How To Pick An Investing Tool (Part 1/3)

各位好! 如果你有某种内容想要我写,可以留下留言。

如果你学到新知识或思维有所改变,可以给我点赞,好评或在你的朋友圈分享给其他人阅读这篇文章。多谢支持!

Sharing some of the more prominent asset classes for investment. This is part one of a three part series.

If you are a beginner in the world of investing, you will be bombarded with endless financial words such as interest rates, Bitcoins, capital gains, endowment plan, FOMO into stocks etc. Feeling even more confused, not sure how to begin or who to trust right? hahaha 😂

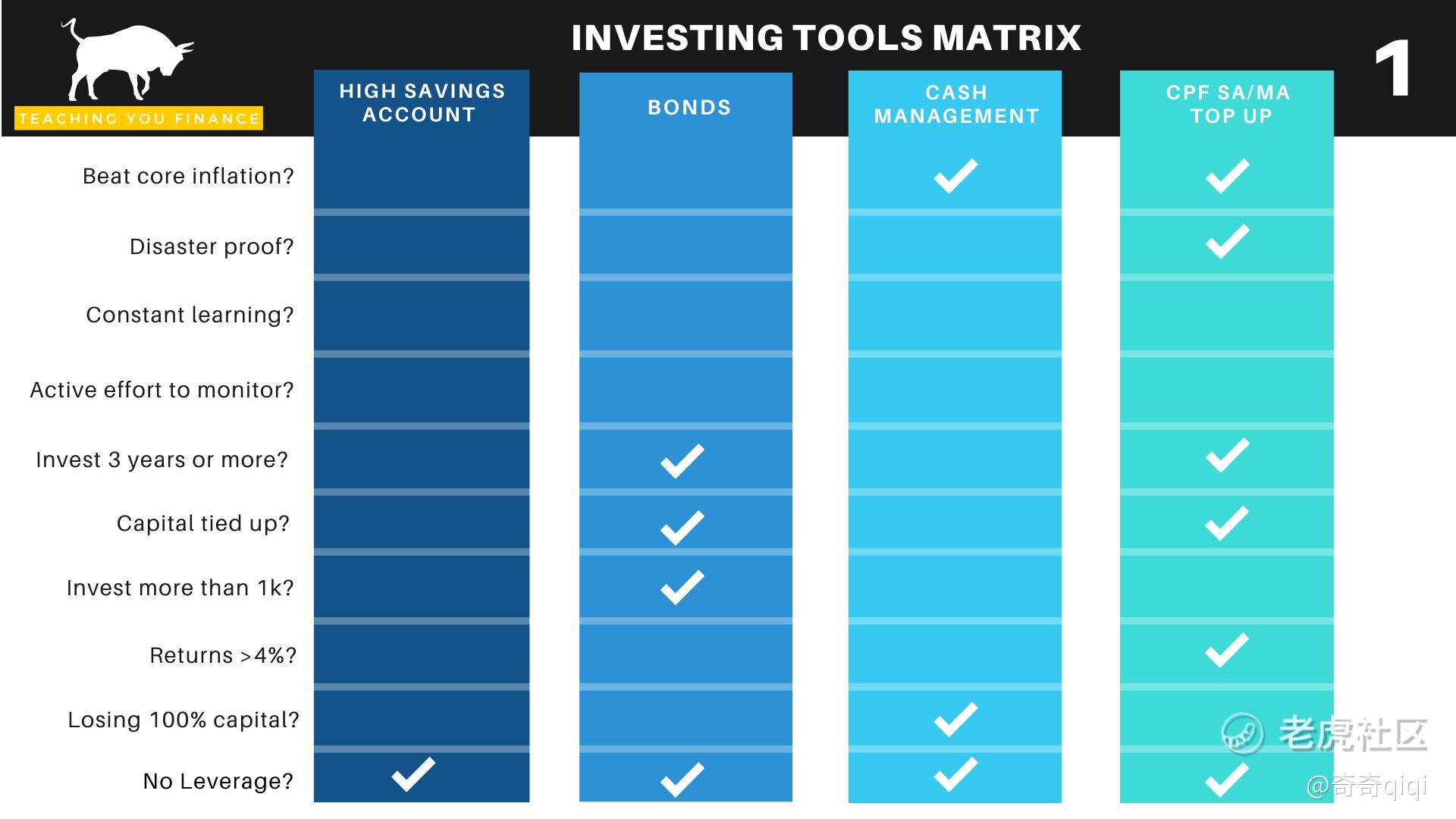

Not to worry too much about this. That’s why I have decided to put together a matrix to let you see and understand what is investing all about at the highest level and what are the various tools out there in the market. From here you can pick and choose one that works best for you.

If you have not read my previous article where I share more about the factors to consider before investing titled ‘Is one ready to invest’ then click here. Is One Ready To Invest

I have tried a number of different products which I will elaborate more below. 😊

I have excluded the following as either I have not tried them or they are not attractive to me at the moment: Forex, Fixed Deposits, P2P lending, SRS, Commodity trading, Endowment plans and other 3rd parties eg. GrabInvest. 😣

Legend:

- Core Inflation: Is whether what you have invested can actually beat the benchmark eg. 1.5% core inflation per year. If you cannot even beat this rate, you are losing money right away.

Click here to find out more on a previous article where I addressed investing to hedge against inflation.

How Can You Invest To Hedge Against Inflation?

- Disaster Proof: Is you investment able to weather past recessions, bear markets and other unforeseen circumstances external to the organization at the macro level eg. pandemic etc without dropping in value?

- Constant Learning: Does it require you to keep learning new knowledge to manage this investment?

- Active effort to monitor: Can you buy and forget? Or do you have to constantly monitor your investment activities daily?

- Invest 3 years or more: The investment will require some time to be committed before capital gains can be enjoyed

- Capital tied-up: Can you withdraw your money anytime after investing or is it tied up for a period of time?

- Invest more than 1k: Either the investment requires to invest a sum of money or you have to put in a minimum amount to see capital gains. Putting in so little cash will not bring about substantial changes to your returns.

- Returns >4%: Investments that have higher opportunity to bring greater gains

- Losing 100% capital: Ability to lose all of your principal sum invested and nothing more than that.

- No leverage: Your invested sum is worth 100% of the value you have invested in. eg. You paid the full $100 to purchase 1 unit of a stock that is indeed worth $100 per share.

