One chart reveals how rising interest rate affects your investment

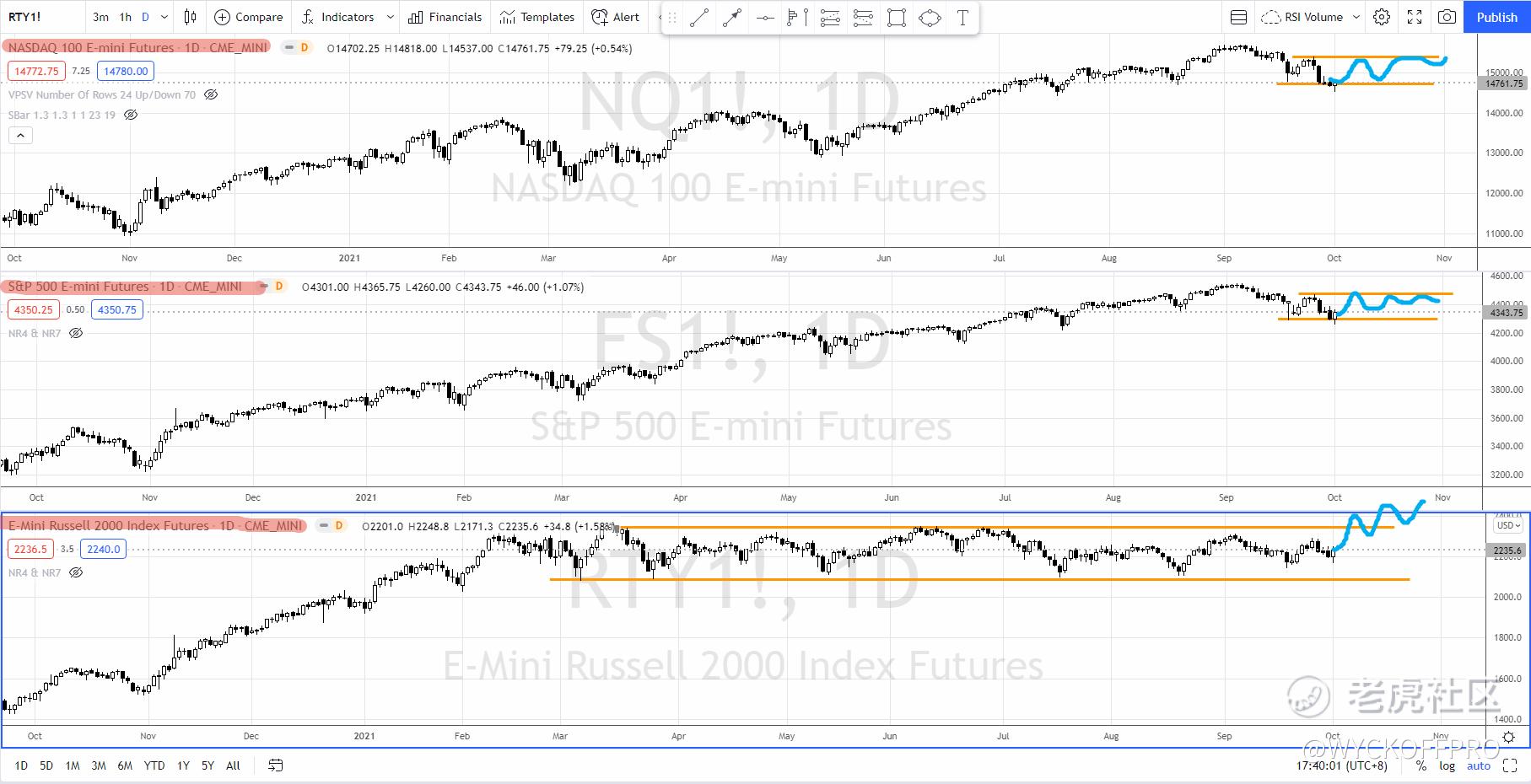

Despite all the 4 major US indices dropped in the past one week, $罗素2000指数主连 2112(RTYmain)$ was the strongest among the 4, where it only dropped -0.37% while $NQ100指数主连 2112(NQmain)$ dropped 3.6%, $SP500指数主连 2112(ESmain)$ dropped 2.3% and the $道琼斯指数主连 2112(YMmain)$ dropped 1.5%.

