Market is at a vulnerable point - what's next?

Market Update

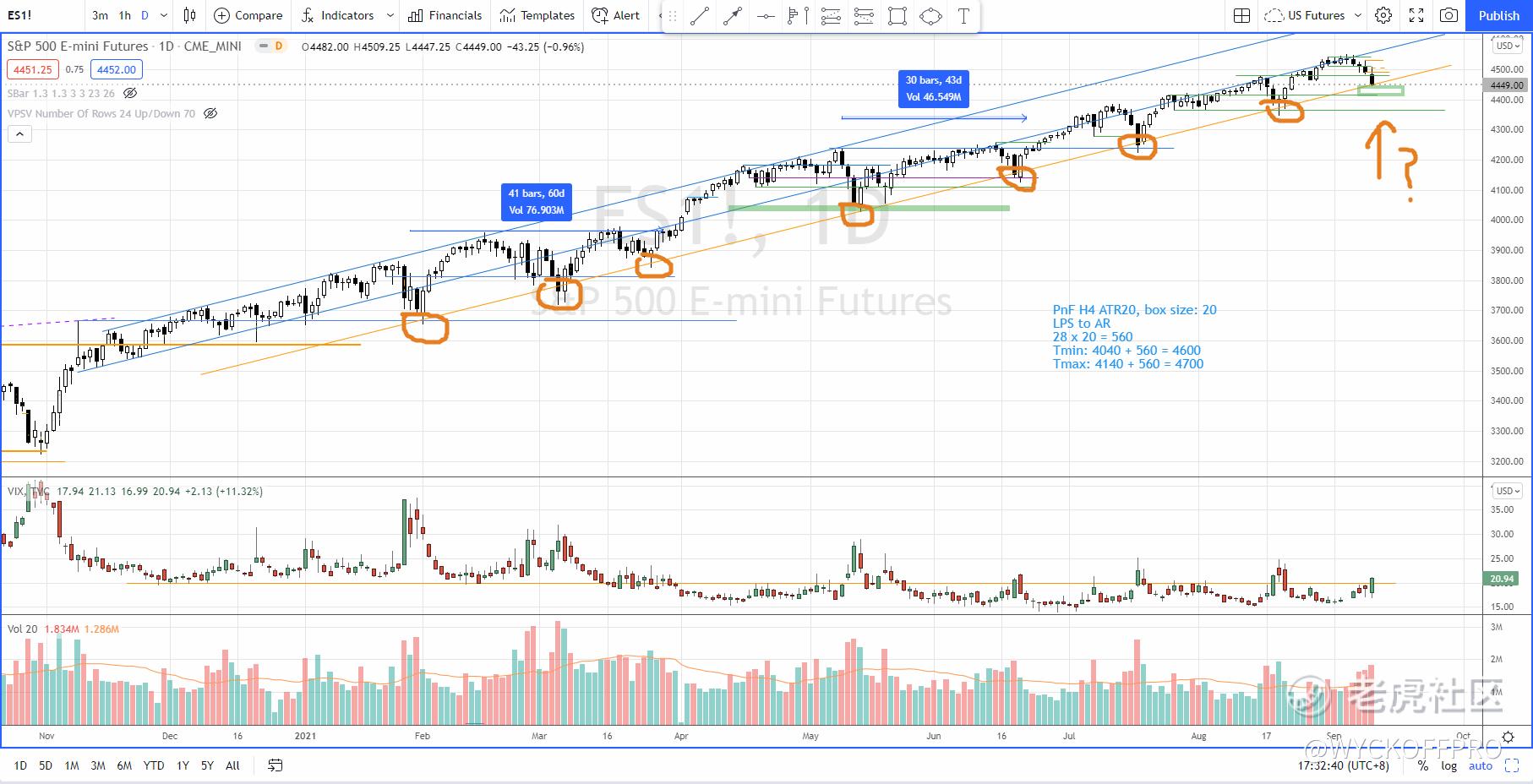

S&P 500 had a correction last week and is right at the demand line of the up channel formed since Nov 2020. This is considered as a vulnerable point as a break below this up channel could trigger a panic sell off.

Since this year, S&P 500 had tested this demand line 7 times (now is the 8th) and every times S&P 500 bounced up from there (refer to the chart below) after an oversold condition.

Supply of the down wave is not excessively high (yet) and this is a natural place to expect bargain hunters to come in.

On top of that, the VIX index is rising (refer to the middle pane) and is expected to test the previous swing high (25) hence we can expect a panic day on Monday.

The immediate support is around 4420. For a bullish reversal case, we could expect a panic wash out and reverse from here. Else, S&P 500 should test lower support at 4360. Should this happen, short term trading range can be expected.

