你可能没意识到的做空风险:做空利率飙升(1)

美股交易自由度高,做多做空都OK。不过交易美股的人,可能都听过一种讲法:“少做空”。

大家熟知的理由是,做空风险无上限,理论上亏多少都可以。

但在爆仓风险之外,还应警惕的则是做空利率。

如图可看到,$Zoom(ZM)$ 做空利率已经飙到100%以上了。大于20%已经算高做空利率,所以100%利率的空票拿在手里啥滋味,虎友们可以感受下。

美股做空利率采取浮动机制,查看做空利率很简单,点击老虎软件右上角就可以。但你只能看得到今天的数字,看不到明天以及后天的。

所以如何计算做空利率,就显得有必要了解下?个人google了下有两种说法,

1,做空数除以流通股

Short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed out. ... For example, a stock with 1.5 million shares sold short and 10 million shares outstanding has a short interest of 15% (1.5 million/10 million = 15%)

做空利率未平仓空券总数相关。例如,一只股票被做空 150万股,流通股 1000万股,其做空利率为 15%(150万 / 1000万 = 15%)

2,做空数除以日均交易量

Short interest ratio is the ratio of short interest to float, expressed as a percentage. The float of a stock is the number of outstanding shares available for trading. The ratio can also be expressed as the number of days to cover, which is the total short position divided by the average daily trading volume.

OR

The short Interest ratio is a simple formula that divides the number of shares short in a stock by the stock's average daily trading volume. Simply put, it can help an investor very quickly find out if a stock is heavily shorted or not shorted versus its average daily trading volume.

卖空利率是一个简单的公式,它用股票的卖空数量除以股票的平均日交易量。

我想这两种说法,可能都不够精确。以Zoom来说,当前做空利率超过100%,难道所有流通股均被做空?似乎不太合逻辑。

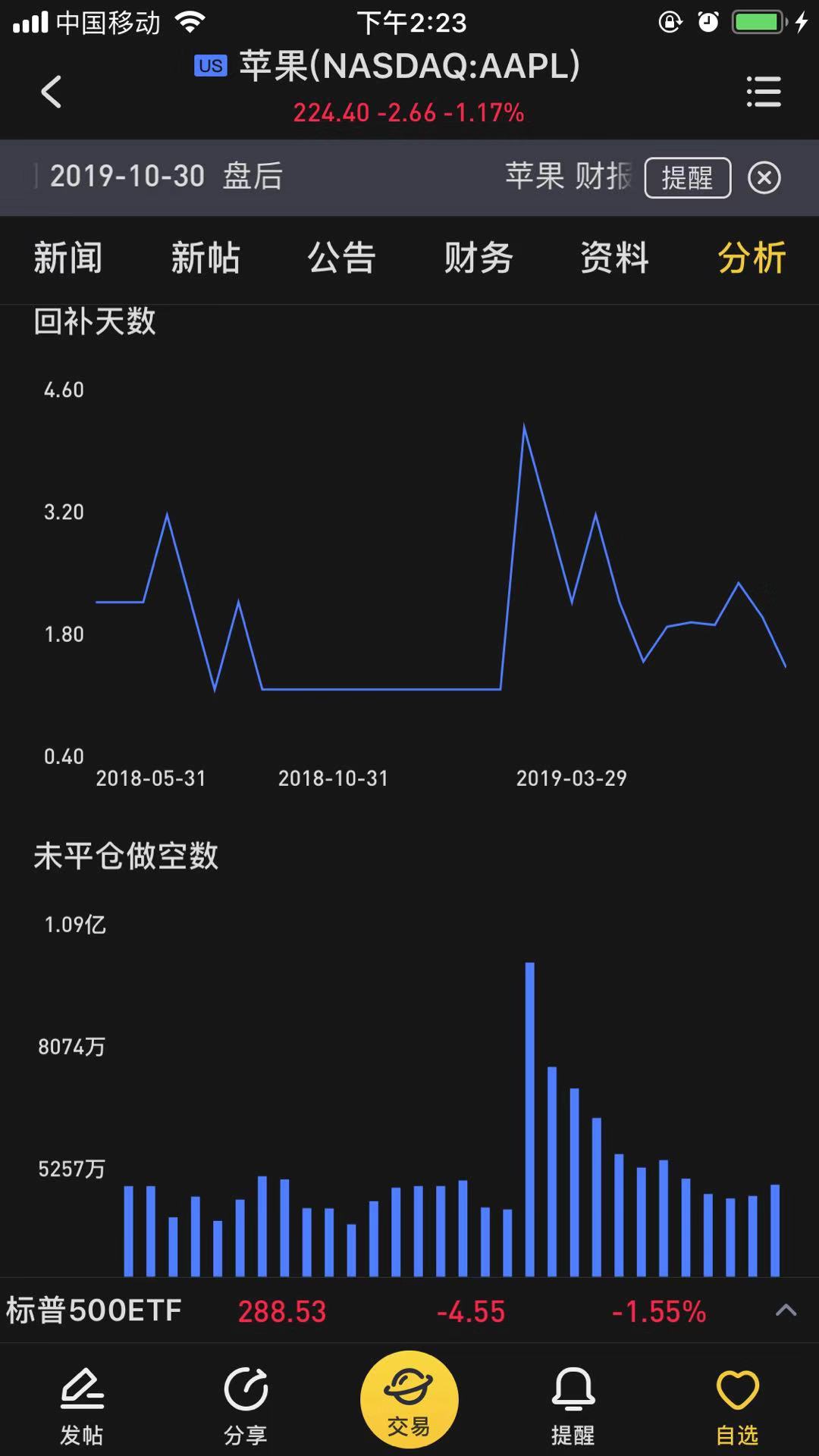

而第二种说法,是空头回补天数的概念。翻开比如苹果和Zoom的空头回补天数大于1是很正常的,但$苹果(AAPL)$ 做空利率常态来说只有1%水平。

最后,做空利率还可以让我们来判断,当前这只股票的做空情绪。参考交易。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 美股新英·2019-10-10学习啦😄点赞举报

- 胖虎哒哒·2019-10-09[强]点赞举报

- 夏夏夏·2019-10-09[666]点赞举报