Stock futures rose on Thursday morning, with the S&P 500 and Dow looking to resume advances after a pause on Wednesday. Traders looked ahead to more key earnings and economic data reports.

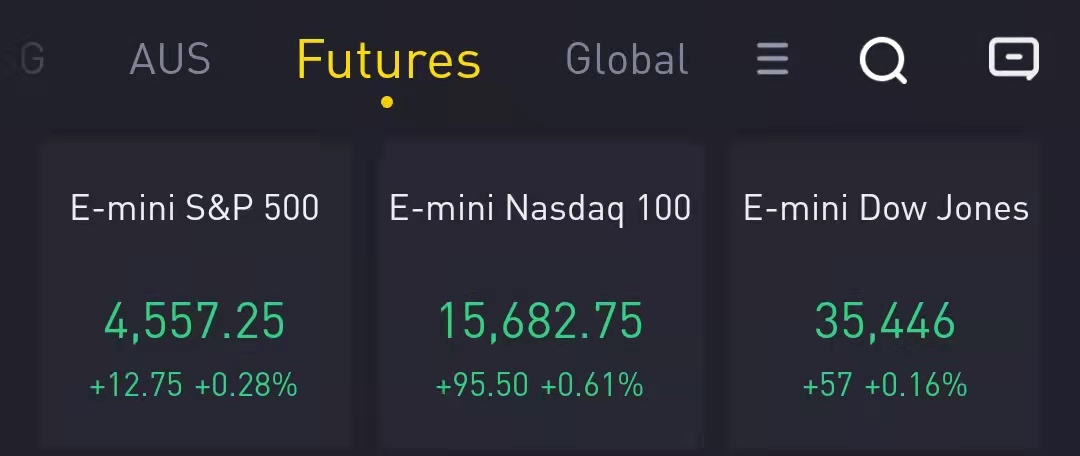

At 8:00 a.m. ET, Dow e-minis were up 57 points, or 0.16%, S&P 500 e-minis were up 12.75 points, or 0.28%, and Nasdaq 100 e-minis were up 95.5 points, or 0.61%.

Stocks making the biggest moves in the premarket:

Comcast – It reported adjusted quarterly earnings of 87 cents per share, 12 cents above estimates. Revenue also beat forecasts as cable and broadband revenue grew, and the stock jumped 3% in the premarket.

Caterpillar – Its shares rose 2.5% in the premarket after the heavy equipment maker beat bottom-line estimates for the third quarter despite a slight revenue shortfall. Adjusted earnings came to $2.66 per share compared with a consensus estimate of $2.20, amid elevated demand in the construction industry.

Merck – The drugmaker beat estimates by 20 cents with adjusted quarterly earnings of $1.75 per share, with revenue also topping estimates on stronger sales of vaccines and cancer drugs. Merck rose 2.2% in premarket trading.

Tempur Sealy – Shares of the mattress company added 2.5% in the premarket after it reported an adjusted quarterly profit of 88 cents per share, 3 cents above estimates. Revenue was also above analyst forecasts, with a particularly strong sales increase in international markets.

Ford – It surged 9.5% in premarket trading, after it earned an adjusted 51 cents per share for the third quarter, well above the 27-cent consensus estimate. Ford also increased its full-year guidance amid strong demand, despite inventory being crimped by the worldwide chip shortage. The automaker said supply chain constraints should slowly ease this quarter and throughout 2022.

eBay – It beat estimates by 1 cent with an adjusted quarterly profit of 90 cents per share, and the online marketplace operator’s revenue also topped forecasts. However, the stock slid 5.1% in premarket action as eBay issued weaker than expected current quarter guidance.

ServiceNow – It came in 17 cents ahead of estimates with adjusted quarterly earnings of $1.55 per share and revenue beating analyst projects as well. The provider of human resources services gave guidance that was merely in line with forecasts, contributing to a 2.5% premarket decline in the share price.

WPP PLC – It easily beat forecasts with its third-quarter results, and the advertising agency operator also raised its sales guidance as companies seek to take advantage of strong consumer spending with new ad campaigns. WPP rallied 7.4% in the premarket.

Anheuser-Busch Inbev SA – The company reported a surprise increase in quarterly profit, and the beer brewer also raised its 2021 earnings forecast. AB InBev is getting a boost from stronger beer sales, particularly in Brazil, and its shares soared 10.2% in the premarket.

Align Technology – It surged 8.4% in premarket trading after it beat estimates by 27 cents with adjusted quarterly earnings of $2.87 per share. The maker of the Invisalign invisible dental brace system also reported better-than-expected revenue.

Sleep Number Corporation – It earned $2.22 per share for its latest quarter, well above the $1.44 consensus estimate, with revenue easily beating forecasts. The mattress maker also issued a slightly better than expected full-year earnings outlook, and its shares surged 7.8% in the premarket.