Fourth Quarter Revenue of $52.3 million, increased 26% year over year

C3.ai, Inc. (NYSE: AI), the Enterprise AI application software company, today announced results for its fiscal fourth quarter and the full year ended April 30, 2021.The report sent C3.ai shares down 9.76% in late trading.

Fourth Quarter Financial Highlights

Revenue:Total revenue for the quarter was $52.3 million, up from $41.6 million one year ago, an increase of 26% year over year.

Subscription revenue:Subscription revenue for the quarter was $43.1 million, up from $36.8 million one year ago, an increase of 17% year over year.

Gross Profit:Gross profit for the quarter was $40.6 million (a 78% gross margin), compared to $32.1 million gross profit (a 77% gross margin) one year ago, an increase in gross profit of 26% year over year.

Remaining Performance Obligations ("RPO"):RPO was $293.8 million, compared to $239.7 million one year ago, an increase of 23% year over year.

Non-GAAP RPO:Non-GAAP RPO was $345.1 million, compared to $246.9 million one year ago, an increase of 40% year over year.

C3 AI Customer Count:Total enterprise AI customer count was 89, an increase of 82% year over year.

Full Year Fiscal 2021 Financial Highlights

Revenue:Total revenue for the year was $183.2 million, up from $156.7 million one year ago, an increase of 17% year over year.

Subscription revenue:Subscription revenue for the year was $157.4 million, up from $135.4 million one year ago, an increase of 16% year over year. Subscription revenue as a percentage of total revenue remained 86%, constant year over year.

Gross Profit:Gross profit for the year was $138.7 million (a 76% gross margin), compared to $117.9 million gross profit (a 75% gross margin) one year ago, an increase of 18% year over year.

Recent Business Highlights

C3 AI continued to accelerate customer momentum and expanded its enterprise AI footprint in Defense and Intelligence, Financial Services, Manufacturing, Oil & Gas, Utilities, and Energy Sustainability, with new enterprise production deployments at the United States Air Force, Bank of America, Standard Chartered Bank, Koch Industries, MEG Energy, Duke Energy, and ENGIE. C3 AI also initiated new enterprise AI projects with 3M, ConEd, FIS, Infor, Koch Industries, New York Power Authority, and Shell, and signed new contracts with Commonwealth Bank, George Washington University School of Medicine and Health Sciences, NCS, One Medical, San Mateo County, Stanford Health Care, SWIFT, and Yokogawa Electric Corporation, as well as expanded business with the US Air Force, including the Rapid Sustainment Office (RSO) and the F-35 Joint Program Office (JPO). Shell signed an expanded 5+-year enterprise agreement with C3 AI to accelerate the deployment of C3 AI and ML applications across Shell global assets. This represents a major expansion of the partnership C3 AI and Shell have forged over the past several years.

The total number of C3 AI customers at the end of Q4 FY2021 was 89, up from 49 at the end of Q4 FY2020, an 82% increase year over year.

C3 AI further expanded its market-partner ecosystem to extend its global distribution and service capabilities. During the quarter C3 AI expanded its relationship with strategic partner and financial technology leader FIS to launch joint solutions for the financial services industry, including FIS Credit Intelligence powered by C3 AI. This builds on the previously announced launch of FIS AML Compliance Hub powered by C3 AI.

The company saw continued success in its partnership with Baker Hughes, exceeding its FY 2021 revenue target for the alliance.

The company formed a wide-ranging strategic alliance with Infor, an ERP technology cloud leader, to jointly expand enterprise-class AI solutions across industries and extend Infor’s native machine learning capabilities. C3 AI also established its first strategic partnership in the telecommunications industry, forming an alliance with Singtel subsidiary NCS, a leading information, communications, and technology service provider. The partnership will focus on delivering enterprise AI solutions to customers in Southeast Asia, Australia, and New Zealand across multiple industries including telecommunications, government, financial services, transportation, and others.

