SGX Lucky Draw Campaign--- Week Three

Singapore REITs Week, earn SGD 200 vouchers for Top3 REITs in Singapore market value!

Attention Fellow Tigers!

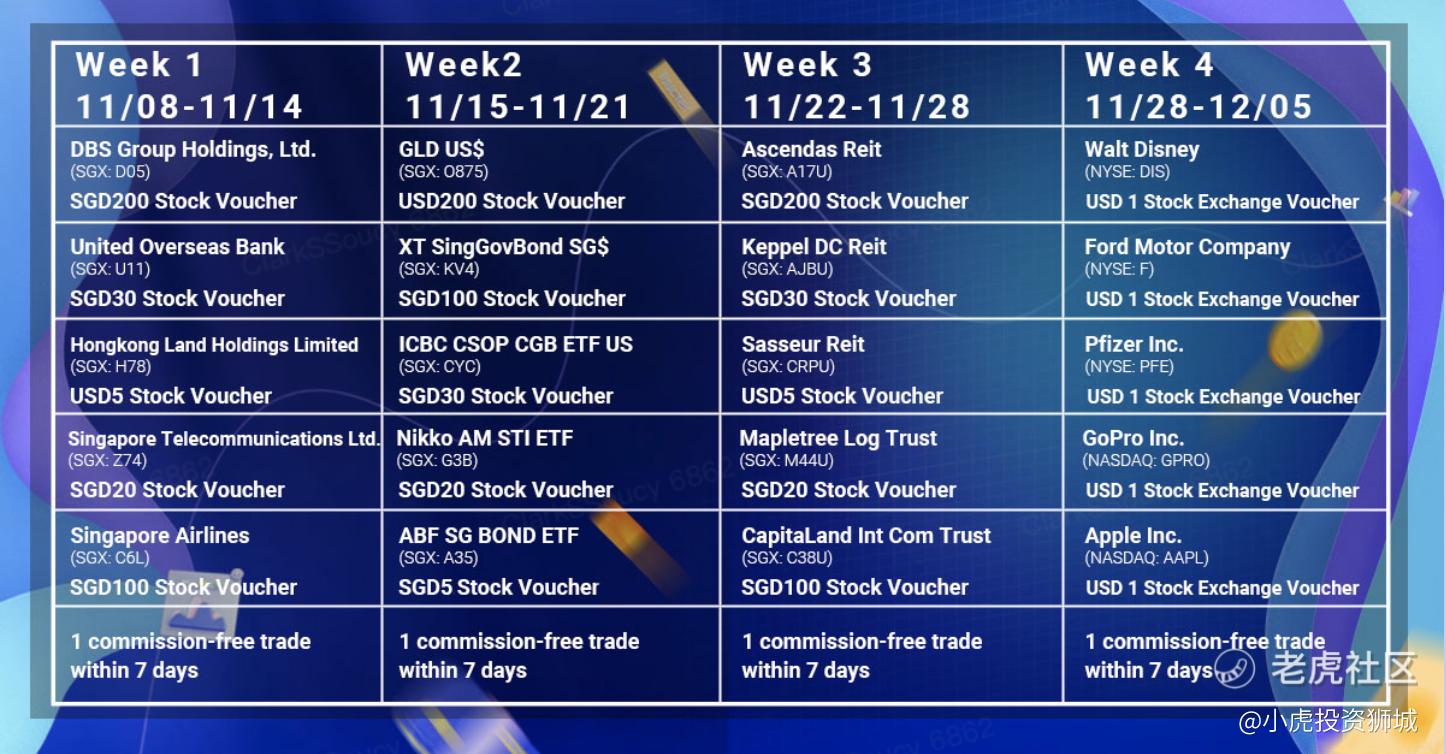

The lucky draw for week 3 has begun! A variety of REITs rewards are launched from November 22 to 28. Investing in REITs makes it possible for investors to benefit from valuable real estate market and obtain opportunities for dividend-based income and total returns. Real Estate Investment Trusts have high and stable dividend income and long-term capital appreciation, and REITs can provide competitive total returns. REITs are more suitable for medium and low-risk investors. For more information, please read the brief introductions of the different REITs below.

Come on and be the lucky one of week 3, this week's lucky draw is waiting for you. This week's reward value ranges from SGD 5 to USD 200. The five clients who cumulatively refer the largest number of account openings in a single week can enjoy up to the annual commission-free. Click here to join us now!

$腾飞房地产信托(A17U.SI)$ ASCENDAS REIT

Ascendas REITs is Singapore's largest REIT (Real Estate Investment Trust) by market capitalization and one of the largest REITs in Asia by assets. The REIT owns 208 properties, the vast majority of which are concentrated in Singapore. Specifically, the REIT owns a wide range of offices buildings, data centers, logistics centers, and warehouses spread throughout Singapore and other countries. Ascendas is managed by Capitaland, Singapore largest property developer.

So why use REITs to invest in property? Under Singapore law, REITs must distribute 90% of their profits as dividends to their investors. The advantage of investing in REITs is that they are essentially giant landlords that pay out the vast majority of tenants' rental fees as dividends. Singapore REITs are especially attractive because the country has no capital gains tax or tax on dividend income. Singapore also exercises strict control over REITs' financial management; REITs' leverage ratio may not exceed 50%. As a result, most of the country's REITs have relatively conservative financial management: Ascendas REIT's leverage ratio is 37%, implying that the value of its outstanding debts, like bonds, only comprises 37% of the value of all the properties and other assets like cash that it has on its balance sheet.