This simply shows outperformance of the small-cap stocks (Russell 2000) over the other indices.

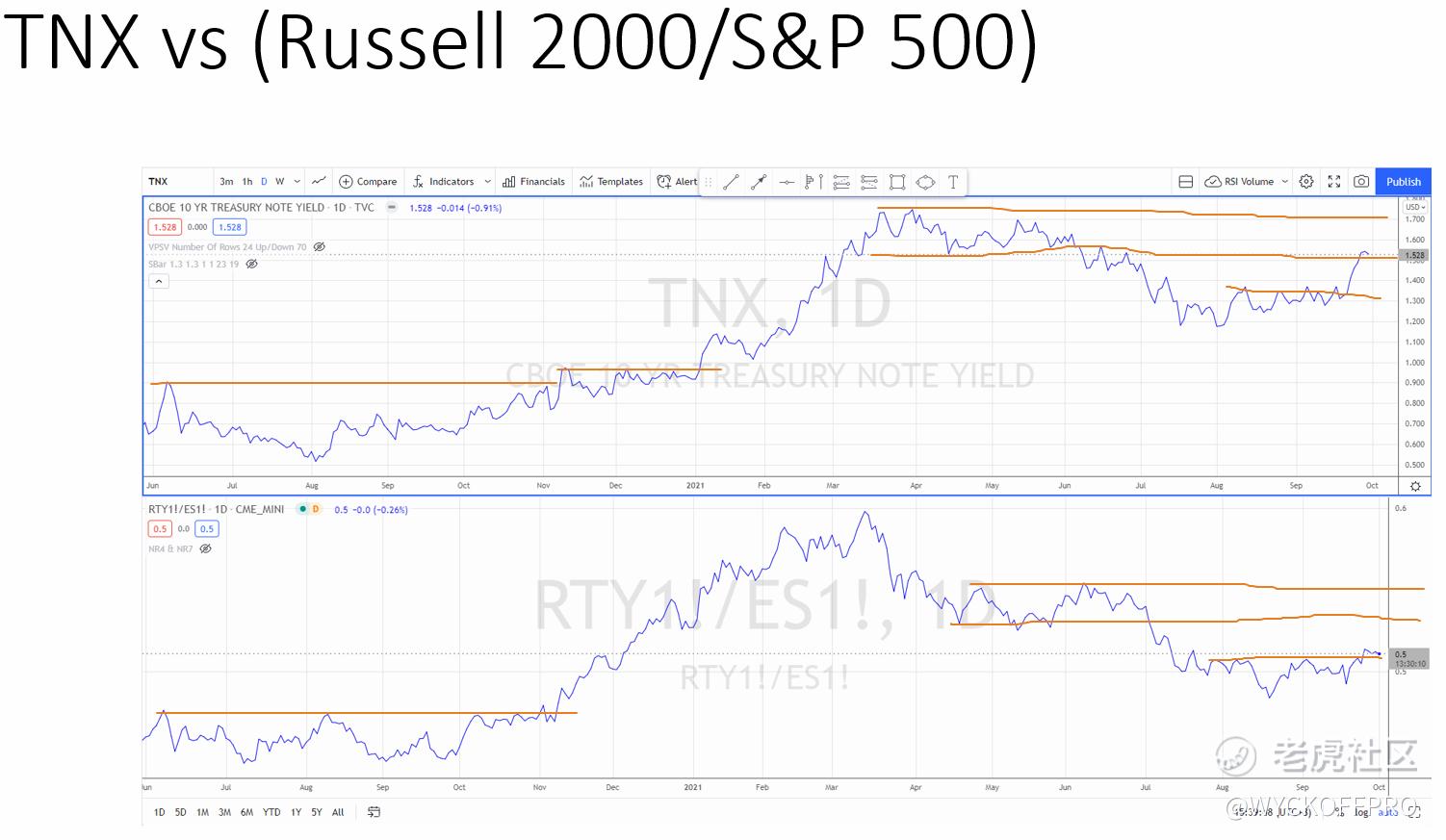

Below is the most interesting chart for last week since the sharp rising interest rate (as shown in the upper pane) triggered more weakness for the market, especially the Nasdaq 100 and the S&P 500.