C3 AI demonstrated ongoing product leadership in enterprise AI. In the fourth quarter, the company released C3 AI v7.19 and v7.20, delivering significant new features and enhancements including new advanced AutoML capabilities in the no-code AI and analytics platform C3 AI Ex Machina, as well as the release of C3 AI UI Designer in C3 AI Integrated Design Studio, a no-code development tool that allows users to create C3 AI application user interfaces rapidly and easily with drag-and-drop components. In addition, in partnership with Baker Hughes, C3 AI released BHC3 Production Schedule Optimization application for demand planning & manufacturing production scheduling.

C3 AI extended its investment in C3 AI CRM, the first enterprise-class, AI-first CRM solution custom-built for industries, developed in partnership with Microsoft and Adobe. C3 AI released new precision sales forecasting capabilities in C3 AI CRM to improve forecasting accuracy for sales teams and executives. C3 AI CRM leverages all relevant economic (stock market indexes, commodity prices, inflation, interest rates, etc.) and company-specific (bankruptcy, M&A, share repurchases, etc.) data along with the traditional CRM data to develop rich AI models enabling precise revenue forecasting, accurate product forecasting, next-best product, next best offer, and customer churn prediction.

C3 AI grew its enterprise AI production application footprint through both new customer acquisitions and expanded use by existing customers, with 91 discrete applications in production at the end of the fourth quarter, including some of largest enterprise AI application deployments in the world at customers such as Shell, Enel, LyondellBasell, Koch Industries, and the US Air Force. C3 AI production applications showed significantly increased industry diversification, growing to 11 industries in Q4 FY2021 compared to 5 industries in Q4 FY2020, with notable expansion in Financial Services. C3 AI application end users also continued to grow, exceeding 7,400 worldwide in Q4 FY2021.

Operating at massive scale, as of April 30, 2021 the C3 AI Suite and Applications were integrated with more than 800 unique enterprise and extraprise data sources, manage more than 4.8 million concurrent production AI models, process more than 1.5 billion predictions per day, and evaluate over 30.5 billion machine learning features daily.

With Shell and Microsoft, C3 AI expanded the Open Energy AI Initiative, an open marketplace for C3 AI energy applications. Announced in February 2021, the Open Energy AI Initiative aims to accelerate the deployment and availability of enterprise AI solutions to the energy industry by providing a framework for energy operators, service providers, equipment providers, and independent software vendors to offer interoperable solutions powered by the C3 AI Suite and Microsoft Azure.

C3 AI continued to invest in its public-private partnership with the C3.ai Digital Transformation Institute, to accelerate research into the new science of Digital Transformation. In the fourth quarter, DTI conducted a weekly series of colloquia presenting original research by DTI-affiliated researchers from leading institutions. DTI also issued its second call for research proposals, on AI for Energy and Climate Security, receiving 52 proposals. Grant awards will be announced later in June. For additional information see:https://c3dti.ai.

C3 AI saw ongoing success in building brand awareness. In Q4 FY 2021, C3 AI ranked #1 in internet search results for the term "Enterprise AI" across virtually all measurements.

C3 AI further enhanced the company’s leadership with the addition of senior executives to the company’s Federal Systems unit including: Lieutenant General (Retired) Edward Cardon as Chair, C3 AI Federal Systems, and Tod Weber as SVP and General Manager, C3 AI Federal Systems. A 36-year US Army career officer, Lieutenant General Cardon most recently served as the Director of the US Army Office of Business Transformation, a role in which he helped to establish the Army Futures Command. Tod Weber most recently served as CEO and chairman of Software AG Government Solutions, and previously held senior roles at webMethods, Oracle, and PTC.

C3 AI continued to attract exceptional talent to the company, adding 56 net new employees in the fourth quarter to end the quarter with 574 fulltime employees. The company received over 12,500 employment applications in Q4.

Financial Outlook:

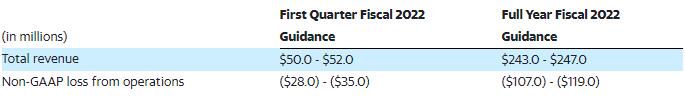

Our guidance includes GAAP and non-GAAP financial measures.

The following table summarizes our guidance for the first quarter of fiscal 2022 and full-year fiscal 2022:

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP results included in this press release. Our fiscal year ends April 30, and numbers are rounded for presentation purposes.