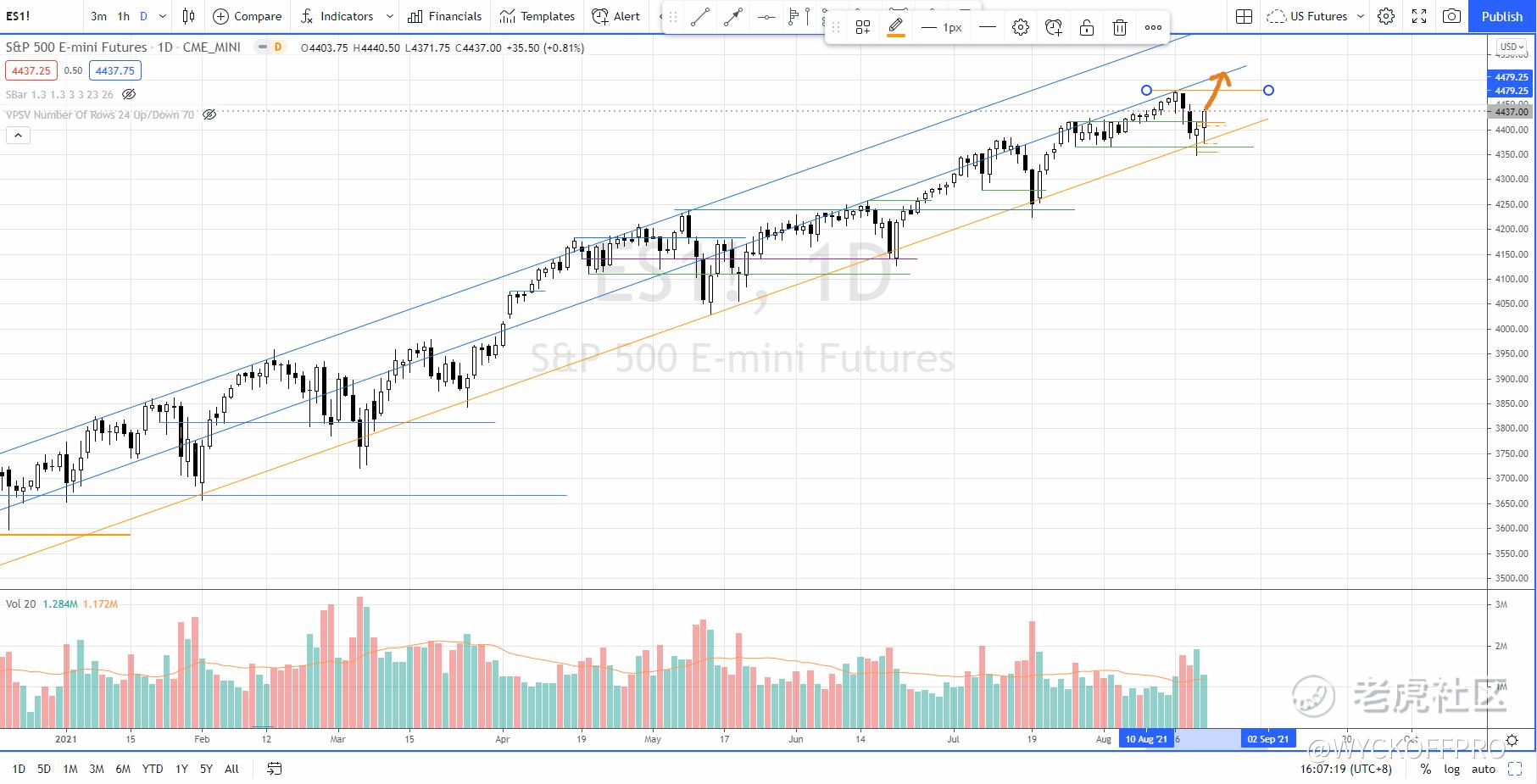

All time High Coming? Beware of the Red flags...

Last week volatility picked up and S&P 500 had a relatively sharp reaction broke below the immediate support area (4415, 4470). Big spread bearish bars were accompanied by increasing supply.

I noticed a few news headlines talked about why "this time is different" using fundamental to justify (e.g. delta variance, tapering by FED will happen sooner than expected, etc...) or technical analysis (e.g. market breadth divergence) plus a lot of other highlights as shown in the news headlines.

The fundamental events are certainly important and make a lot of sense, but they are likely not for timing the market but for reference on hindsight if people would like to study and find out the "reasons or catalysts" after it happens.

Divergence of market breadth is certainly one of the conditions I pay attention to when analyzing the broad market. Notice that I mentioned condition rather than confirmation/signal.

In general, the divergence could last for some time so might not suitable not for timing the market but as a condition to take into consideration when analyzing.

On 19 Aug (before US session open), I shared my view on S&P 500 futures (ES) in my private Telegram Group above.

Though I have a bullish bias but I need to seek for confirmation for both price and volume. So far, S&P 500 did have a bullish reversal and is likely to challenge or even break all time high again to test 4500.

Red Flags

Having said that, I am preparing myself to watch out for more pronounced correction or consolidation because of quite a number of the signs that are bad for the market including the market breadth and a few others.

I discussed one of it (belongs to intermarket relationship) in my Weekly live session on Sunday earlier on.

Anyway, short term direction is still up until proven otherwise with plenty of trading opportunities.

Further Reading

TA, FA or Hybrid? Results Inside

3 Stocks Ready For Big Move This Week — RMBS, SKY, DHI (Trading The Earnings Announcements)

If you are day trading the US futures (especially $SP500指数主连 2109(ESmain)$ ) or swing trading for Malaysia and US stocks, feel free to check out my YouTube Channel: Ming Jong Tey for additional videos and resources. $NQ100指数主连 2109(NQmain)$ $道琼斯指数主连 2109(YMmain)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 得失缘·2021-08-23疫情反复,美联储缩表提前,八月还是多看少动,谨慎操作啊5举报

- 艳阳高照天·2021-08-23是不是一般在牛市的末端还会有一次更疯狂的冲刺,但是没有人可以成功的预测到底哪里才是顶部,这就像谁也不知道下一期彩票会开出什么号码。目前指数虽然很贵,但是个股很多都在腰斩。风险永远大于机会。2举报

- 奶粉侠·2021-08-23八月历来跌多涨少,非要挑战八月的话,真的勇气可嘉,但战绩会不理想!4举报

- 哎呀呀小伙子·2021-08-23上周波动性上升,标准普尔500相对剧烈的反应跌破了即时支撑区域(4415,4470),个人觉得,这只是短线的调整,而不是趋势的变化。3举报

- 赢在中国V·2021-08-23要其灭亡必先疯狂,或许牛市疯狂上涨的时候,就是危险来临的时候3举报

- 搞钱树·2021-08-23如果人们想在事件发生后研究并找出“原因或催化剂”的话,基本面事件当然很重要,也很有意义,但它们很可能不是为了给市场计时,而是为了事后参考。2举报

- 宝宝金水_·2021-08-23市场广度的发散当然是我分析广阔市场时关注的条件之一。请注意,是条件,而不是确认信号。2举报

- 老夫追涨杀跌·2021-08-23指数的背离可能会持续一段时间,因此可能不适合对市场进行计时,而是作为分析时需要考虑的一个条件。2举报

- 沙漠追光大海逐风·2021-08-23个人觉得,无论如何,短期方向仍然是向上的,仍然有大量的交易机会。3举报

- duduwang2002·2021-08-238月份我打算坚持短期操作,特别是在港股上~2举报

- 正午·2021-09-09阅1举报

- 涛声依旧1·2021-09-09好3举报