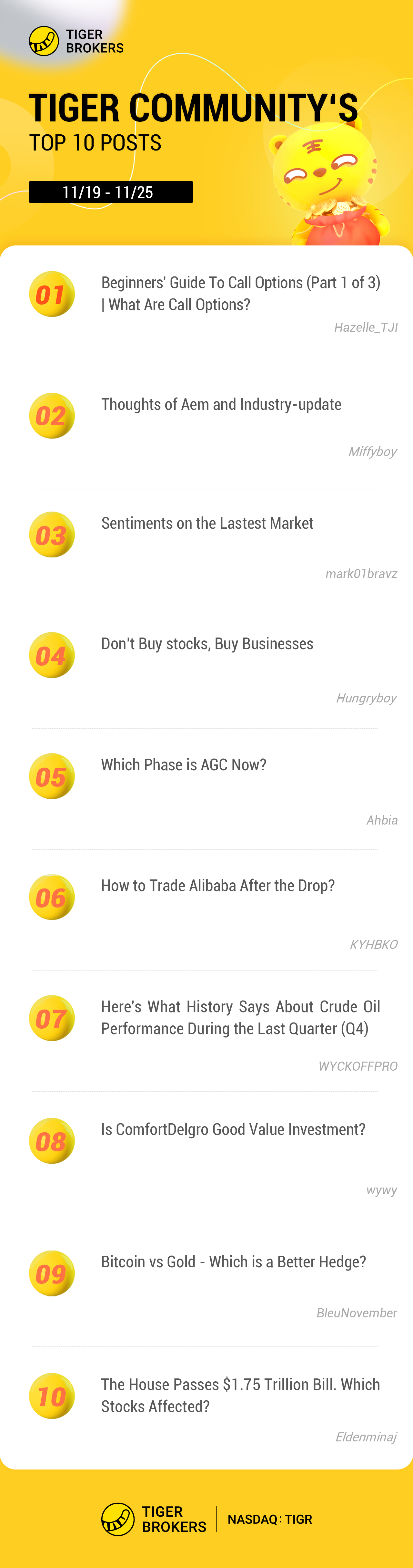

🏆 Posts of the Week (Nov 19- Nov 25)

Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

A tip:

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1. @KYHBKO @WYCKOFFPRO @wywy have mentioned @Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. Congrats to Tigers @Hazelle_TJI @Miffyboy @Hungryboy! Their posts are the first time selected in the "🏆 Posts of the Week". Thanks for sharing your insights on stocks and markets with us.

3. Another highlight is “Beginners' Guide To Call Options (Part 1 of 3) | What Are Call Options?” by @Hazelle_TJI. Welcome👏👏👏 She is a new Tiger in our community, and she explains Call Options for beginners in her video. Go to her main page, check what she says!

Market trends and industry news:

1. Sentiments on the Lastest Market

Tiger: @mark01bravz

We saw markets rally toward all-time ceilings, then blow the roof completely off the building. We saw terrible companies have their stocks squeeze historically high, and perhaps even worse, we saw their “investors” try to rationalize the move. We saw an electric vehicle company roll their truck down a hill and call it good enough, Fortune 100 CEOs have a pissing match in outer space, and the largest property developer on earth rack up $300B in debt, shocking the world once they said they probably can’t pay it off.

2. Here's What History Says About Crude Oil Performance During the Last Quarter (Q4)

Tiger: @WYCKOFFPRO

As shown in the daily chart below, crude oil is still in a well-established up channel.

Tiger: @BleuNovember

Here we can see using the Equity Risk Premium (ERP) - ERP and BTC follows in an inversely related fashion. In an equity sell off (resulting in premiums going up), BTC and crypto follow the sell-off. The opposite happens for gold.

4. The House Passes $1.75 Trillion Bill. Which Stocks Affected?

Tiger: @Eldenminaj

The $1.75 Trillion Bill will accelrate the US economy and increased corporate America's profits overall. The more the goverment spends, the more corporate America Earns.

Tigerpedia:

5. Beginners' Guide To Call Options (Part 1 of 3) | What Are Call Options?

Tiger: @Hazelle_TJI

Heard about investors using options but have no idea what they are? [疑问] Fret not, here's a beginners' guide for you!

Stock opportunities:

6. Thoughts of Aem and Industry-update

Tiger: @Miffyboy

Increased in revenue was mentioned by the management during Q3 business update. With this increases in revenue, Q4 result could be the starting point for better quarters ahead. So we should see visibility for better sales in 2022. Early next year, I will be looking forward to their sales estimation for 2022.

7. Don’t Buy stocks, Buy Businesses

Tiger: @Hungryboy

We need to bear in mind that although, Sono is a “Car” business and only starts their production in 2023, their tech is said to be able to be used on not only cars but buses, trains, trailers, trucks, boats and houses. This brings about huge potential in the market if the company decides to sell their tech to bigger players.

Tiger: @Ahbia

Trend: This is the phase where no new highs are created and the stocks move sideway for a period of time.

Why: Institutions buys up main bulk of the sharesavailable in the market. In the case of AGC, institution are holding close to 90%. They will help us form the base of the stock price and we will unlikely to see a big drop.

9. How to Trade Alibaba After the Drop?

Tiger: @KYHBKO

My trade set up with be focused on reversal using 1 Day chart MACD indicator. this is a lagging indicator but can be a more prudent approach. the reversal may happen at end of November or early December pending any more black swan events and news. I rather buy on a higher price on the way up than to be part of the dropping price. the recovery will take time and there are worthy competitors like $JD.com(JD)$ & $Pinduoduo Inc.(PDD)$ .

10. Is ComfortDelgro Good Value Investment?

Tiger: @wywy

Taking an average figure, assuming dividend can go to 7-8cents then at current entry price will see a yield of around 5%. double of cpf OA interest. And since we are still at a pandemic recovery phase, share price appreciation is more likely than downside.

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1.Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- TigerStars·2021-12-01Hi, dear tigers! The coins have been sent, and you can check on [Me] - [Tiger coins] - (Upper Right Corner). If you have any questions, please feel free to tell me! Thank you for your contributions to the Tiger community! @Hazelle_TJI @Miffyboy @mark01bravz @Hungryboy @Ahbia @KYHBKO @WYCKOFFPRO @wywy @BleuNovember @Eldenminaj6举报

- UrsulaFowler·2021-11-26Fabulous! thanks to tiger stars and these friends, really hope I can learn and earn hhh5举报

- NancyZhang·2021-11-26Congrats to all! Enjoy reading, hope to see more posts like these!5举报

- MorganHope·2021-11-26GOOD JOB! Thanks for sharing👏👏👏4举报

- Twelve_E·2021-11-26Many inspirations, cool3举报