Penny stocks speculation, trading plan and analysis 细价股的投机、交易计划和分析

Market Update

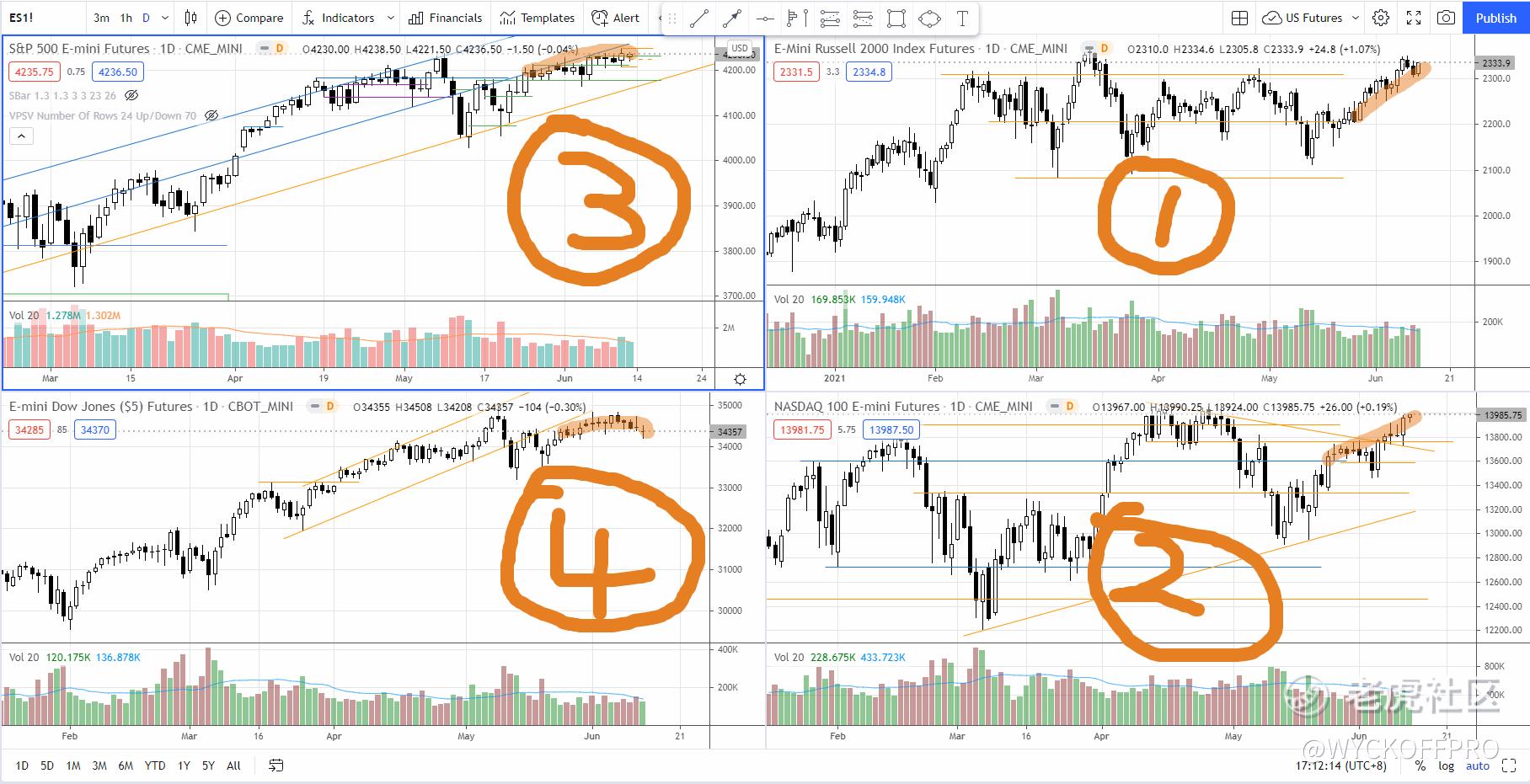

For the past 3 weeks, Russell and Nasdaq outperformed the S&P 500 and the Dow.

