Rotation Back to Tech & Growth with AMD Analysis 板块轮动回到科技和成长股与AMD的分析

Rotation back to Tech/Growth

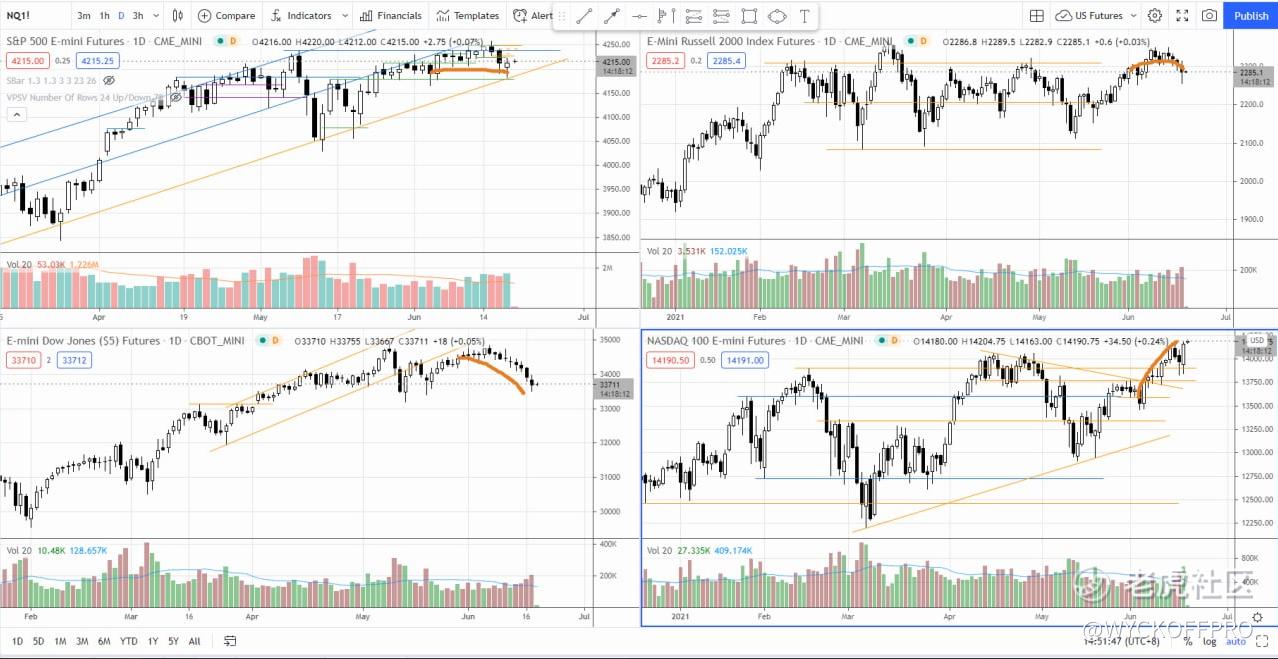

The chart above clearly showed Nasdaq has outperform while Dow is the underdog since 2 weeks ago.

Rotation is back to Tech/growth since around 2 weeks ago where I covered $老虎证券(TIGR)$ , $fuboTV Inc.(FUBO)$ , Sklz in the video (Click to watch) and NIO as well (Click to check out the post)

Having said that, it is too early to conclude if the leadership is back to tech/growth since it could just be catch up for them while "value" is getting a bit pricey...

上图清楚地显示,自两周前以来,纳斯达克指数表现优异,而道指则处于劣势。

自两周前我在视频中介绍了Tigr、Fubo、Sklz(点击观看)和NIO(点击查看帖子)后,轮动又回到了科技/成长股上。

尽管如此,现在断定领导层是否回到了科技/增长领域还为时过早,因为这可能只是暂时性的板块轮动,因为 "价值股 "变得有点昂贵了。

Analysis of AMD

The breakout yesterday was healthy with increasing demand and firm close. I expect $AMD(AMD)$ to at least test the resistance at the axis line around 87. So far it is still within the big range 76-96.

昨天的突破是健康的,需求量增加,收盘坚挺。我预AMD至少会测试87附近的轴线阻力。到目前为止,它仍在76-96的大区间内。

Recommended Reading 推荐阅读

Are Growth Stocks Back? Huge Upside for TIGR, FUBO, SKLZ [Video]

NIO: Potential Wyckoff Accumulation Phase D with Point & Figure Price Target Projection

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- TomYX·2021-06-18$英伟达(NVDA)$ 看好1举报