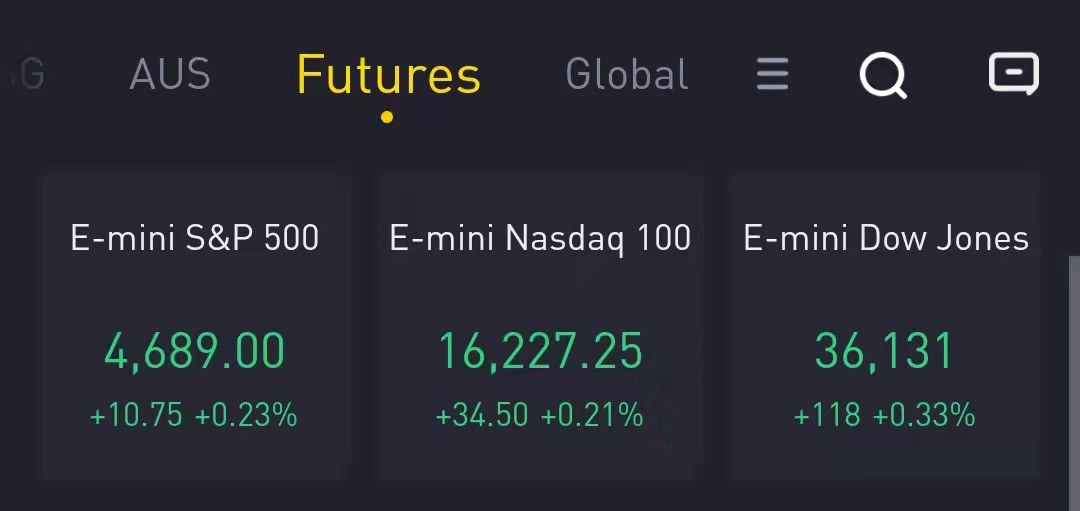

Stock futures pointed to a higher open Monday morning as investors awaited key retail sales and earnings results out from major U.S. companies later this week.

Investors this week are also set to receive new data from the Commerce Department on U.S. retail sales. The report is likely to show a 1.3% month-on-month jump in sales for October after a more sanguine 0.7% rise in September. And retail earnings results from major names including Walmart, Target, Home Depot and Lowe's will offer additional details on the state of the consumer.

Stocks making the biggest moves in the premarket:

Oatly Group AB – The oat milk producer lost 7 cents per share for its latest quarter, smaller than the 10 cents a share loss anticipated by analysts. Revenue came in below forecasts, however, and its shares tumbled 14.1% in premarket action. Oatly said it faced challenges related to various Covid-related restrictions, but that it continues to scale up production.

Tesla Motors – Tesla slid 2.1% in premarket trading after a weekly loss last week ended an 11-week winning streak. Tesla CEO Elon Musk sold nearly $7 billion in stock last week.

Dollar Tree – Dollar Tree surged 8.3% in the premarket after activist investor Mantle Ridge took a stake in the discount retailer. The Wall Street Journal reports that Mantle Ridge wants Dollar Tree to take action to boost its stock price and is focusing on pricing strategies at the company’s Family Dollar chain. The news prompted Deutsche Bank to upgrade the stock to “buy” from “hold,” citing potential improvements.

Tyson – The beef and poultry producer earned $2.30 per share for its fiscal fourth quarter, 27 cents a share above estimates. Revenue topped Wall Street forecasts as well. Tyson also announced a new productivity program that it says will save $1 billion annually by the end of 2024.

American Tower – The communications infrastructure real estate investment trust is buying data center REITCoreSite Realty(COR) for $170 per share in cash, or about $10.1 billion. CoreSite rose 2.6% in premarket action.

John Deere – The heavy equipment maker and striking workers reached a third tentative contract agreement after the first two were rejected. Neither side gave details on the new agreement and it is not yet clear when a vote will take place. Workers have been off the job since Oct. 14.

EVgo Inc. – The operator of public EV charging networks saw its stock tank by 7.7% in the premarket, after Credit Suisse downgraded it to “neutral” from “outperform.” The company said a recent rally in the stock has likely priced in benefits from the infrastructure bill as well as recent partnership announcements.

Royal Dutch Shell PLC – Royal Dutch Shell plans to scrap its dual share structure and also drop the “Royal Dutch” part of its corporate name. The announcement comes amid calls by activist investor Third Point to split up the energy giant into several companies to increase shareholder value. Class “A” shares gained 1.5% in premarket action, while class “B” shares rose 1.1%.

Boeing – Boeing Senior Vice President Ihssane Mounir said the jet maker is “getting close” to resuming deliveries of its 787 Dreamliner, after suspending them to deal with production issues. Mounir said the exact timing depends on the outcome of ongoing talks with regulators. The stock added 2.7% in the premarket.

Petco Health and Wellness Company, Inc. – The pet products retailer’s stock slid 2.9% in premarket trading after Jefferies downgraded it to “hold” from “buy.” Jefferies cited valuation after a 26% rise over three months, as well as challenging labor conditions in Petco’s veterinary business.

CrowdStrike Holdings, Inc. – Morgan Stanley began coverage of the cybersecurity company with an “underweight” rating, noting increasing competition and pricing pressure. Crowdstrike slid 4.6% in the premarket.