Tiger Earnings Season: AAPL

"This year we launched our most powerful products ever, from M1-powered Macs to an iPhone 13 lineup that is setting a new standard for performance and empowering our customers to create and connect in new ways. We are infusing our values into everything we make — moving closer to our 2030 goal of being carbon neutral up and down our supply chain and across the lifecycle of our products, and ever advancing our mission to build a more equitable future." -- Tim Cook, Apple’s CEO

The most optimistic earnings report to me is Apple. When most of my other shares have turned red, it was AAPL that have helped to boost my overall portfolio in Tiger. I have to say that I am not being biased either. While I do not own an iPhone, I do have a MacBook Air which I am using to type this report. And the MacBook has been serving me for a good 8 years. Apple products are very well known for their high quality and simple yet sleek design. And just like the timeless design of the product, its technology is also always kept up to date.

I am also holding some shares of $(AAPL)$. Currently it is showing a strong "buy" on the meter for the stock at tradingview.com, and the chart shows that the price of $(AAPL)$ is now working its way to current top-level high of $153-157. Also, it looks like prior to the recent dividend date on 5 November, people are loading up on its shares. (RSI increases from 33-39 around the 1st week-midweek October, hitting 55-66 on the scale). Based on the history analysis of past dividends, prices of the stock looks likely to rise up after the profit sharing. But I need to also watch out for market's reaction this coming Monday, just in case I need to sell some shares if there is any bad reaction as I have yet to take profits from my current holdings of 59 shares, on top of that 1 share which was given by Tiger Brokers. Should I really needed to sell my AAPL shares, definitely I will find an entry point again for AAPL and hold for long-term.

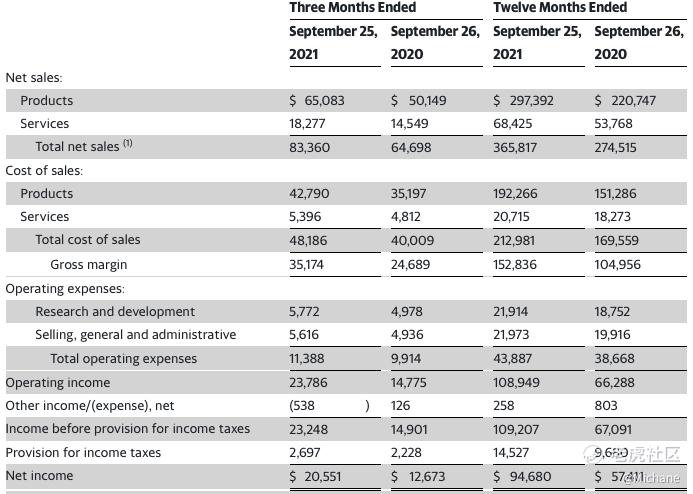

Let me share the company’s financial results for the last quarter, which is FY2021, Q4 for the company, as their Fiscal year ends in September:

FY2021, Q4 total sales revenue: $83.36 billion

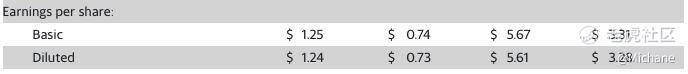

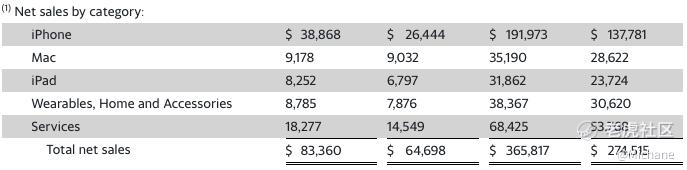

Comparing year on year, Apple, Inc. achieved a total net sales of 83.36 billion, which is a 28.8% growth from FY2020, Q4. Out from the total sales revenue, the net profit is 20.55 billion, and that is about 62.2% more than that of FY2020, Q4. Further to that, earnings per diluted share has increased:

Overall, this is good news because Apple, Inc. has increased earnings to pay out dividends or reinvest in the business.

For now, seems like its Q4's revenues were largely contributed to the release of new products: iPhone 13, iPhone 13 Pro, iPad mini 6, Apple Watch Series 7, new entry-level iPad, with the main bulk of sales from its iPhones. Also from its services which includes Apple TV+, Apple Music, News+, iCloud service, Apple Card.