After a spectacular run up of the 10 year treasury yield ($微型10年美债收益率主连 2110(10Ymain)$ ) from 1-1.7 in Jan-Mar 2021, it slowly came down to consolidate between 1.2-1.3 and last week had a breakout from the range and spiked to 1.5.

The chart above compares the 10 year treasury yield (TNX) with the ratio chart (Russell 2000/S&P 500).

How to read the ratio chart (Russell 2000 / S&P 500)

The ratio chart (Russell 2000/S&P 500) compares the 2 indices. During a rising trend, Russell 2000 outperforms S&P 500 and vice versa. The ratio chart works in both bullish and bearish market.

In a bullish market, the outperformance means Russell 2000 rises more than the S&P 500 while in a bearish market (where both indices are in a correction and falling) the outperformance could mean Russell 2000 drops less than the S&P 500.

Relationship between 10 year yield and the ratio chart

Back to the chart above, we can notice that since at least a year ago, while the 10-year yield is trending up, the ratio chart (Russell 2000/S&P 500) is also trending up. This is especially obvious from Nov 2020 till Mar 2021.

This means when the interest rate is rising, there is a rotation from S&P 500 into the Russell 2000 hence the Russell 2000 outperforms the S&P 500 because the smart money took profit from the big/mega cap stocks and rotated into the small-cap stocks where a lot of them are undervalued and/or underperformed.

Since Mar 2021, the 10-year yield has been gradually coming down while the ratio chart (Russell 2000/S&P 500) is trending down too.

This means that when the interest rate is coming down, the S&P 500 starts to outperform the Russell 2000 because the smart money took profit from the small-cap stocks (after a significant run up) and rotated back into the big/mega cap stocks.

This is the short version of how the rotation is played out. Of course, within the index (no matter the Russell 2000, or S&P 500), there will be sector/industry group rotations going on from time to time.

What's happening now?

As the 10-year yield is rising, we are witnessing an on-going rotation from the big/mega cap (including Nasdaq 100) into the small cap stocks (Russell 2000). Russell 2000 has showed outperformance since Aug 2021 (refer to my last post - The Next Biggest Index/ETF Winner - Here's What You Need to Know for more detail analysis).

I anticipate a potential trading range formed for S&P 500 and the Nasdaq 100 while Russell 2000 is to breakout of the existing range, as shown below:

So it is essential to analyze your portfolio and see if you need to adjust your holdings to exit those underperform and re-balance with the outperforming stocks so that you will always beat the market.

Of course portfolio re-balancing is highly dependent on your trading/investing strategies, holding duration and risk profile. Maybe time for a reflection?

Safe trading :) If you are day trading the US futures or swing trading for Malaysia and US stocks, feel free to check out my YouTube Channel: Ming Jong Tey for additional videos and resources.@Tiger Stars

Further Reading

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- epeizhi·2021-10-04看来米股需要回调,先用利率回调理论洗脑 [龇牙]2举报

- 股友之家00·2021-10-05还是静观其变,年底前都要保持敬畏之心,不要轻易判断方向。手中的头寸尽量用对冲做一些保护。危险随时会来,宁可错过也不要犯错。1举报

- 华尔街的花儿姐·2021-10-05很奇怪的是标普回调到4300附近,可是恐慌指数并没有怎么涨,恐慌指数现在和标普得下跌不成正比,这点我很困惑。1举报

- 九洲仙人·2021-10-05在大盘股不明朗的情况下,小盘股确实是更好的选择1举报

- 期货小当家1号·2021-10-05炒股人的辛酸,辛辛苦苦一整年,一夜回到解放前1举报

- 波king·2021-10-05那指的每一次下跌都是进场时机,请相信自己1举报

- 小秘书谢谢因为有你·2021-10-05主要还是美联储给人带来的不确定性很大1举报

- 为了生活奔波·2021-10-05已阅1举报

- Wwqj·2021-10-05谢谢2举报

- Jingluoluo·2021-10-04谢谢1举报