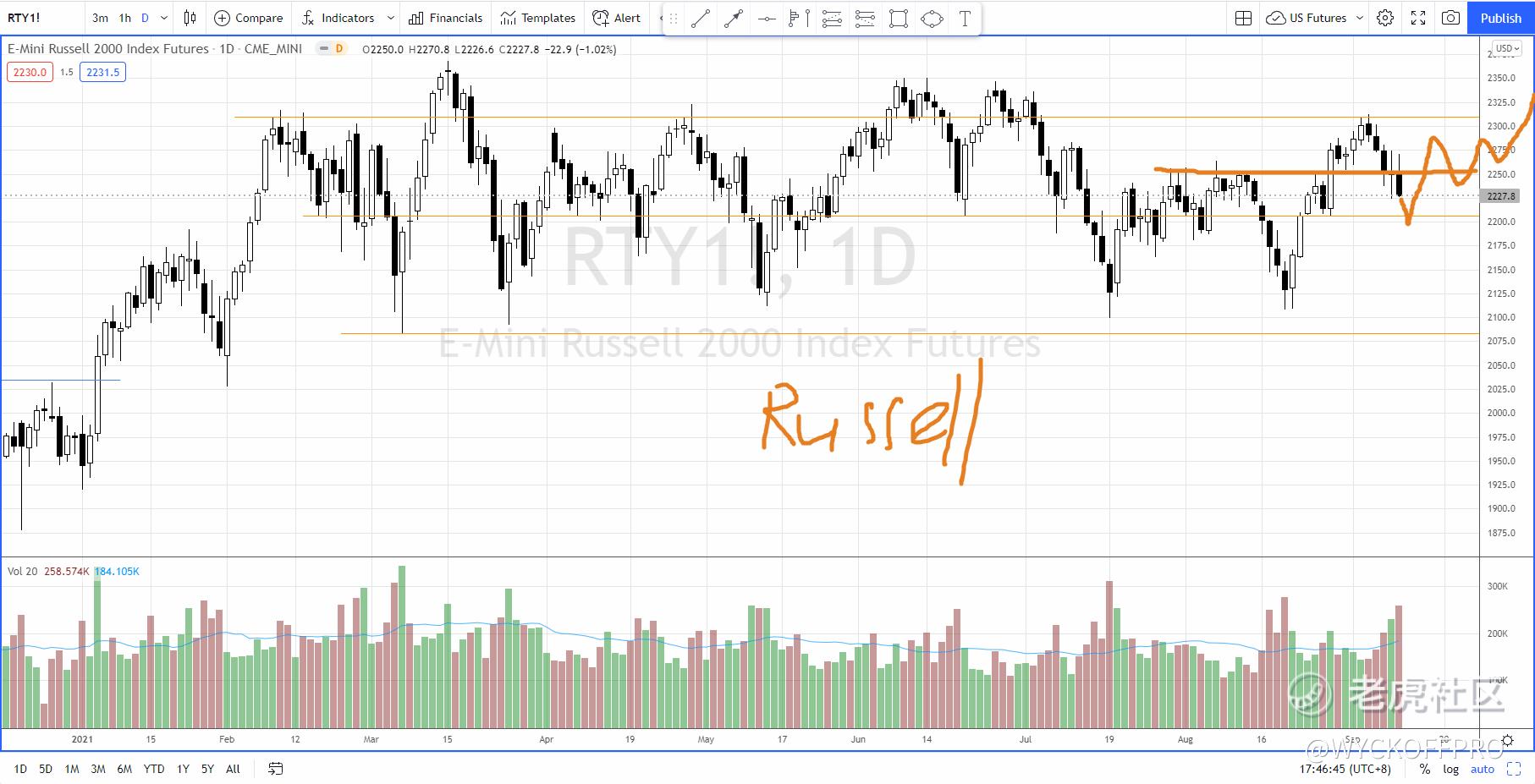

Russell 2000

Last week I mentioned using Russell 2000 and ARKK as proxies to confirm the super bull. For Russell 2000, it is not the time yet to break above the resistance level at 2310.

For a short term bullish case, the support at 2200 needs to hold and we can expect multiple attempts to breakout of the immediate resistance level at 2310 (refer to the chart below).

Else, another test of the swing low near 2100 would suggest more prolong trading range for Russell 2000.

Now, the big and mega cap growth stocks are still leading the market. Check out the ETF IVW (S&P 500 Growth) to ride on the strong uptrend. GNRC, FTNT, ALB, WAT are some of the outperformers, certainly beat the S&P 500 index.

In trading we can't control the market and the results, yet we can control the process and the risk. So, do focus on what we can control. Over the long run, the edge based on the system we follow will only play out. This is the best way to stay in the game in the long run and still be profitable.

Safe trading :) If you are day trading the US futures or swing trading for Malaysia and US stocks, feel free to check out my YouTube Channel: Ming Jong Tey for additional videos and resources.

Further Reading

The two proxies to confirm the super bull run

All time High Coming? Beware of the Red flags...

$NQ100指数主连 2109(NQmain)$ $SP500指数主连 2109(ESmain)$ $阿里巴巴(BABA)$ $小鹏汽车(XPEV)$ $苹果(AAPL)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 妥妥的幸福11·2021-09-15是不是可以今天布局一些做多恐慌指数的产品,17号是四巫日,波动肯定会比较大。下周可能会有一些相对确定性的收益。1举报

- 纯天然绿色学渣·2021-09-15罗素2000的指标可以用来参考,但是短期内还是不会有太大变化1举报

- 东营天地人和·2021-09-15现在标普的趋势,没有改变,还不需要担心,好公司有许多,还是要保持耐心1举报

- 路人丙钉钉·2021-09-13keeping an eye on Russell 2000,perhapes it will have a great breakout in a few moments.1举报