1 Min To Learn Three Key Factors Affecting Market This Week

In the past week, we learned to always be in awe of the market. History repeats itself, but the events we experience are always different.

$S&P 500(.SPX)$ , $NASDAQ(.IXIC)$ , $DJIA(.DJI)$ closed in the negative; U.S. Treasury yields spiked to 3%; and $Light Crude Oil - main 2206(CLmain)$ rose again to $110. The FOMC was followed by a series of twists and turns, with stocks rising and then falling.

What are the key factors that will affect the stock market this coming week? Join me to find out~

Three Key Takeaways:

- Economic data: US April Consumer Price Index (CPI) and Producer Price Index (PPI), EIA crude oil inventories and China April M2, CPI/PPI will be released.

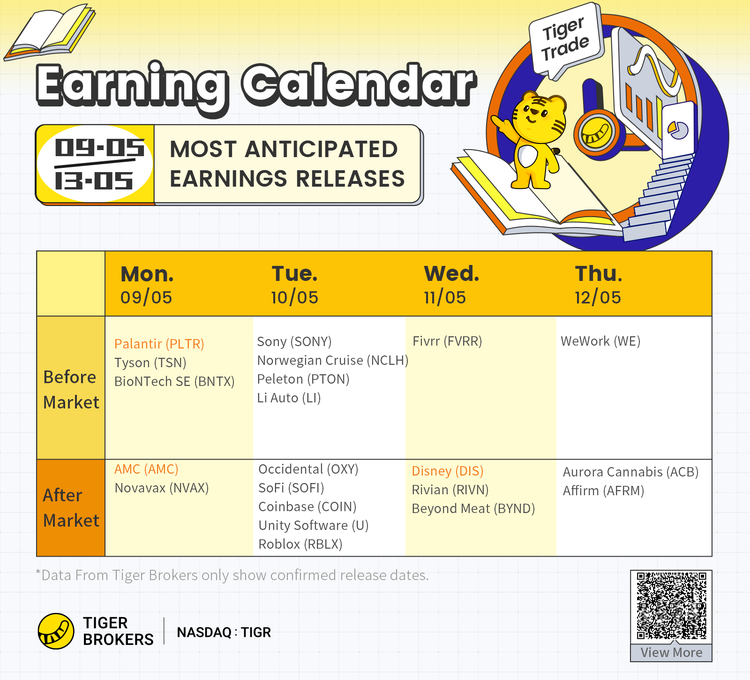

- Earnings: Leading companies includes $BioNTech SE(BNTX)$ , $Occidental(OXY)$ , $Li Auto(LI)$ , $AMC Entertainment(AMC)$ , $SMIC(00981)$ and $Rivian Automotive, Inc.(RIVN)$.

- IPOs: new share subscriptions for medical operation service provider $YUNKANG GROUP(02325)$ closed.

1. May 9: Key Data release includes China's April trade accounts, money supply; $BioNTech SE(BNTX)$ , $Palantir Technologies Inc.(PLTR)$ earnings

2. May 10: New York Fed President Williams will give a speech; $Li Auto(LI)$ $AMC Entertainment(AMC)$ earnings

In terms of economic data, the NFIB Small Business Confidence Index for April and China's April social electricity consumption will be released.

Companies such as $Li Auto(LI)$ ,$AMC Entertainment(AMC)$ , $Novavax(NVAX)$ and $Peloton Interactive, Inc.(PTON)$ will publish their latest earnings reports.

$Li Auto(LI)$ : According to Bloomberg analysts' expectations, Q1 2022 revenue is about RMB9.587 billion; adjusted net income is about RMB205 million; adjusted EPS is a loss of RMB 0.371.

3. May 11: China April CPI/PPI; US April CPI, EIA crude oil inventories; $Occidental(OXY)$ earnings

With the market eagerly anticipating an 'inflation top', any surprises in the inflation data will trigger another round of market stampede. Economists are currently giving expectations of a year-over-year growth rate of roughly 0.2%. But at the level of annual rate, April's data is likely to show a relative decline, mainly because this round of inflationary spike began in last April.

$Occidental(OXY)$ : According to Bloomberg analysts' estimates, $Occidental(OXY)$ 's Q1 2022 revenue was $8.216 billion; adjusted net income was $1.991 billion; adjusted earnings per share was $2.049.

$YUNKANG GROUP(02325)$ IPO subscriptions are to be closed.

Yunkang Group is a medical operational services provider offering a full suite of diagnostic testing services to healthcare institutions, with a 3.7% market share in China's medical operational services market in 2020 on a revenue basis, according to Frost & Sullivan.

4. May 12: US April PPI; US Weekly Initial Jobless Claims; $SMIC(00981)$ and $Rivian Automotive, Inc.(RIVN)$ Earnings

On Thursday, U.S. April PPI and U.S. Weekly Initial Jobless Claims will be released.

Industry giants such as $SMIC (00981)$ and $Disney (DIS)$, as well as Tesla rival $Rivian Automotive (RIVN)$, will report their latest earnings.

SMIC: According to Bloomberg analysts, SMIC's Q1 2022 revenue was approximately $1.838 billion, up as much as 66.5% year-over-year; adjusted net income was approximately $448 million, up 180.7% year-over-year; adjusted earnings per share was $0.057, up as much as 181.1% year-over-year.

Rivian Automotive: According to Bloomberg analysts, Rivian's Q1 2022 revenue was about $131 million; adjusted net income was a loss of $1.426 billion; adjusted earnings per share was a loss of $1.447.

5. May 13: US April Import Price Index, and Consumer Sentiment Index for May by University of Michigan.

The final U.S. consumer confidence index for April came in at 65.2, the highest reading in three months and the first increase in the index this year; the index had peaked at 88.3 in April 2021 as the economy began to recover from the pandemic, but then began to decline due to rising inflation.

May you invest safe this week! See you next week~~

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

学习