Earnings season: PING AN Q3 Report

Lets discuss the Financial report for Q3/ 9M 2021

$Ping An Insurance (Group) Company Of China, Ltd.(601318)$

Here are my key takeaways from the report:

1. Operating Profit of the company is up 9.2% YOY and they company have achieved 20.3% ROE

2. PING AN retail customer grew 3.1% to 225 million. And 39% of the customers has contracts with multiple different subsidary.

3. Leta look at each business:

L&H insurance: Ping An life and health insurance contributed 61.2% of overall profit. It decreased 2.8% YOY, however it is still strong and their agent force is still stable.

P&C Insurance: Ping An Property and Casualty Insurance rose 20.2% to 13.221 RMB million.

Banking: Ping An bank profit grew 30.1% YOY. Non performing loan is lower at 1.05%.

Technology business: Patent has increased by 5423 YTD to 36835. Ping An has cutting edge techs!

4. Overall combined ratio is lower by 1.8% at 97.3% this year, which is good.

5. Ping An is also coming up with alot of different products mainly High End Eldercare and Health Management plans to sell to the aging population of China.

My Conclusion:

-I will be adding more Ping An into my portfolio. This company is the white horse of China and it is doing very well.

-My Free Cash Flow Valuation method for this company shows that the share price is worth 92. (50% discount to intrinsic value)

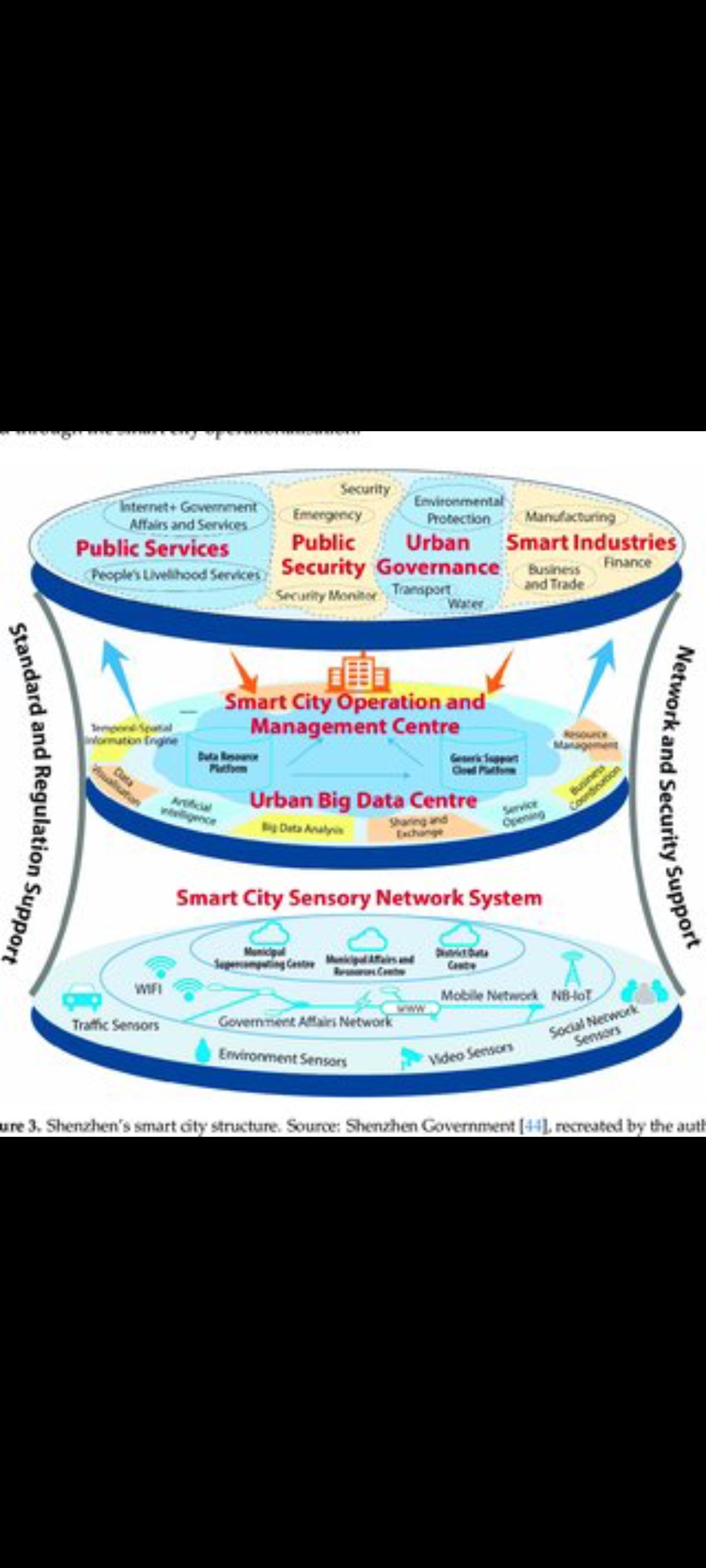

-This company is the next $Berkshire Hathaway(BRK.B)$. Although its main core business is insurance, it has so much of other business under it such as banking, technology business, smart city, and they have many listed companies under them. They are the main player in China's Financial Sector and Tech Sector.

Time to buy Ping An? Yes! It is expected to continur soaring for the next many years to come!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- Eldenminaj·2021-10-28What do u guys think of the company? Let me know if u buy into the company!1举报

- Eldenminaj·2021-10-28@patricklowck It dropped bec people are focusing on net income. bear in mind net income is manipulated. furthermore, the outlook in china equities is bad sentiment now1举报

- PhoebeReade·2021-10-29ping an group is really tenacious, it was nearly half price(compared to pick) a couple of months ago, and now it is coming back gradually, like eating an elephant bite by bite点赞举报

- AprilBridges·2021-10-30Interesting post and I think PING AN's core service is the still insurance, many scandals appeared lately. I will have short this.点赞举报