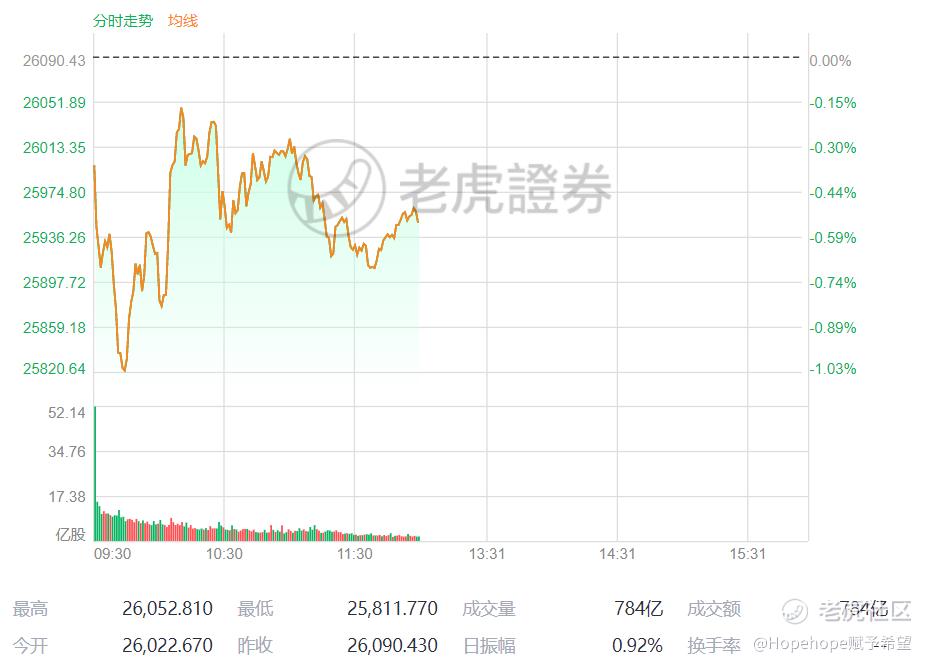

$老虎证券(TIGR)$ Chinese markets are not at its best this morning after reports on poor economic data showing a contraction of economic activity freaks out the Hang Seng spot this morning, which sees it dipping to below 26,000 points and is currently trading at around 25,950 points. Morning low saw it as low as 25,820 but is still considered a positive by me since it has not breached the 25,700 mark that I have been monitoring. Whether can Hang Seng spot find itself closing above 26,000 points today would be what I will be watching today. Keep following for more updates.

So far today, I am not particularly worried about the economic slowdown in China, of which the services sector showed a contraction rather than expansion. Why? This being my unique way of interpreting and what I can say is stock market doesnt behave exactly to the numbers on hand and one has to have a deeper level of understanding and inference to have a conclusion of the data on hand.

