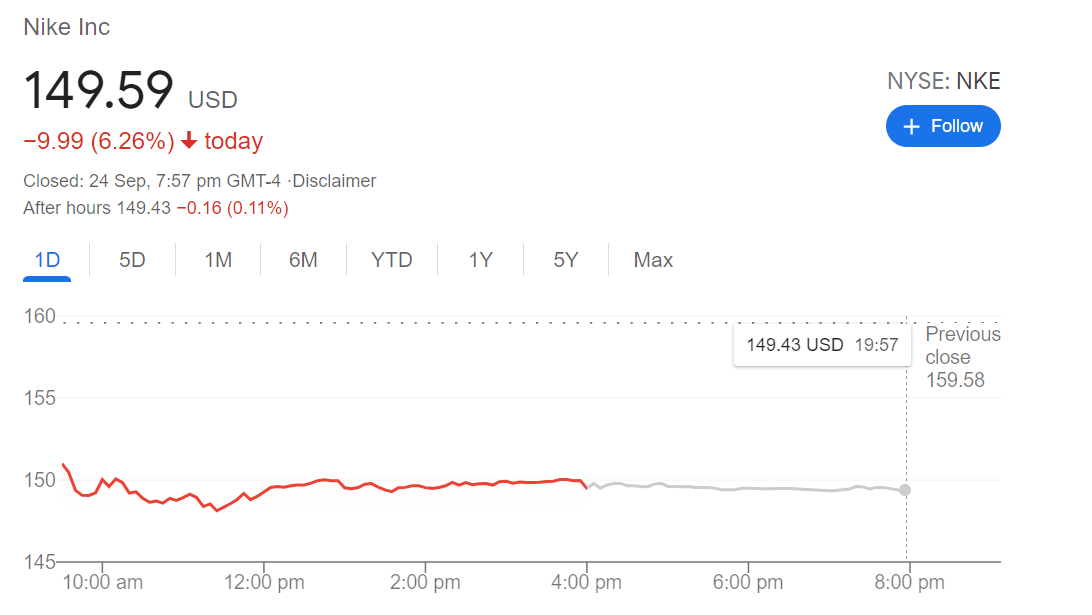

Why Did Nike (NYSE: NKE) Drop By 6% Last Friday?

Shares of Nike Inc. $Nike(NKE)$dropped by more than 6% last Friday after the company announced earnings for the first quarter of fiscal 2022 that disappointed investors.

The company cited supply chain disruptions which include temporary forced closures of its manufacturing facilities in Vietnam and Indonesia – both countries that are still facing battle of the Covid-19 pandemic.

First quarter earning is not all bad and gloom.

The company reported sales of $12.2 billion and an underlying EPS of $1.16, which is just under the market estimates of between $12.4 billion and $12.6 billion.

The company managed it’s profit margin better in the first quarter due to less incentives given to customers due to higher than expected demand in the marketplace which led to a higher EPS but warned the increasing supply chain disruptions might hurt their margins going forward.

The ongoing disruptions with the manufacturing facilities in Vietnam and Indonesia are also likely to reduce productions over the next few months which likely leads to a lower sales.

The company also guided for next quarter (Q2) to be flat and revised down the overall fiscal year 2022 revenue to be on mid-single digit growth (down from the previous low double-digit) due to inventory and supply chain disruptions.

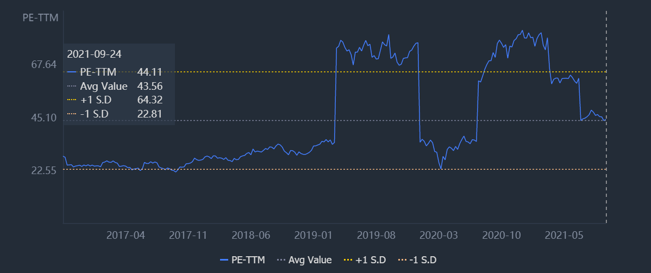

The company is currently trading at a market cap of $236 billion and a price to earnings valuation of around 44x, not exactly cheap if you compare them across the last 5 years period.

From a technical chart perspective, Nike had a gap up when it announced and guided for higher growth in the last Q4’21 earnings.

This gap is now likely to be filled in with sentiments muted for the rest of the year since the company has guided for a much slower growth for the rest of the fiscal year.

For investors who are looking out on this, you may want to watch out the $139 gap level to be filled in in due time.

If you want to be further conservative, you can use the options to look at the $126 strike when the share price has hit the $139 mark. That would be a good level where investors can start going long again, and paid to wait to be patient.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 花儿对我笑0·2021-09-27很客观的一篇分析,这要看是短暂的生产力造成的不足引起的业绩下滑,还是基本面发生变化,很显然,基本面没有发生变化,并且耐克的设计团队还是保持的高的核心竞争力。所以趁合适的价格,做多是个比较稳健的操作。10举报

- 哈里吨冲击·2021-09-27价值投资的角度来看,价格合适的话还是要买,耐克有非常非常高的市场占有率,不会轻易被取代。6举报

- 来一口汤·2021-09-27身边很多小伙伴都觉得耐克鞋的质量越来越不好,这些切身感受是不是也会真实反映到股价上?5举报

- 哎呀呀小伙子·2021-09-27Nike貌似新疆棉之后就不中了吧?销量一路下滑吧?6举报

- 哎呀呀小伙子·2021-09-27第一季度的收入并不都是糟糕和低迷的,但是这话投资者也并不喜欢听。6举报

- Albertwong85·2021-09-28A good brand will bring cheers to investor. Just stay calm and have faith with their management team.4举报

- 华尔街的花儿姐·2021-09-27好公司好股票的一个代表,不过疫情对它的影响也是着实不小,一切都是为了降低生产成本。4举报

- 德迈metro·2021-09-27短线趋势图走坏了,不好弄呀,看看国内的几家运动服企业。6举报

- 迪士尼迪斯尼·2021-09-27本来还打算买这个股的,一看你这文章妥妥的不敢买了。5举报

- 豆腐王中王·2021-09-27当初如果不把工厂挪到越南情况会不会好点?5举报

- 路人丙钉钉·2021-09-27耐克的财报不及预期,这个真的还是很影响市场信心的。虽然中华区的销量还在上涨,但是竞争环境却愈发激烈,前景未知4举报