Let's take a look at the chart above and visually compare the 4 major indices for the past 3 weeks, where I highlighted in orange. It is clear that Russell has the most gain followed by Nasdaq, S&P 500 and the Dow.

This could suggest that some of the growth stocks (refer to my video that talked about bottomed out growth stocks if you missed it, as there is plenty of upside) and small cap stocks are beating the value stocks.

So far, there is nothing threatening on the indices in terms of the price action and the volume. Although Dow and S&P 500 are under-performed, it could probably suggest a pause of those value stocks rather than a reversal to the downside.

I am still cautious about growth theme where I spelled out the reasons in my last Sunday's email using Cathie Wood's ETF as growth proxy.

Trading Plan & Analysis

"What do you mean by let the market play out? I though you are bullish!" A reader asked.

A lot of time, I tend to respond with stick to your trading plan and let the market play out despite I have formed a directional bias with my analysis.

For example, If I am bullish on Stock A based on the analysis of the characters of the price action and the volume, I will still consider the opposite case (or the failure case).

Some of the questions I would ask myself:

1. At what point my analysis will be invalidated and turn bearish?

2. What are the characters of the price action and volume would I anticipate for a failure case?

My trading plan is to prepare for both scenarios despite it is very clear that there is only 1 scenario plays out at the moment. My trading plan helps me to react and execute according to how the market move, rather than to prove me right, it needs to help me to get out when the market doesn't agree with me.

So, analyze the charts as usual and have your trading plan ready so that you will react and execute your plan comfortably.

US: 3 Top Penny Stocks to Watch or Buy Before They Pop — RESN, NOK, F

In the past 3 weeks the small cap stocks especially the penny stocks have seen buying interests rush in that propel the stocks up.

In this video,you will find out the 3 top penny stocks — $Resonant Inc(RESN)$ , $诺基亚(NOK)$ , $福特汽车(F)$ that could be ripe to pop after days of consolidation. Watch the video below:

市场最新情况

过去3周,罗素和纳斯达克指数的表现超过了标准普尔500指数和道琼斯指数。

让我们看一下上面的图表,直观地比较一下过去3周的4个主要指数,其中我用橙色标注。很明显,罗素的涨幅最大,其次是纳斯达克、标普500和道指。

这可能表明,一些成长股(如果你错过了,可以参考我的视频,其中谈到了触底的成长股,有大量的上升空间)和小盘股正在领先价值股。

到目前为止,从价格走势和成交量来看,股指没有任何威胁性。虽然道指和标普500指数表现不佳,但这可能表明这些价值型股票的歇息,而不是反转下行。

我仍然对增长型主题持谨慎态度,我在上周日的邮件中用凯西-伍德的ETF作为增长型的代表,阐明了其中的原因。

交易计划和分析

"你说的让市场发挥出来是什么意思?我认为你是看涨的!" 一位读者问道

很多时候,我倾向于回答:坚持你的交易计划,让市场发挥,尽管我的分析已经形成了方向性的偏见。

例如,如果我根据对价格行为和成交量的分析看好股票A,我仍然会考虑相反的情况(或失败的情况)。

我会问自己一些问题。

- 在什么时候我的分析会失效并转为看跌?

- 在失效的情况下,我预期的价格行为和成交量的特征是什么?

我的交易计划是为这两种情况做准备,尽管非常清楚目前只有一种情况在发生。我的交易计划帮助我根据市场的走势做出反应和执行,而不是证明我是对的,它需要帮助我在市场不同意我的观点时脱身。

所以,像往常一样分析图表,并准备好你的交易计划,这样你就能从容地做出反应并执行你的计划。

美国:3只最值得关注的细价股,或在它们爆炸前买入--RESN, NOK, F

在过去的3个星期里,小盘股尤其是细价股出现了购买兴趣,推动了股票的上涨。

在这段视频中,你会发现3只顶级细价股--RESN、NOK、F,它们在经过几天的盘整之后,可能已经成熟,会出现爆炒。请看上面的视频。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 谭楚弘·2021-06-28你的油管名称是什么?1举报

- 睿姐姐·2021-06-15好1举报

- 口丁口米口米·2021-06-14mark1举报