EV stocks are in vogue today🔥, as it seems the majority of EV names are all accelerating to the upside. 📈

Here are some strong EVs…

$Tesla Motors(TSLA)$

Tesla trucked ahead 4.08% and closed back above $1K at $1,054.73.This boost comes just a day after Elon Musk sold another 934,091 shares — he exercised his options to acquire 2.1 million shares for $6.24/share on Monday. Despite Elon’s share dump, Tesla is hanging in there, +49.3%.

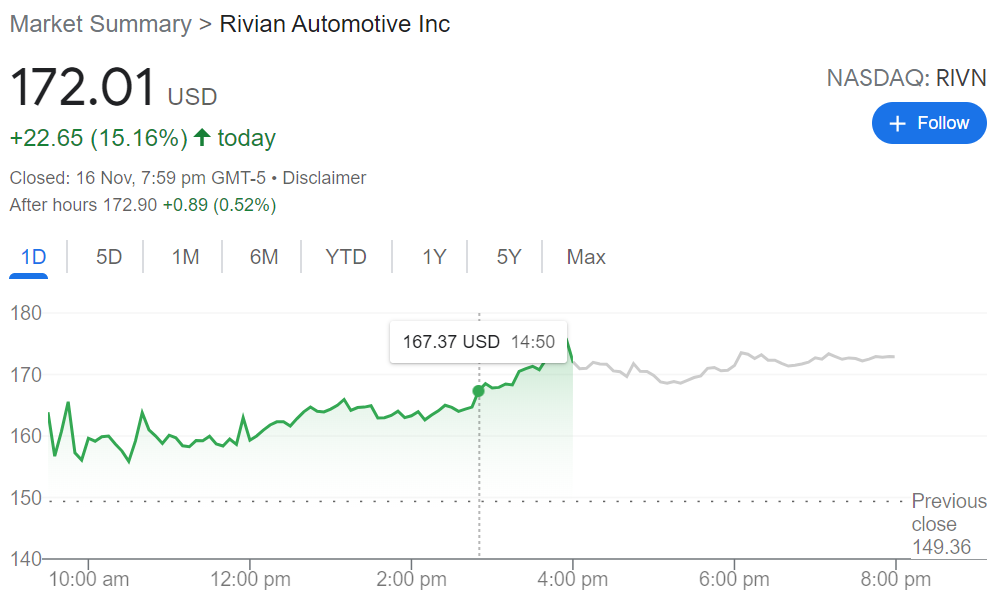

$Rivian Automotive, Inc.(RIVN)$

Rivian Automotive rushed 15.16% to all-time highs. The fresh IPO has registered gains every day since its public debut. Rivian is up over 120% since IPO and has a market cap of $147 billion. It’s now the third-most valuable carmaker.

$Lucid Group Inc(LCID)$

Stock in Lucid jumped nearly 24% Tuesday to close at $55.52 a share, following the Monday release of its first financial results as a public company. The rally pushed the company’s valuation to $89.3 billion, surpassing that of $Ford(F)$ -0.35% for the first time since Lucid’s debut on the public markets over the summer.

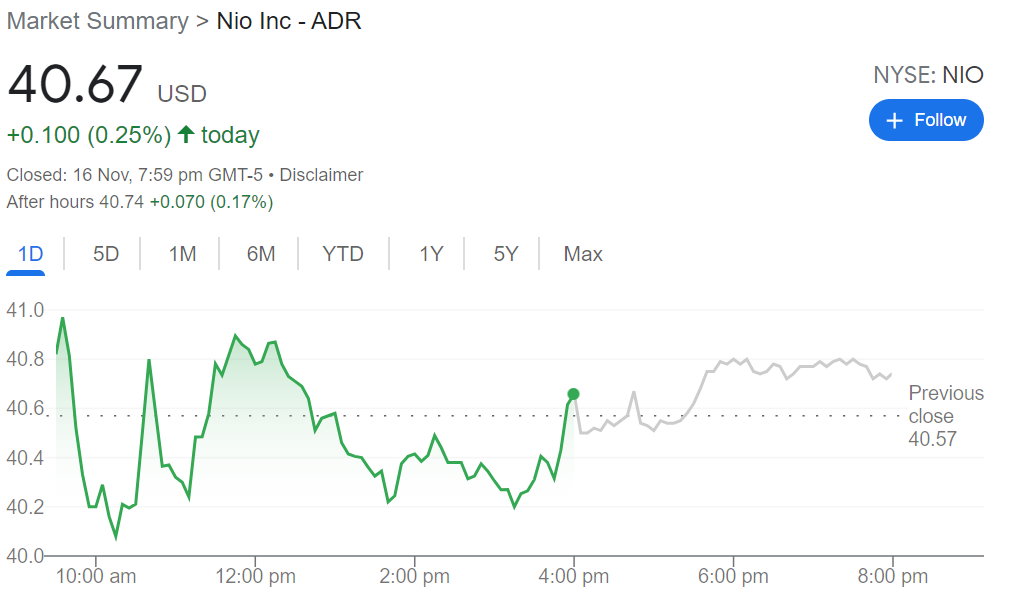

$NIO Inc.(NIO)$

NIO closed at $40.67 in the latest trading session, marking a 0.25% move from the prior day. While Nio delivered 3,667 vehicles in October, it expects Q4 deliveries to stand at between 23,500 to 25,500 cars, roughly flat from Q3 2021 figures of 24,439.