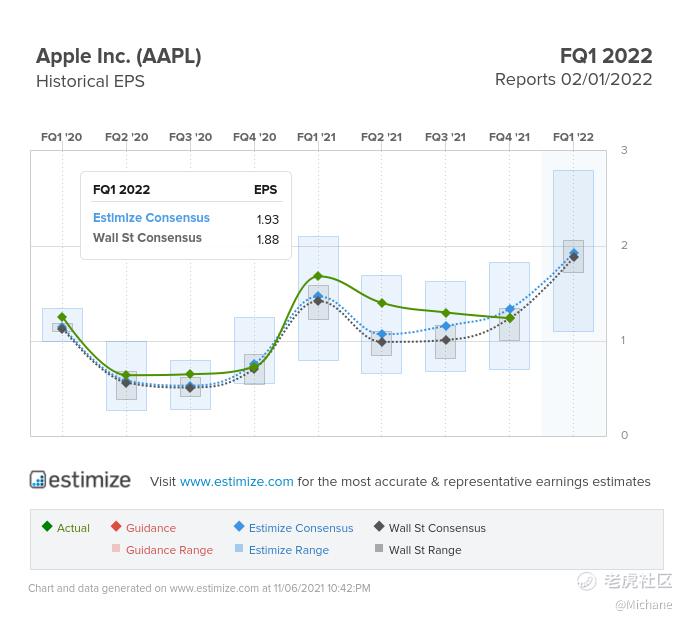

I am positive on the sales outlook both short-term and long-term. With the recent launch of the 14 and 16” MacBook Pro on October 26, that would certainly be adding up to its net sales for the Mac category for the next quarter. Although Apple, Inc. is expecting to reduce its projected iPhone 13 production targets for 2021 by as many as 10 million units in view of chip shortages, it is imperative that shipments gets fulfilled by end December, with the holiday season being in the corner. Based on Estimize.com, the growth of Apple, Inc. has a positive outlook and Wall Street consensus is optimistic for Q1, FY2022.

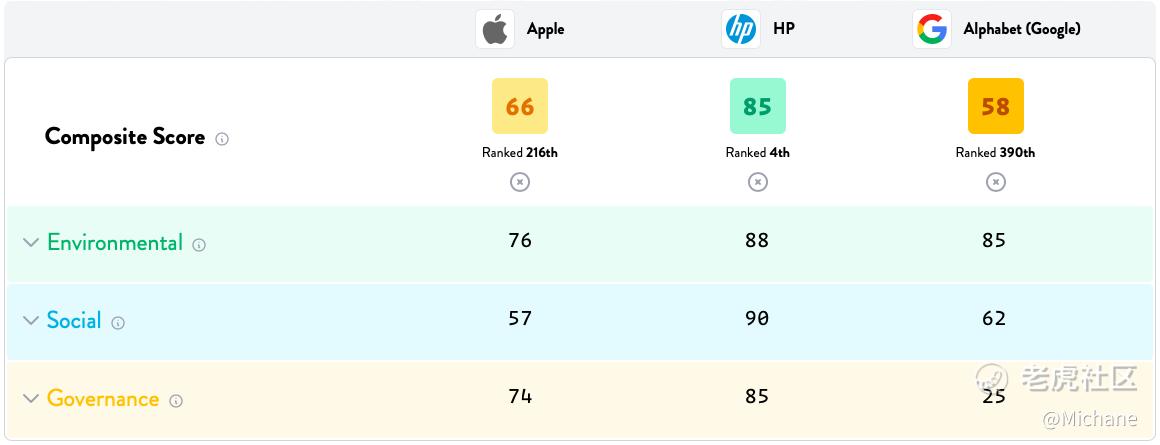

Apple, Inc. is also doing well on these key factors of Environmental, Social, Governence:

In comparison to HP or Google, although Apple, Inc. does not grade as good with the environmental or social factor, it is fairly well in terms of its governance score. (The governance score measures how well the company’s board and management drive positive change. It includes adherence to specific policies and processes like ethics, anti-corruption, anti-discrimination, executive pay equality and how leadership responds to and interacts with the board.)

So now let me share about the company's fundamental analysis. Although the main business of Apple products (especially the iPhone and MacBook) are generally selling good over the years, it turns out that last quarter, Apple's services revenue has a higher profit margin and is more stable than the products revenue.

This means its services business as shared in earlier part of my post, especially digital content streaming like Apple TV+, Apple Music, News+ and the iCloud service is becoming fast-growing, possibly due to sales driven by the pandemic. The attractiveness from this part of the business also comes from Apple TV+ serving its subscribers with at least one new TV show or movie each week. Even streaming content providers like Netflix plays a big part in most of the younger generations’ life during the pandemic.. so certainly Apple, Inc. is smart to keep itself relevant to people’s lives and to take in more revenue with the opportunity!

While the current growth of its services business puts it on a more competitive edge to other technology companies, the disadvantage is the possibility of being seen as too “monopolistic” in its practices. It has gotten itself into “hot soup” when it became involved in a lawsuit with game developer “Fortnight”. When that happened, many other companies did not give chances to it and took on their advantage to contribute to the “fire”. This leads Apple, Inc. to agree with developers offering different payment options to users of their apps outside the App Store. On the other hand, Apple, Inc. has come out with a new settlement for the companies, where it would create a $100 million fund for payouts to small app developers and agree not to raise commission rate for small developers, which has already been reduced last year from 30% to 15%, for at least three years.

Now that the company has made a huge step to show that it is keeping check on its own practices and maintaining support with its partners in the business, perhaps it can even be on par with Microsoft in the future if it continues to rise above the other technology companies, and staying out of trouble’s way!

It has certainly a bright future ahead.. because it is reported on October 22 that it has taken into hire - Tesla’s former Autopilot software director, Christopher Moore, who had almost 7.5 years during his time with Tesla. And Christopher Moore will be working directly under Stuart Bowers, who is another former Tesla employee.

This is great news while the company is undergoing the process of working on a self-driving electric car project for more than five years, codenamed Project Titan. So we can be expecting something new from Apple, Inc. with the prospect of this Apple car being developed for 2024 or a later release.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

好好学习