2021 Week 28 - Marathon vs Trading & Investing? Market Update + Stocks to Watch

Marathon vs Trading & Investing

I used to participate running from time to time (maybe 8 years ago), such as the Stan Chart & Sun Down half-Marathon and a few others local events, mainly because I enjoy the feeling of a sense of achievement upon completion.

Although I was an amateur runner (I no longer run since running hurts my knee badly...), I do know that it is essential to keep moving (no matter how slow) even I am extremely tired and exhausted during running. Else, it is almost impossible to complete the run within the acceptable duration (yes, you will be stopped and a bus will pick you up).

Stay in the game is the key to complete a Marathon. Similarly, in trading or investing, stay in the game is also the key. Let me explain further:

A lot of traders tend to give up especially during challenging market. It is fine to stay out and only monitoring instead of trading. Yet, it is not acceptable to totally ignore and abandon the market and only come back when you realize it is at all time high from the news. There is a subtle difference between staying out and abandoning the market.

If you still keep in touch with the market, it will be a lot easier for you to come back in when you spot the right opportunity and the right market environment that suits your personality and trading method.

Vice versa, if a person was out of touch due to account drawdown caused by the market volatility and only come back when realize the market hit all time high and FOMO (fear of missing out). The chances of him/her to survive and profit from the market in the long run is slim because of the emotion and lack of the skill of analyzing and execution.

The market since Feb 2021 has been challenging due to sector rotation and changing of the dynamics. Breakout trades tend to fail easily and even if they are successful, the trend might not last long enough. Yet, there are still many profitable trades waiting to be discovered every week and we just need to pay attention to adopting the right trade management strategy.

So do stay in the game with the right mentality and risk management in order to become profitable in the long run.

Market Update

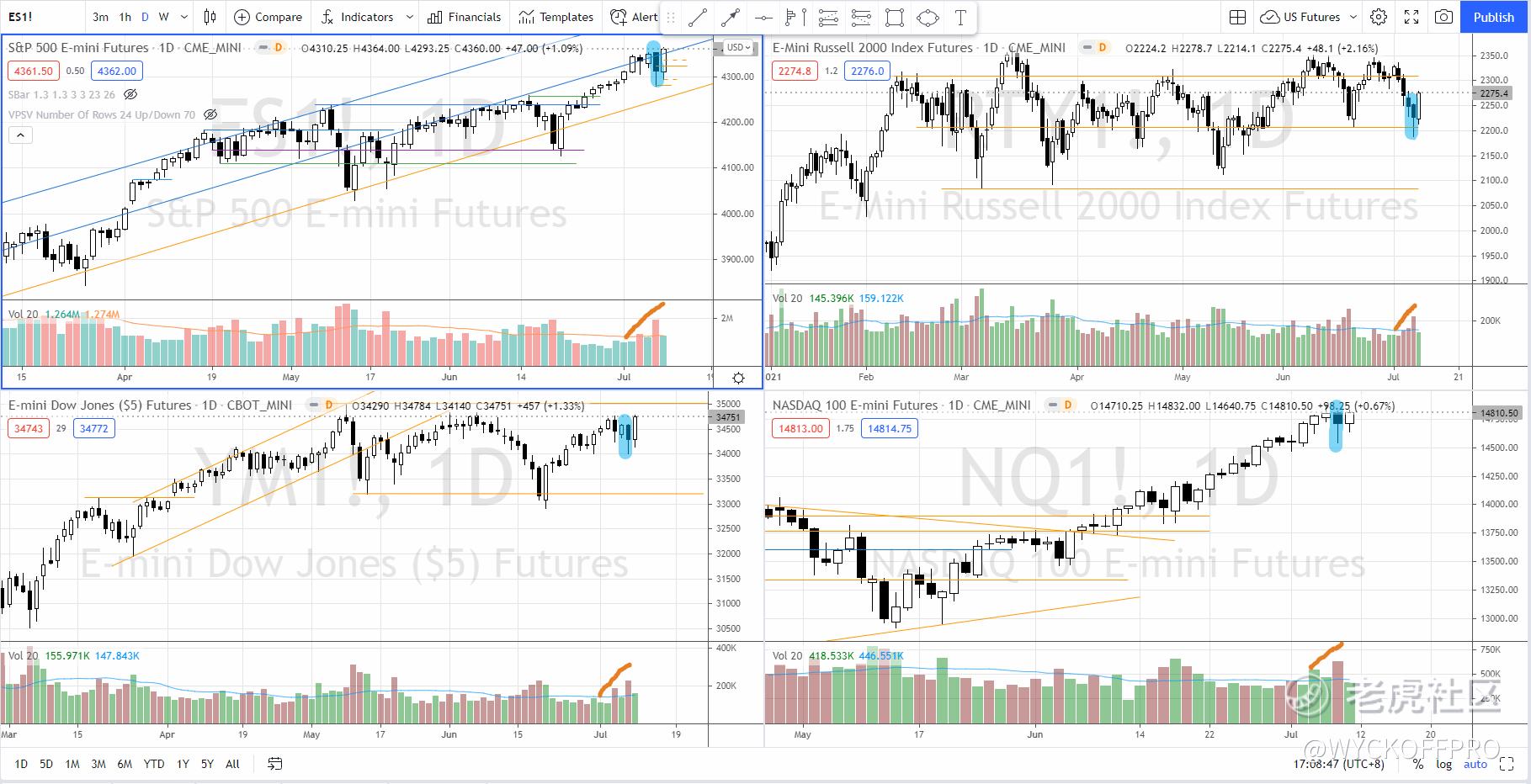

Despite emerging of supply last week for 4 major US indices, the attempt to have a correction was not successful. The close on Thursday's was mainly a hammer (highlighted in blue) suggesting lack of commitment to the downside and that was confirmed by Friday's bullish bar.

The market direction is still up. Yet the market breadth does not improve and the price certainly is over-stretched, which are still the red-flags. Focus on the trade management is still the priority.

Meanwhile, check out the stocks to watch for Week 28 below.

US: Massive Move Coming for These Underhyped Stocks? LB, TMDX, ANGO

These 3 stocks — $L Brands Inc(LB)$ , $TransMedics Group Inc.(TMDX)$ , $阿吉奥动态(ANGO)$ have outperformed the S&P 500 and set to take off after this bullish pattern shows up with potential massive move ahead. Watch the video below:

Timestamps

- 0:17 LB (L Brands, Inc)

- 3:10 TMDX (TransMedics Group, Inc)

- 6:45 ANGO (AngloDynamics, Inc)

Further Reading

Q&A EP3: Price Action Analysis on PYPL, LQDT, FUBO, NIO, XPEV

2021 Week 27 - 3 Stocks Set To Move Higher, Market Update & Growth Stocks Proxy

2021 Week 26 - Adjust & Adapt under the Great Sector Rotation?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。