REITs like Ascendas will not only develop their own buildings, but they will also engage in selective acquisition of new properties as well as sale of existing properties in their portfolio. Ascendas has used acquisition to diversify its portfolio of properties and enter the UK, US, and Australia.

Over long periods of time, Ascendas has delivered solid returns to its shareholders. In the past five years, the REIT's share price has risen at a compound rate of 6.4% annually and its average annual dividend yield was 4.5%, so shareholders have enjoyed total returns of around 10%~11% per year.

$吉宝数据中心房地产信托(AJBU.SI)$ KEPPEL DC REIT

The Keppel Data Center "DC" REIT is a REIT solely focused on building and operating data centers, with profits from data center operation paid out to shareholders in the form of dividends. By solely focusing on data centers, Keppel DC REIT gives investors targeted exposure to a rapidly growing segment of the digital economy. As demand for cloud computing rises, corporations all over the world are leasing computing power and storage from data centers. With the exception of technology giants like Google, that operate their own data centers, most mid-size and even larger companies rely on data centers for their computing needs.

Keppel DC REIT is managed by Singapore based Keppel Corporation, a major infrastructure and asset manager. Keppel DC REIT currently operates 19 data centers that are located in Singapore, Malaysia, China, Australia, The UK, Ireland, The Netherlands, Italy, and Germany.

Due to surging demand for data center services, the Keppel DC REIT has delivered solid returns for its investors. Over the past five years shareholders' total return has been around 15%~17% per annum.

$砂之船房地产投资信托(CRPU.SI)$ SASSEUR REIT

If you like big dividends, Sasseur REIT is hard to ignore. Sasseur owns four large outlet malls (total retail space for rent: 312K square meters) in four fast growing Chinese cities: Chongqing, Hefei, Kunming, and Bishan. The REIT pays dividends in Singapore dollars every quarter and currently its dividend yield is 8.2%! This high dividend yield is not an exception, in 2020 Sasseur's dividend yield was 7.6% and in 2019 it was 9.5%.

Sasseur, just like other Singapore REITs, pays out 90% of its profits as dividends. The main reason that Sasseur pays out so much to its shareholders is that unlike other Singapore REITs, Sasseur has a unique operating model. Instead of just taking fixed rental income from the stores and restaurants in the malls it operates, it also makes about 30% of its revenue from a specified proportion of its lessee's revenues, so if Chinese consumers spend more, the REIT automatically makes more money.

China has the world's largest consumer class and the country is recovering well from the coronavirus pandemic; investing in Sasseur REIT is an solid choice for obtaining returns from China's macroeconomic growth.

$丰树物流信托(M44U.SI)$ MAPLETREE LOGISTICS TRUST

You've never seen such a boring business that has such high returns: Mapletree Logistics Trust is a REIT that solely invests in warehouses and logistics centers. In total, the REIT owns and operates 163 properties spread across Singapore, Japan, Hong Kong, Korea, Australia, China, India, and other Asian countries. In the past five years, the stock price of Mapletree Logistics Trust has doubled and over that time period it paid an average annual dividend of 4.9%, so shareholders who just held the stock made a total return of around 19% a year!

Why exactly is this REIT making so much money? Well, it has to do with e-commerce. As e-commerce becomes more popular around the world, global consumers are making ever more online purchases. This increases demand for warehouse space to hold and process all of the goods before they are shipped.

As a result of this surge in demand, Mapletree's logistic centers and warehouses barely have any free space. Presently, the occupancy rate is nearly 98% and it hasn't even budged since the pandemic began. High occupancy means that Mapletree is able to increase rents on its newly signed tenants, further boosting future revenues and profits. In its most recent financial report, Mapleetree disclosed that the average new tenant was paying 2.4% more for their rent than the same period last year. Everyone has read the news about supply chains and parts shortages all over the world; it's reasonable to expect that Mapletree will be able to keep raising rents and delivering even more value for its shareholders going forward.

$凯德商用新加坡信托(C38U.SI)$ CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust is the largest REIT that is focused solely on properties in Singapore. The REIT in total owns 24 properties valued at 22 billion SGD, including several that are in Singapore's swanky Marina Bay. The REIT presently invests in both office buildings and malls, including famous malls in Singapore like Raffles City.

Before the pandemic the REIT was delivering very solid returns to its shareholders. Dividends were around 5% per year and the REIT's share price was increasing by around 10% per year. Once the pandemic hit, the REIT's share price fell around 30% and has yet to recover to the highs it reached in 2019.

The pandemic severely affected foot traffic and retail sales at malls in Singapore as people stayed home to comply with pandemic restrictions. As a result the REIT had to give big discounts on rent to its retail tenants. However, investors should note that due to the REIT's conservative financial management and low debts, it did continue to pay regular dividends throughout 2020.

What's worth noting is that the REIT's share price hasn't responded to its improving business fundamentals. Singapore is opening back up and welcoming travelers from many different countries without quarantine; normal life is returning. As a result, business is steadily improving at the malls that the REIT operates; in the third quarter of 2021, retail sales by the REIT's tenants were up 101% year over year and had already reached 84% of 2019 levels.

With a 5% dividend yield and a share price off 20% from its 2019 high, Capitaland Integrated Commercial Trust deserves a look from both property investors and speculators alike.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- ElsieDewey·2021-11-23excellent! Look forward to Singapore's stock market getting better and better! Stocks soared!3举报

- jinhut·2021-11-23good点赞举报