“ Coinbase今晚上市交易,整体估值与比特币关联性极高。本文为浏览招股书和reddit路演后的笔记摘要。”

01

—

比特币还能涨吗?

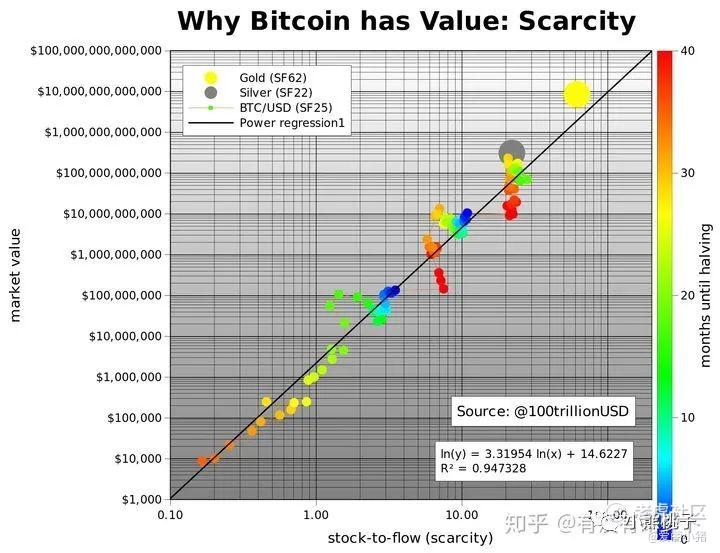

先找个Stock/Flow模型看看。

Stock表示人类社会现有的比特币存量

Flow表示一年时间能生产出的新增比特币(流量)

S/F的比值,直观上表示把世界上现存这么多东西生产出来需要多少年,年数越多就越稀有。

高SF值表示格外稀有,使得黄金白银天然是货币,而钯金铂金的易生产易获得使得价格便宜。

当一种金属易于生产时,就不会有人囤积等待升值。由于铂金SF值为0.4,假设有人试图从市场上大肆购买并囤积铂金,炒铂金,让市场上铂金变少价格变高。但由于铂金产量高,0.4年,也就是半年后,就能生产出同样多的铂金,因此铂金并不紧俏,无法涨价。

把不同货币(黄金、白银、BTC)的历史价格和同期SF值,取对数,得到线性关系。表示模型较为有效。

2020年4月产量减半后根据稀缺程度预估一枚价格会到55000美金,2021年实现该价格。下次产量减半是2024年4月。到2025年预估16万美金,则年化约30%。

比特币价格上行是交易所赖以生存的基础。Coinbase的季报里也明确这个点,强调多次。18年比特币暴跌,coinbase月活用户数降低了70%。进入2020年年底的比特币牛市前,coinbase年年net income为负。

02

—

交易所是不是7/24天然casino,不落幕的生意?

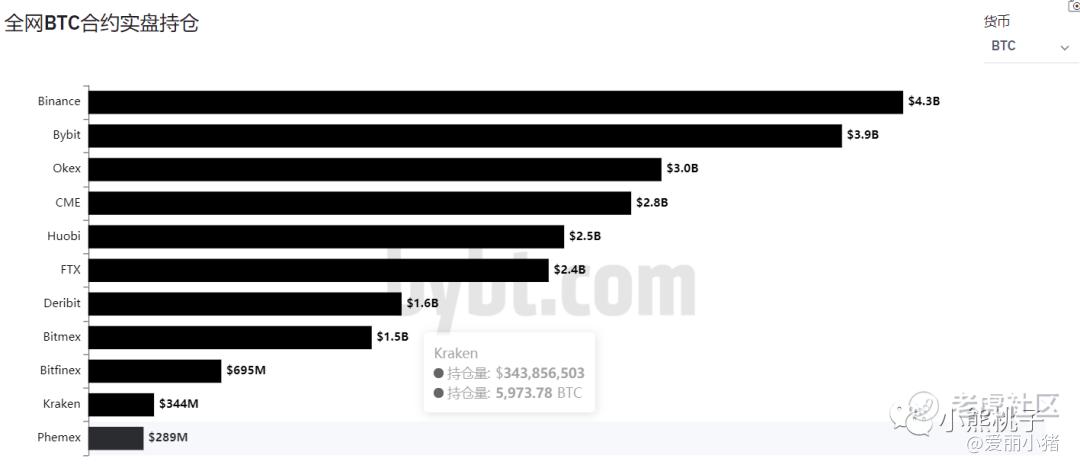

市面上主流的交易所按用户体验和BTC持仓量排名如下:

