(Oct 8) U.S. futures drifted and stocks edged higher as investors awaited a key employment report for clues on the Federal Reserve’s monetary policy. Treasury yields climbed.

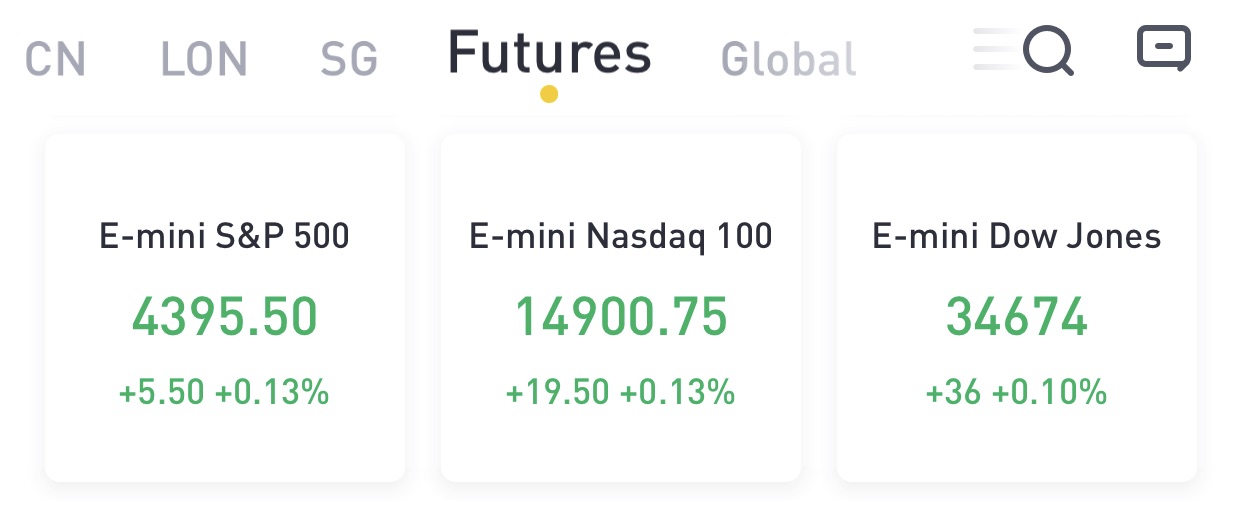

At 7:47 a.m. ET, Dow E-minis were up 36 points, or 0.10%, S&P 500 E-minis gained 5.5 points, or 0.13% and Nasdaq 100 E-minis rose 19.5 points, or 0.13%.

Here’s what we’re watching ahead of Thursday’s open:

- Bitcoin rose 2.4% from its price at 5 p.m. ET on Thursday, and stocks in the crypto world were also gaining. The SEC approved Volt Equity’s ETF, which aims to track companies that hold a majority of their assets in bitcoin or derive most of their earnings from bitcoin-related activities.Coinbasewas up 1.1% premarket, and bitcoin minerMarathon Digitalgained 2.2%.

- Vaxart, Inc shares jumped 9.7% premarket after the company said its oral Covid-19 vaccine candidate has shown it could reduce the airborne transmission of the virus in an animal model.

- Fellow vaccine makers Moderna and Novavax, that have suffered price stumbles recently, were also on the rise premarket, up by 0.9% and 1.6% respectively.

- Crude prices are climbing, and shares of energy producers are following them higher.Occidental Petroleumadded 1.3% premarket,Devon Energygained 1.8% and oil-services companyHalliburtonrose 1.1%.

- Tesla Motors shares nudged up 0.2% after the electric-car maker said it is moving its headquarters to Austin, Texas, adding to a handful of Silicon Valley companies that have relocated there.

- U.S.-traded shares of Chubb added 0.8% premarket. The Switzerland-based insurer agreed to buy some of Cigna‘s Asia-Pacific operations as part of its strategy to expand in the region.

- Accoladeshares dropped 7.3% premarket after the employee health benefits company reported a loss for the recent quarter.