Intel rose based on Mobileye’s IPO, can this action reverse its fall?

Intel announced on Monday that Mobileye, a subsidiary in Israel that builds driver-assistance technology for major carmakers, will go public next year. Intel will maintain majority ownership of Mobileye, and the two companies will continue to collaborate on technologies for the automotive market.

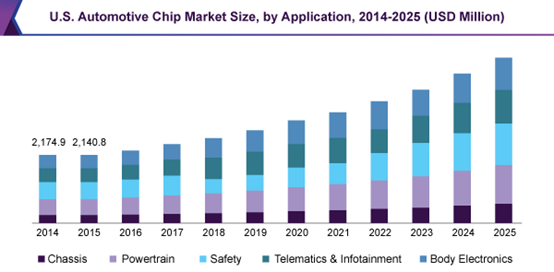

With the automotive chip market size continuing expanding, it seems that all companies don’t want to miss this big cake.

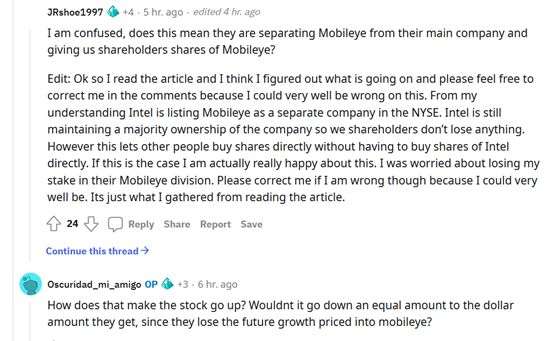

Compared to Mobileye’s IPO, Intel’s shareholders mainly care about what if they lose anything from their separation. But according to this news, Intel’s stock price starts to rise after the market close.

Mobileye, once the dominant ADAS player, has fallen behind in the new era of smart EV and autonomous driving.

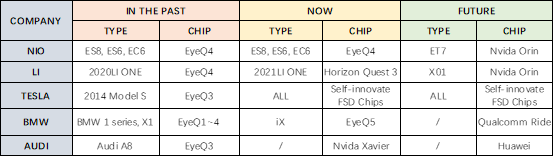

5 years before, BMW formed an autonomous driving alliance with Mobileye, and built numerous Mobileye's EyeQ chips into its vehicles. They even shared the technology's patents with each, they were absolutely brothers in other’s eyes.

But half a month ago, Qualcomm had claimed to cooperate with BMW in 2025, BMW’s new cars would start to use Qualcomm Snapdragon Ride Autonomous driving platform, which means BMW, the most important cooperator, had left Mobileye away.

This news means the end of the alliance of BMW-INTEL-Mobileye, even the end of ADAS era when Mobileye was the leader.

Mobileye: the star of Israeli enterprise...in the past

In the past 20 years, Mobileye has shipped more than 60 million EyeQ chips , which have been used by global automaker tycoons such as BMW, Volvo, Audi, Nio$NIO Inc.(NIO)$ and even Tesla$Tesla Motors(TSLA)$ . But Mobileye had so many clients, the most reason is its advantage of forwardness. As we can see, new models for 2022 and beyond, especially smart EVs, are almost exclusively powered by self-driving chips from tech giants like Nvidia, Qualcomm and Huawei...$NVIDIA Corp(NVDA)$ $Qualcomm(QCOM)$ $Hua Wei Design Group Co.,Ltd.(833427)$

In the tech industry, if you don't keep up with the latest technology trends, you hit the top and then you go downhill quickly. Mobileye, which was strong in the past, is being displaced and will be badly lost in the future.

Whatever Mobileye goes public or not, the truth is it has lost many cooperators and its market share gone downtrend. This move from Intel should be a helpless action to save Mobileye’s losing reputation.

If I am autodriving bull, why not choose Tesla or Nvida? Or other smart car producers?

Will Mobileye come back and reverse its fall after IPO?

Anyone has different opinions? I’d like to hear your voice😜😜😜

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- skyscar·2021-12-07科技公司还是看产品力,不看牌子,初创也可以nb,老牌也可以瞬间跌落点赞举报

- RosalindElinor·2021-12-07IPO can raise more funds. Mobileye should be better without the shackles of Intel. The future belongs to auto driving. I am optimistic about Mobileye.1举报

- BaronLyly·2021-12-08It's hard to say. The key is what Intel does with the money it raises. Its CEO has said it might use the money to build chip plants rather than improve technology.点赞举报

- falleno·2021-12-07As far as automobile chip manufacturers are concerned, I prefer NVIDIA and Qualcomm. Don't say Mobileye, Intel is hopeless.点赞举报

- lemonadey·2021-12-07It is not terrible for BMW to choose other manufacturers' chips. Without Tesla's support, Mobileye can hardly compete with Qualcomm.点赞举报

- pigone11·2021-12-07When Nvidia and Qualcomm begin to focus on the automobile chip market, there is almost no future for Mobileye.点赞举报

- Awayaway·2021-12-07Mobileye is the best in this area, so are tesla and nvida点赞举报

- WINTERIN·2021-12-07I don't know too much about this company, but feel smart car producers are more charming点赞举报

- imath60·2021-12-12intel世风日下 短期不看好点赞举报

- ChristopherGonzalez·2021-12-07Keep eye on it, it will fly next year点赞举报

- 123zj·2021-12-12666666点赞举报

- 交易wei生·2021-12-10差点意思点赞举报