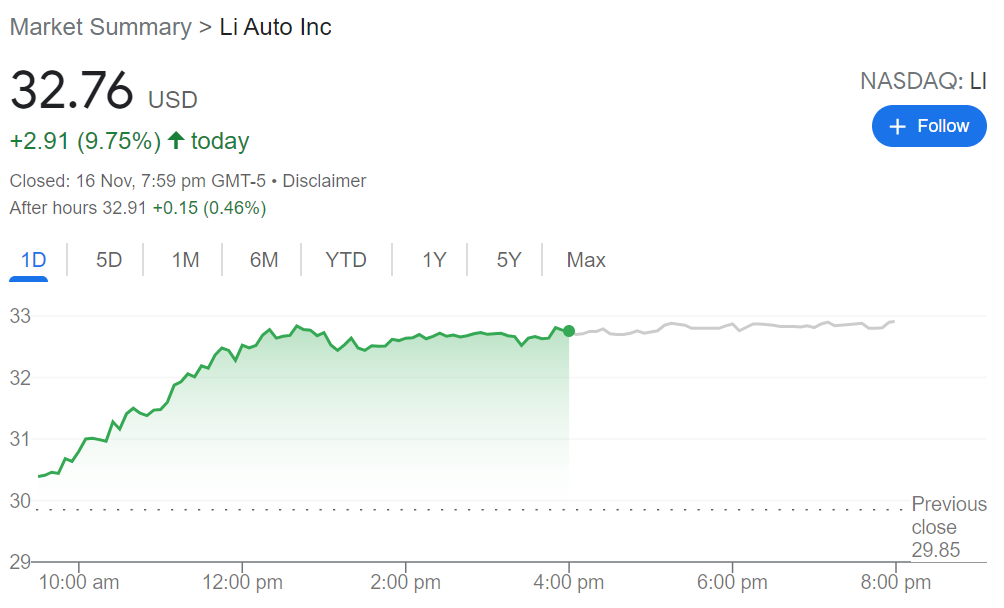

$Li Auto(LI)$

Today, shares of Li Auto are trading higher by 9%. The Chinese electric vehicle (EV) manufacturer recently had its price target upgraded by Morgan Stanley from $39 to $49. This price target followed the news that Li Auto had more than doubled its October delivery numbers when compared to a year ago.

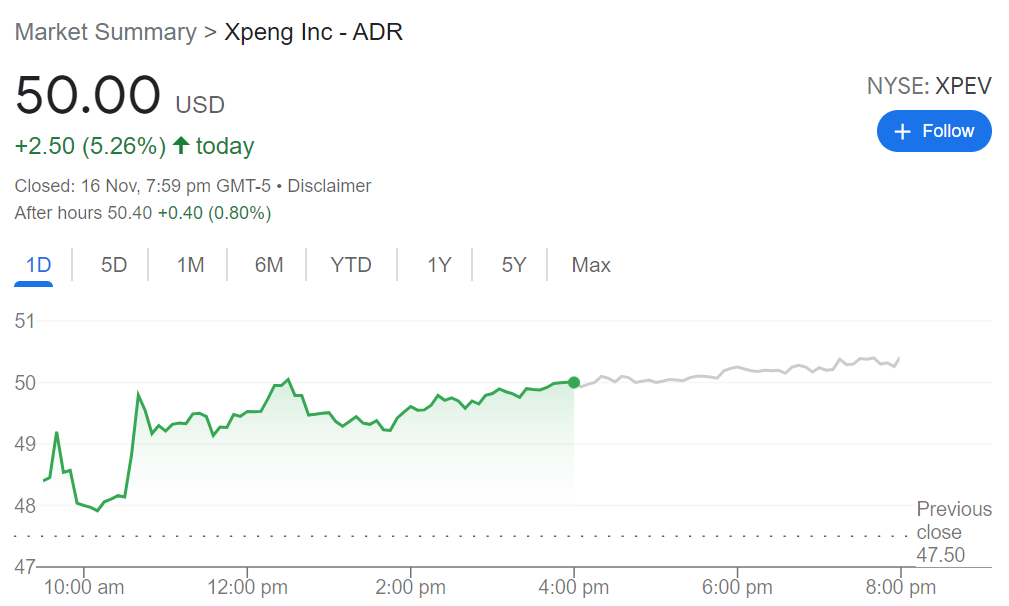

$XPeng Inc.(XPEV)$

Xpeng shares are trading higher by 5% after the company reported a second consecutive month of more than 10,000 vehicle deliveries in October. Xpeng also recently announced that it would unveil its new smart EV model at the Guangzhou auto show on Nov. 19. The new EV model is likely to be an electric SUV called G7.

$Canoo Inc.(GOEV)$

According to Investor Palace, shares of Canoo are skyrocketing higher by 23% after the EV startup reported a smaller-than-expected loss and an earlier-than-expected production date for its first vehicle. Indeed, Canoo announced that production for the Lifestyle Van will begin before the fourth quarter of 2022.

$Gores Guggenheim Inc(GGPI)$

Polestar has drawn more comparisons to industry giant Tesla. It prepares to come public through a SPAC merger. Its partner Gores Guggenheim is off to a good start this week, with GGPI stock up more than 38% this week.

EV stocks are the market’s strongest sector right now, and it ain’t a secret.

Which Ones Are the Best Bets?

Leave your opinion in the comment and you may be rewarded with Tiger Coins💸💸💸

We want to hear your ideas! 👂👂👂

悬赏1000虎币

悬赏1000虎币

精彩评论