1. High Savings Account

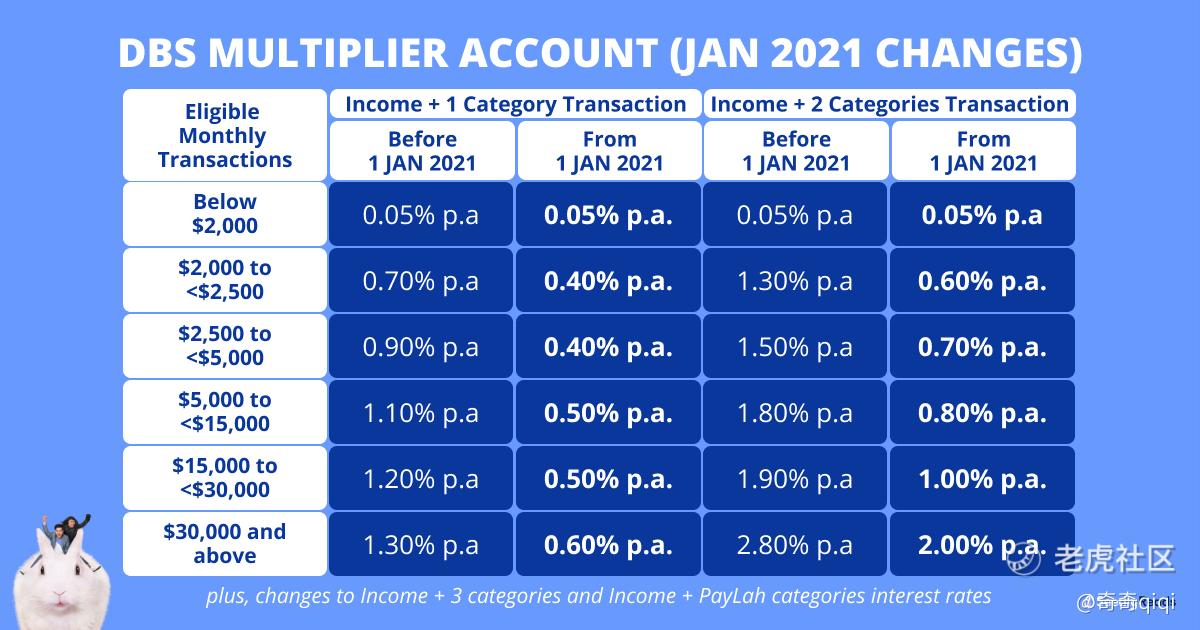

Different types of bank accounts eg. OCBC 360, UOB One Account, DBS Multiplier etc. I have no comments for this. 😂This is purely a ‘safe heaven’ to store all your cash for short to longer term usages. I don’t consider this as a form of investment to be honest as there are no genuine investing element in this.

In short, the banks want you to sign up and park all your hard earn money with them. They will try to entice you by giving you some interest rates bonuses which may seemed attractive at the beginning. Once the banks achieved their targeted number of sign ups, they will start to cut down on these bonuses.

Moreover with the pandemic, you should have seen how all the banks have started to slash their interest rates bonuses. Our gains are at the mercy of the banks. I really have no idea why are we still using them. 😂

Even Singlife 2.5% guaranteed interest rate has been decreasing and they are planning to drop it further to 1.5% in end Jan 2021. 😑 Now it has gone down to 1%.

An example of the DBS Multiplier account as shown

2. Bonds

The biggest problem with this is you are required to put in minimum amount lets say 1000 SGD (depending on the terms and conditions) to start investing into Singapore Saving Bonds or T-Bills.

To gain the full benefits of bonds coupon payments (interest rates), you have to hold for xxx time period, can be 6 mths or 2 years or 10 years or even 20 years till maturity. Your money is tied up and you have no way to take them out unless you are willing to forfeit your bond coupons. 😐

The coupon rate you earned is at a fixed percentage and predictable eg. 1% and this will stay fixed no matter what happens tomorrow. 😪 Hence, you will be able to calculate up front and know exactly how much you will earn before you even purchase the bond.

The safest are Singapore savings bonds or any bonds with the AAA credit ratings meaning the chances of default is the lowest but their rates are unattractive. You have to venture out to international bonds to have higher rates.

However, the bond coupon rates have dropped during the pandemic. Its not something that is a must-have at the moment for me.

3. Cash Management Account

Not sure why, but there is an upsurge of cash management options now available in the market compared to 2 years ago.

Such as Stashaway Simple, Syfe Cash+, Endowus Smart Cash, FSM One Auto Sweep etc.

These kind usually their interest rates have a range from 0.6% to 1.8% meaning your earnings are also fixed and predictable. They are able to achieve higher interest rates compared to savings account as they will park your money into some low risk funds.

4. CPF (Central Provision Fund) SA/MA Top-up

In Singapore we are really blessed to have a mandatory national saving scheme to use for retirement and other purposes.

This is similar to the 401k scheme that is used in the US for retirement.

I treat the CPF as a long term ‘bonds’ like kind of instrument as it has the ability to generate consistent interest rates and not only that, it helps to compound my money and grow it further. 😌

Voluntary top up into your Special Account (SA) and Medisave Account (MA) can earn minimum 4% interest rates. However, all cash transferred into your CPF are irreversible so please plan wisely on how much to put in.

CPF always make minor changes to their policies ever now and then but the bulk of the model remains the same. Always refer to their official website to find out more.

Part 2 is here! Click on the link to find out more. WOHOO! How to pick an investing tool - Part 2

Originally published at https://medium.com/the-investors-handbook/investing-tools-matrix-part-1-3-9228711f1b5e?sk=bc52cc4f16ee950a19d658382917203b

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- Stuckey·2021-10-29Awesome6举报

- estherytwu·2021-10-28Ok3举报