头部交易所用户体验排名

BTC持仓量

主流交易所中较为成熟的标的有Coinbase,币安,火币,Kraken。平台币paltform token的本质是代币,功能包括用来抵扣交易费,获取平台空投的权利,加入一些平台托管计划(Depost & Savings Programs)。NFT正在兴起,也成为新的流量入口。

03

—

认识Coinbase第一集

发展历程:

- 创始人Brian Armstrong从Y Combinator孵化器拿到天使投资,2012年5月Coinbase正式成立

- 2015年Coinbase在C轮融资7500万美元,并推出美国第一家持有正规牌照的比特币交易所

- 2017年,随着加密市场牛市的到来,更多的投资者通过Coinbase购买加密货币

- 2018年,Coinbase宣布推出首支指数基金,进军资产管理行业

Abstract:

- Institutional and retail clients,数字资产托管量高达223billion美金,总托管量价值约占加密数字货币整体市值的11.3%,环比增长147%。其中55%的资产来自机构投资者,$122 billion

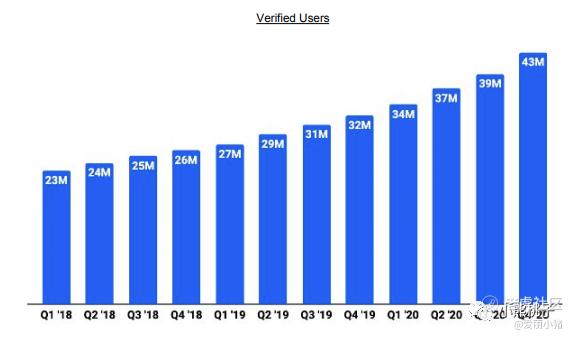

- 1200 employees, 43 million customers in more than 100 countries

- 2020 $1.3 billion in revenue, $322 million in profit

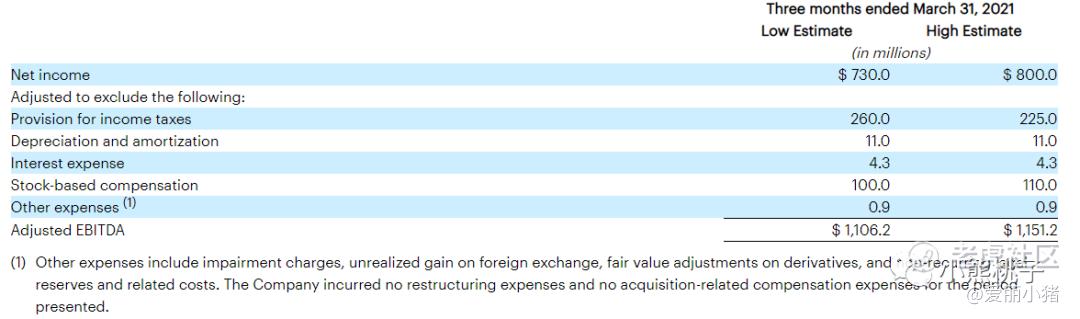

- 2021 Q1 Total revenue $1.8 billion, Net Income $0.73~0.8 billion, Adjusted EBITDA $1.1 billion

- Q1 Trading Volume 第一季度成交量达到了$335 billion,环比增长276.4%

- Q1 认证用户量达到了56 million,每个月交易用户量(MTUs)达到了6.1 million,环比增长118%

- In this DPO, won't raise any money. Valuation of 67.6 billion。公司通过DPO上市,原股东或将出售股份,收益与公司无关。原股东无锁定期,DPO当日即可卖票。原文:None of our stockholders are party to any contractual lockup agreement or other contractual restrictions on transfer. Following our listing, the sales or distribution of substantial amounts of our Class A common stock, or the perception that such sales or distributions might occur, could cause the market price of our Class A common stock to decline.

