- Nasdaq futures lead stock drop

- Meme stocks fluctuated greatly

U.S. equity futures dropped with European stocks on Thursday as fresh geopolitical tensions added to investor concerns over inflation and a potential reduction in stimulus.World stocks stepped back from record highs on Thursday as investors weighed inflation concerns ahead of key U.S. economic data, while oil prices rose for a third straight session.

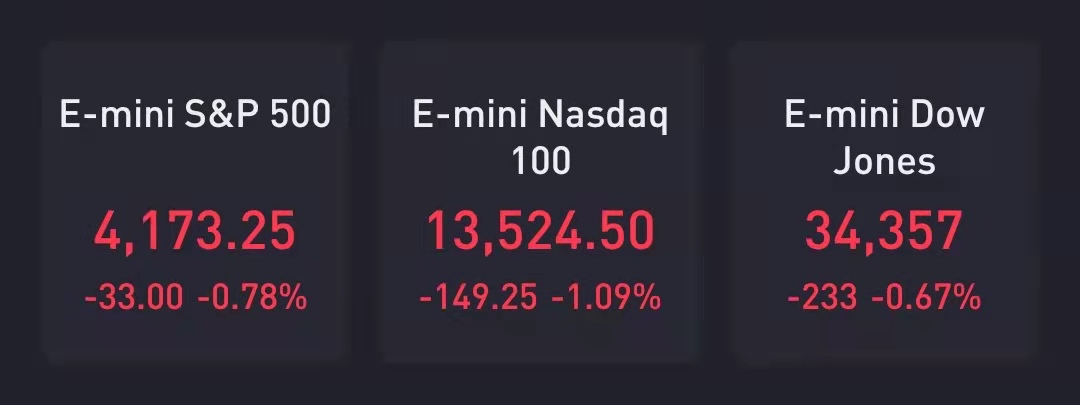

At 8:12 a.m. ET, Dow e-minis were down 233 points, or 0.67%, S&P 500 e-minis were down 33 points, or 0.78%, and Nasdaq 100 e-minis were down 149.25 points, or 1.09%.

A weekly U.S. unemployment report and May private payrolls data on Thursday will be followed by the monthly jobs numbers on Friday. Investors will be looking for signs of an economic rebound and rising inflation.

Initial jobless claims fell below 400,000 for the first time since the early days of the Covid-19 pandemic as the labor market continues to recover, the Labor Department reported Thursday.

Initial claims fell to 385,000 for the week ended May 29, a decline from the previous week's 405,000 and below the Dow Jones estimate of 393,000.

Stocks making the biggest moves in the premarket:

AMC Entertainment (AMC) – AMC filed to sell up to 11.55 million common shares “from time to time,” according to a Securities and Exchange Commission filing, but cautioned against investing in the stock due to recent moves “unrelated to our underlying business.” AMC had initially surged in the premarket after nearly doubling Wednesday, but fell 9.7% after the filing.

BlackBerry (BB),Koss (KOSS),GameStop (GME),Bed Bath & Beyond (BBBY) – These stocks remain on watch today, after surging yesterday on investor enthusiasm for the so-called “meme” stocks. BlackBerry jumped 11.2% in the premarket, but Koss fell 10.1%, GameStop lost 2.3% and Bed Bath & Beyond dropped 12.9% after soaring 62% Wednesday.

Express (EXPR) – The apparel retailer reported a quarterly loss of 55 cents per share, smaller than the 58 cents a share that analysts were expecting. Revenue topped Street forecasts and Express said it expects sequential comparable sales improvement throughout this year. Its shares fell 7.1% in the premarket after an initial jump higher.

Meredith Corp. (MDP) – Meredith accepted a revised bid from Gray Television(GTN) for its local media group. Meredith shareholders will now receive $16.99 per share in cash, up from the prior $14.51 a share, plus one share in the new post-close version of Meredith.

Ciena (CIEN) – The networking equipment and services company reported quarterly earnings of 62 cents per share, 14 cents a share above estimates. Revenue also came in above analysts’ projections. Ciena said it was helped by an improving market environment and a rebound in customer spending. Ciena gained 1.1% in premarket trading.

J.M. Smucker (SJM) – The food producer beat estimates by 22 cents a share, with quarterly profit of $1.89 per share. Revenue came in slightly above forecasts. Sales fell compared with a year earlier, however, when homebound consumers stocked up as the pandemic took hold. Smucker did issue an upbeat full-year earnings forecast.

PVH (PVH) – PVH earned $1.92 per share for its latest quarter, more than double the consensus estimate of 83 cents a share. The company behind apparel brands like Tommy Hilfiger and Calvin Klein also saw revenue beat estimates, and it also raised its full-year forecast.

Exxon Mobil (XOM) – Exxon said in an SEC filing that hedge fund Engine No. 1 had won a third seat on the energy giant’s board. Engine No. 1 – a small investor in Exxon – won a surprise victory with a campaign centered on environmental concerns.

FireEye (FEYE) – FireEye announced the sale of its security software products unit – along with the FireEye name – to private-equity firm Symphony Technology for $1.2 billion. The business that remains will be called Mandiant Solutions, the same name used by CEO Kevin Mandia’s business before its sale to FireEye in 2014. FireEye shares tumbled 7.5% in the premarket.

Emergent BioSolutions (EBS) – The Food and Drug Administration is working with Johnson & Johnson (JNJ) and AstraZeneca (AZN) to ensure that Covid-19 vaccine doses produced at an Emergent plant in Baltimore are uncontaminated and safe to use. That comes after the plant accidentally contaminated doses of J&J’s vaccine with the active ingredient in AstraZeneca’s treatment.

Splunk (SPLK) – Splunk reported a greater-than-expected loss for the first quarter, though the maker of network analytics software did see revenue beat Wall Street forecasts. Splunk has been transitioning customers to cloud-based versions of its software, and recurring cloud revenue did jump 83% during the quarter compared to a year ago. Splunk lost 5.1% in premarket trading.

Tilray (TLRY) – The cannabis producer’s shares rallied 3.6% in premarket trading after Cantor Fitzgerald rolled out new estimates after the completion of Tilray’s merger with Aphria and rated the stock “overweight.” Cantor cites the combined company’s scale as well as upbeat overseas prospects.