Mright

格局要大!眼光要高!

IP属地:海外

38关注

4粉丝

3主题

0勋章

$Phunware, Inc.(PHUN)$这个要停多久呀

$默沙东(MRK)$这个股票没人看好吗?

$嘉楠科技(CAN)$财报如何看呢?

$嘉楠科技(CAN)$兄弟们,还有救吗?

$嘉楠科技(CAN)$前面说回到10快以下的呢?不懂能不能别发帖?

$嘉楠科技(CAN)$哎呀!红了!开盘气势汹汹吓到我了

$挪威邮轮(NCLH)$为什么最近一直跌呢?

这篇文章不错,转发给大家看看

@大空神:期权实战手册(一)——最具价值的六大期权策略

这篇文章不错,转发给大家看看

@大空神:期权实战手册(一)——最具价值的六大期权策略

这篇文章不错,转发给大家看看

@大空神:期权实战手册(一)——最具价值的六大期权策略

这篇文章不错,转发给大家看看

@老鲁随笔:美股期权入门,看完这篇全懂了

收藏看看

@美股预言家99:$标普500ETF(SPY)$$Palantir Technologies Inc.(PLTR)$$苹果(AAPL)$标普从现在开始到三月的第二周会有至少5-7%的correction,大概跌到375-370左右,之后大家可以上期权做多一波个股比如amd,aapl tesla,四五月份会再冲高一波,下半年根据我的周期分析不会冲到400了。大家可以收藏一下这个post,应验之后求一波真准😊

这篇文章不错,转发给大家看看

@Raytroninvs:我本金只有3500,我不好赌但也不想赔钱

这篇文章不错,转发给大家看看

@Raytroninvs:我本金只有3500,我不好赌但也不想赔钱(2)

这篇文章不错,转发给大家看看

@Raytroninvs:我本金只有3500,我不好赌但也不想赔钱(3)

这篇文章不错,转发给大家看看

@Raytroninvs:百试不厌,15分钟赚5000的小技巧

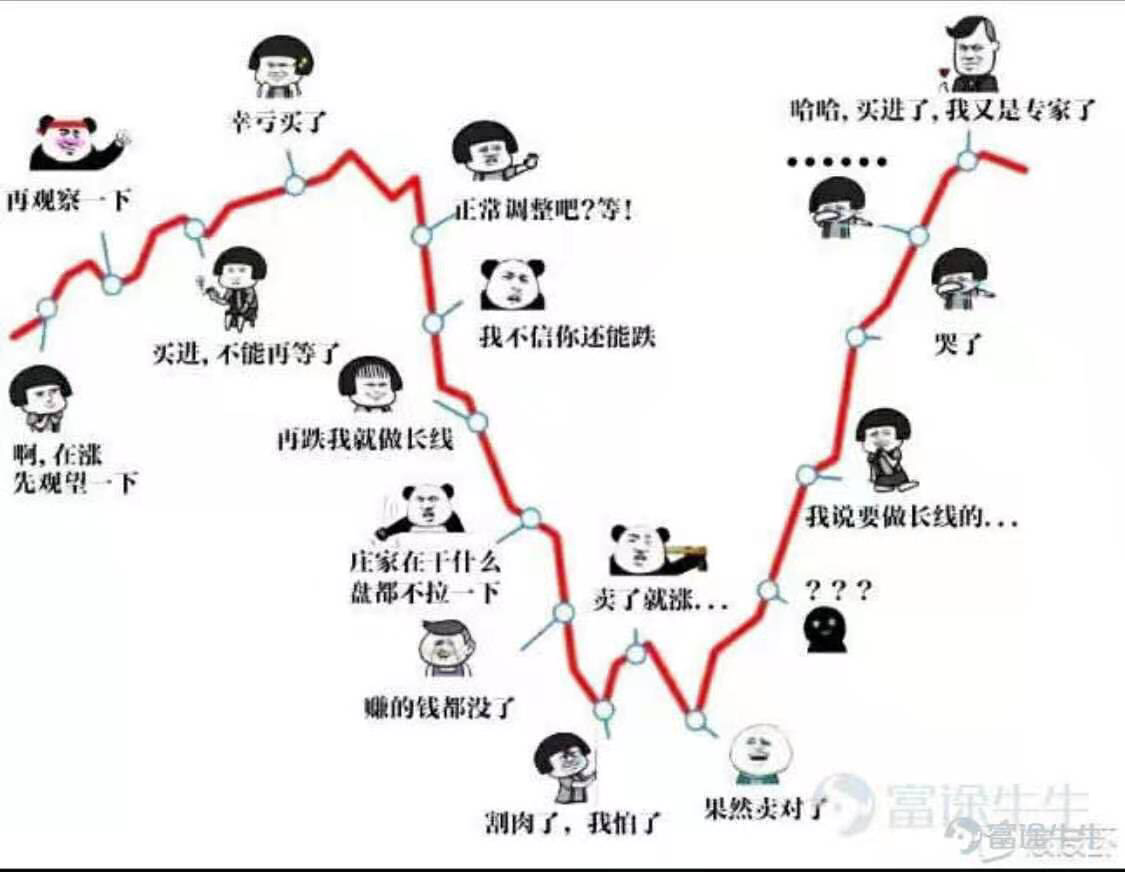

$Tilray Inc.(TLRY)$贪婪了!没能控制住自己的情绪!发帖自我反省!可以赢十次,但是输一次就亏完了!

去老虎APP查看更多动态