- Cash $1 billion

- Revenue breakdown: 96% comes from transaction fees, highly volatile.In 2019, a down year for bitcoin, loss of $31 million. 4% comes from a suite of subscription products and services launched since late 2018, such as Store, Stake, and Borrow & Lend. A full service, diversified platform for the broader cryptoeconomy will reduce dependence on transaction revenue.

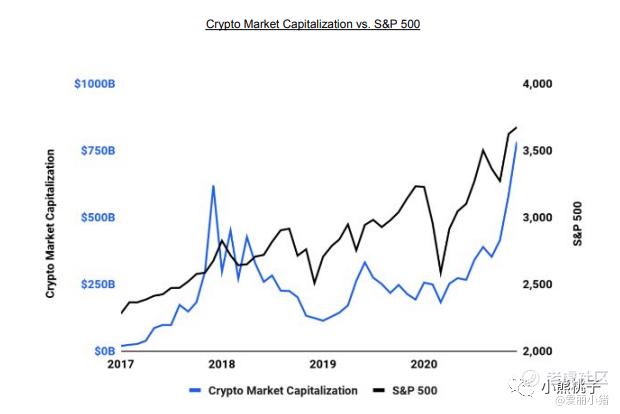

- 2020年3月,币圈与美股齐跌后,股币资产关联度提高

- In the past, crypto markets have not appeared correlated with the broader U.S. equity markets. This trend held true until February 2020, when the U.S. stock market and crypto markets experienced a significant downturn due to the ** pandemic. Through December 31, 2020, these markets subsequently appeared more correlated as each market recovered.

2021 Annual Average MTU possible scenarios

In terms of Institutional Revenue,

Coinbase said they expect meaningful growth in 2021 driven by transaction and custody revenue given the increased institutional interest in the crypto asset class.

Revenue Drivers: Customer acquisition and engagement

Approaches: sales and marketing investment, planned as of 12%~15% of net revenue in 2021

图中可以看出2020年sales and marketing支出占营收的5%,金额上比2019年翻倍,占比不高,coinbase依靠口碑自发吸引新客户。5%的营收占比较低,未来加大投入可以有更多获客空间。

科技研发投入占20%,主要是cyber crime detection

Key Business Metrics

1) Assets on Platform

平台托管资产产生托管费,计入subscription and service revenue。

资产负债表中可以看到,公司用来当做市商的储备数字货币并不多,但用户托管资产2020年比2019年底的几乎10倍。

2) MTUs (retail users only)

3) Trading Volume:定义为一段时间内交易发生时的币的美元定价*交易币数,求和。它的意义是反映流动性、trading health, and the underlying growth of the cryptoeconomy. 会被price of Bitcoin and crypto asset volatility深刻影响

4) Verified Users:retail users+institutions+ecosystem partners

目前是4300万零售用户、7000个机构账户、115000个生态系统合作伙伴

*未来判断时需要注意VU会大于客户人数,因为单人会使用多个邮件、手机 、用户名注册多个不同的账户。

Reconciliation of Net Income to Adjusted EBITDA

*We calculate Adjusted EBITDA as net income (loss), adjusted to exclude interest expense, provision for income taxes, depreciation and amortization, stock-based compensation expense, impairment of goodwill, acquired intangibles and crypto assets, restructuring expenses, non-recurring acquisition-related compensation expenses, unrealized gain or loss on foreign exchange, fair value adjustments on derivatives, and non-recurring legal reserves and related costs.

Reddit 路演

1,coinbase上线山寨币的标准是什么?

Security, legal reasons, compliance

*coinbase到2021年1月上线了44个数字代币的交易,币安290种

2, coinbase上能够买coinbase股票?

不能。

*币安已推出代币来买卖特斯拉股票,4月12日新闻

3,最大的威胁threats and concerns

government and regulators

cyber security-配备cyber crime insurance policy

innovation

4,为什么不直接发币用代币表示equity?

答曰基础设施不具备,机构投资者不能买security tokens, 没有做市商资源提供流动性,没有牌照和基础做这个。未来会考虑。

5, Coinbase 和Coinbase Pro费率不一样

素人小笔交易手续费率basicly小于专业trader的手续费率,合理。

04

—

下期问题

用3%的费率大规模合规买入比特币是值得的吗?这比交易费有意义。

精彩评论