(July 20) U.S. stock futures edged higher Tuesday, after major indexes tumbled Monday on concerns over the spread of Covid-19 variants and potential setbacks to the economic recovery.

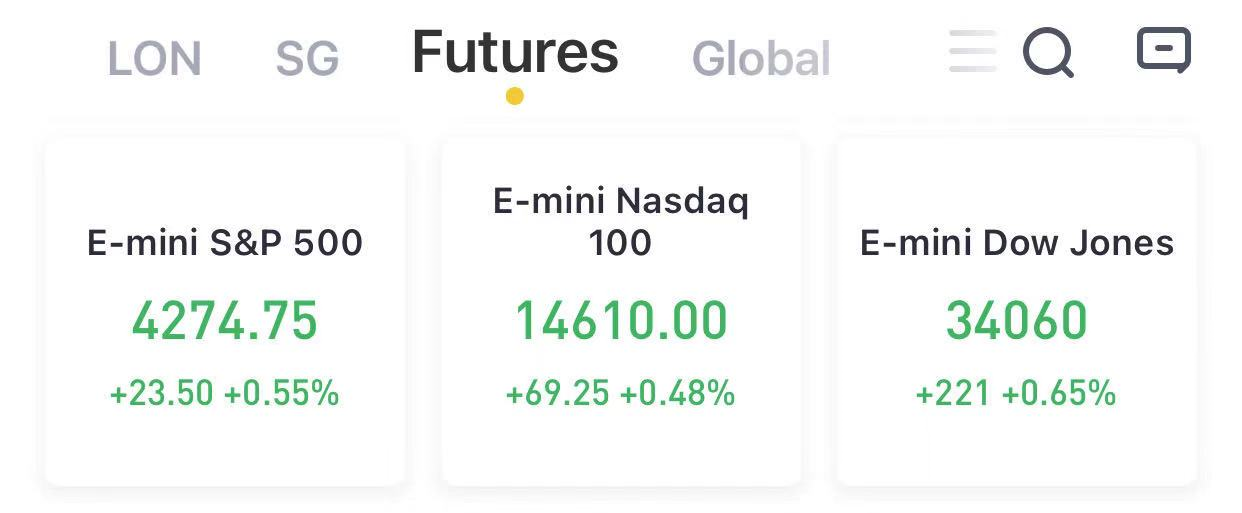

At 7:46 a.m. ET,Futures tied to the Dow Jones Industrial Average rose 0.65%, suggesting a reversal for the blue-chip index that fell more than 700 points Monday in itsworst session since October. S&P 500 futures and Nasdaq 100 futures also climbed about 0.5%, pointing to gains for both the broad-market index and technology stocks.

Investors have grown concerned over the Delta coronavirus variant, prompting a reassessment of the economy’s prospects. Despite this, the three major stock indexes each closed only around 3% down from their all-time highs Monday, underscoring the strength of the rally that powered equity markets in the first half of the year.

“When you get a selloff like we had yesterday, there are certainly going to be some investors who are going to see that as an opportunity to invest for the longer term,” said Kiran Ganesh, a multiasset strategist at UBS Global Wealth Management. “Especially where the 10-year [Treasury] yields have gone, that still points to the default position for investors as long equities, because there are simply very few other options.”

Stocks making the biggest moves premarket:

1) Amazon - Amazon.com gains 0.6% in premarket trading ahead of Jeff Bezos’s flight to space with his Blue Origin crew. Watch Live<<

2) IBM gained 4.0% in premarket trading as brokerages raised their price targets on the stock following strong quarterly growth in the company’s cloud and consulting businesses.

3) Halliburton - Halliburton added 2% after it posted a second-straight quarterly profit, as a rebound in crude prices from pandemic-lows buoyed demand for oilfield services.

4) Energy stocks Chevron, Schlumberger, Occidental and Phillips 66 rose between 0.8% and 2.7%, as oil prices edged higher after the previous session’s 7% slide.

5) Ardelyx - Ardelyx slumps as much as 73% in premarket after the FDA identified deficiencies on the company’s New Drug Application for

6) Tenapanor for the Control of Serum Phosphorus. Piper Sandler downgraded the stock to neutral from buy and slashed its price target to $4 from $14, adding that it struggles to see a path forward for Tenapanor.

7) Cryptocurrency-exposed stocks fall in premarket trading after the selloff in Bitcoin accelerated and pushed the token below $30,000 for the first time in around a month. Marathon Digital (MARA) slides 2.3% and Riot Blockchain (RIOT) drops 2.4%, while Bit Digital (BTBT) falls 1.6%.

8) Airline stocks, Cruise Stocks rally in premarket trading.

In commodities, oil prices stabilized after slumping around 7% in the previous session due to worries about future demand and after an OPEC+ agreement to increase supply. Brent crude gained 0.7% to $69.11 a barrel. The U.S. crude contract for August delivery, which expires later on Tuesday, was up 0.9% at $66.64 a barrel. Spot gold fades Asia’s modest gains to trade near $1,815/oz after hitting a one-week low of $1,794.06 in the previous session. Base metals were mixed, LME lead and LME copper outperform; zinc drops as much as 0.7%.

In a separate gauge of investor risk appetite, bitcoin fell below $30,000 for the first time since June 22.

Meanwhile, Q2 reporting season is underway, with 41 of the companies in the S&P 500 having reported. Of those, 90% have beaten consensus estimates, according to Refinitiv data. Focus is now on earnings reports from companies including Netflix Inc, Philip Morris and Chipotle Mexican Grill later in the day.

Looking at the day ahead, the data highlights include US housing starts and building permits for June. From central banks, we’ll hear from the ECB’s Villeroy, while earnings releases include Netflix, Phillip Morris, HCA Healthcare, Chipotle, United Airlines and Halliburton.

精彩评论