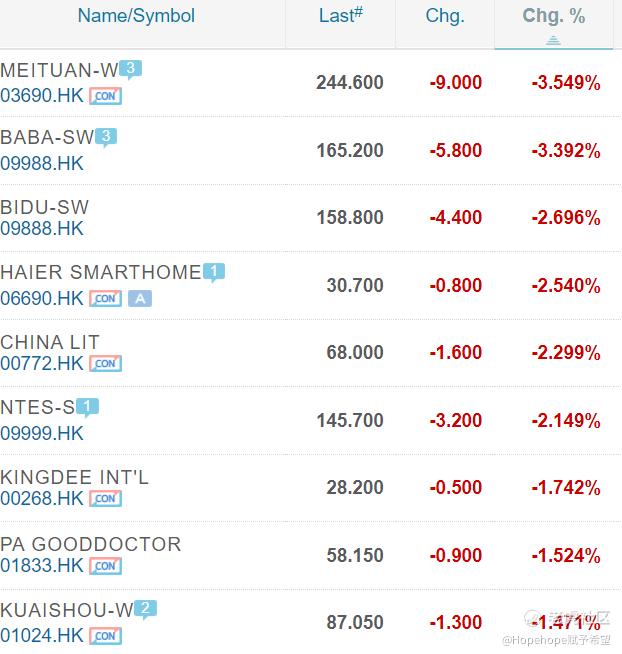

Hang Seng Tech wasnt trading that badly too though it did dipped by around 1% to below 6700 before coming back above 6700. For me, this is not a time to panic since a retracement is not uncommon after a few days of fierce rally bursting past 6,300 to above 6,900 to current point level of around 6734 level. Companies wise, Xiaomi lives up to my point of being a relatively resilient stock though people have been "scolding" it for being extremely flat in terms of price movement. $小米集团-W(01810)$ However, readers should note that Xiaomi did experience a significant jump from around 17 HKD to aroun 27 HKD within 1 to 2 months sometimes last year from what I remember. This is a time for Xiaomi to consolidate its share chips before finding a clear direction of price movement. Being optmistic over its long term developments, I have been buying the dip in Xiaomi from as low as 23.2 HKD all the way to buying it up to 27.5 HKD over the last few months. Will I be right? What I know is one needs patience when one is intending to buy Xiaomi. It is not the number one lover of institutional funds and in fact, there are a varying view on the target price of Xiaomi from below 20 HKD all the way to 40 HKD. For me, I maintain a 3 years view that Xiaomi has the potential to hit 60 HKD though it may experience pullback in prices due to market conditions. Current worries over Xiaomi is more a case of chips concern and brokerage firms wondered if chip shortage could cause Xiaomi sales to fall. Coupled with Honor brand mobile sets making a comeback, these pessimists did find any reasons not to love Xiaomi. However, Xiaomi is up slightly by around 0.6% this morning and is at around 25.45 HKD. Whether can Xiaomi move past 25.6 HKD strongly will prove critical to clearing one price barrier and bringing it to higher price level to around 26.6 HKD? Time will show the results though I am cautiously optimistic despite the group of naysayers.

For Shenzhen market, it is still trying to hold onto the 14,000 mark and it seems like today's market negative news did not do too big a harm of the Chinese stocks in Shenzhen. China has also released a positive news relating to the opening of Beijing stock exchange, which would cater to small and medium enterprises. This is consistent with China's goal and what China has been saying which is creating common prosperity and enhancing its China's core. I have viewed this as a good news and going into these two weeks, good news have been coming out of China market except for the news concerning limiting time duration for youths to play video games. However, this again is consistent with enhancing China's core, which should not come as a surprise for investors.

Nikkei 225 futures is up close by 2% to around 29,000. Readers who read my twitter tweets (https://twitter.com/Nicolaslow1/status/1433642176139825152) will note that I have long commented about the critical level and though the dip past 28,000 last time, it has creeped all the way back to around 29,000 on report that Prime Minister Suga is set to depart. So again, I have been proven right as I continue to monitor my probability of being right in macro views and directional bets on futures instruments. Reades should nevertheless note that due to my current schedule, I am not able to actively trade futures instruments unlike the first few months of this year.

Kuaishou Tech did not do well today given the current day price movement of the broad market. Support this time round would be around 80 HKD and whether can it break 92 HKD would be a new observation point that we have to monitor. For $虎牙(HUYA)$ Huya, the resistance now is around 11.4 to 11.5 USD before the next resistance point of around 12.55 USD. Will it find support above 11 USD today will remain a key question that readers have to judge for themselves. I have to declare that I have positions in Huya and Xiaomi.

For Tiger Brokers, readers know that I have a big position in Tiger Brokers due to my conviction that investment habits will be formed for the younger professionals below 35. Ooops.. Sorry that I am way older than that given that I have been monitoring financial markets for over 18 years.. But I believe the thematic concept of fintech especially for changing habits of population moving into taking control of one's finance in control would do well for Tiger Brokers. However, current price movement did see short term resistance level at 14.6 USD and many retail shortsellers are betting against Tiger Brokers. I have time and again tried to caution retail shortsellers against a changing tide and the infinite risks of shortselling. I sincerely hope that they will listen though there is no 100% certainty that I will definitely be right on Tiger Brokers. As what I have always said, portfolio management is important in terms of equity allocation. If a shortseller only have 100,000 USD for instance and they shorted 100k USD of Tiger Brokers, could you imagine that if the price suddenly surged by 100%, you could have lost everything. I have seen many instances that some stocks suddenly surged dramatically and if a shortseller leveraged on his/her short bet, he/ she would lose the entire capital even quickly.

I will wait for Tiger Brokers to release its results on 10 September 2021 to make further assessment.

My current take is that I will not be overly worried about my current holdings in selected stocks that I have openly declared open positions in it. Current retracement in the markets is not unexpected. A better question would be is this uptrend a retracement from earlier plunge or is it really a reversal of trend back to the upwards.

As always, the above should not be construed as any investment or trading advice.

My twitter account as https://twitter.com/Nicolaslow1

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 花儿对我笑0·2021-09-03我就是小米的坚定持有者,坚定的看到40港币,长期投资,小米目前的价格非常具有竞争力。3举报