Unity software - Are you ready for the Metaverse?

Intro

Unity $Unity Software Inc.(U)$ is a technology driven company that provide a platform and software solutions for clients to create and operate real-time 3D (RT3D) content. Although the company started in the gaming industry for game developers, it has quickly extended its use to various sectors including education, making films, architecture works, automotive industry and many more. The company also offers an integrated environment for clients to monetise their works on mobile phones, tablets, PCs, game consoles, and augmented and virtual reality devices.

Background

Unity Technology started in 2004 by David Helgason (CEO), Nicholas Francis (CCO), and Joachim Ante (CTO) who saw the demand for a good developing tool for gaming industry. And the crown jewel Unity Engine was born. Their first success was gaining dominance in mobile games with the launch of iPhones in 2007. Fast forward, Unity now has more than 2000 in the research and development team to support its clients. The management believes in open source and works with various third parties to make integration seamless for clients.

Unity went IPO in NYSE on 18 Sep 2020 at price of $52, valuating the company around $13.6 billion.

Business model

Unity business is mainly from 2 categories: Create and Operate.

Create Solutions

Clients use the renowed Unity Engine to create their applications, mainly via subscription model. Subscribers could also engage other professional Assisted Artistry tools, including ArtEngine and Granite, which use machine-learning algorithms to accelerate material creation and editing.

Operate Solutions

This section of the business focuses on helping clients to grow and engage their end-users and monetise their content, optimise acquiring end-users and increase lifetime value of their end-users.

This is supported by Unity Ads, Unity In-App Purchases and other analytic tools to help clients optimise end-users experience.

Strategic Partnerships and Other revenue

Unity provides robust support for clients on forging strategic partnerships. It also has various tools to assist in cloud operation including Multiplay, Vivox, Cloud Content Delivery, Build Server, and Simulation.

Finances

Unity claims they have approximately 2.7 billion monthly active end users who consumed content created or operated with their solutions. The applications developed by these creators were downloaded, on average, five billion times per month in 2020.

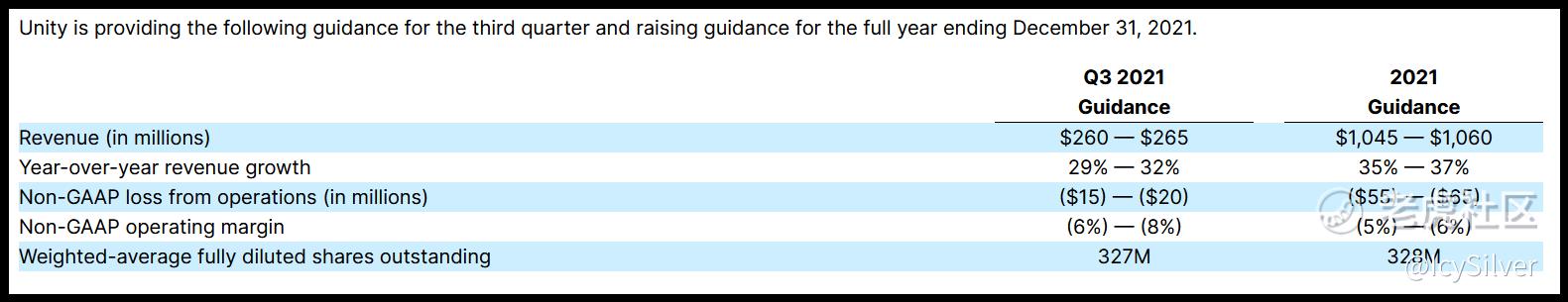

Second Quarter 2021 Financial Highlights

- Revenue was $273.6 million, an increase of 48% from the second quarter of 2020.

- Create Solutions, Operate Solutions, and Strategic Partnerships and Other revenue was $72.4 million, $182.9 million, and $18.3 million, respectively, an increase of 31%, 63%, and 9%, respectively, from the second quarter of 2020.

- Loss from operations was $149.2 million, or 55% of revenue, compared to loss from operations of $24.8 million, or 13% of revenue, in the second quarter of 2020.

- Non-GAAP loss from operations was $3.2 million, or 1% of revenue, compared to a non-GAAP loss from operations of $8.7 million, or 5% of revenue, in the second quarter of 2020.

- Basic and diluted net loss per share was $0.53, compared to basic and diluted net loss per share of $0.21 in the second quarter of 2020.

- Basic and diluted non-GAAP net loss per share was $0.02, compared to basic and diluted non-GAAP net loss per share of $0.09 in the second quarter of 2020.

- 888 customers each generated more than $100,000 of revenue in the trailing 12 months as of June 30, 2021, compared to 716 as of June 30, 2020.

- Dollar-based net expansion rate as of June 30, 2021 was 142% as compared to 142% as of June 30, 2020.

- Net cash used in operating activities was $26.7 million for the second quarter of 2021, compared to net cash provided by operating activities of $16.6 million for the same period last year. Free cash flow in the second quarter of 2021 was $(33.5) million, compared to $4.9 million for the same period last year. Cash, cash equivalents, and restricted cash were $1.0 billion as of June 30, 2021, compared to $0.5 billion as of June 30, 2020.

Challenges

Although slightly more than 50% of gaming developers are using Unity Engine, there are formidable competition from other platforms including Cocos2d and Epic Games' platform known as Unreal Engine. Epic Games$ had some successes with Fortnite but is now embroiled in battle with Apple$苹果(AAPL)$ on anti-trust laws.

The other concerns is revenue from advertising may be affected by the Apple's decision to remove Identifier for Advertisers (IDFA) that is essential for targeted advertising. However, Unity CFO, Luis Felipe Visoso mentioned in Q2 2021 earnings report that Unity was well prepared and managed to build market share.

Future ahead

Unity has been onboarding many non-gaming industries including eyewear manufacturer, The Nature Conservatory to use their Unity Engine. The application of Unity software is likely limited by clients' imagination instead of technical capabilities.

Unity has also been actively acquiring synergistic companies to provide even better services to clients.

Recently, Unity also launched Unity Gaming Services – a new platform experience that unifies Unity’s existing Operate Solutions for games and introduces new tools and services that simplify any developer’s ability to launch cross platform, multiplayer games. This is likely due to demand for multiplayer games. The seamless work across Unity's tools would definitely make it sticker for existing subscribers to continue.

Fun fact:

Did you know the popular game Pokémon Go was built using Unity Engine?

Chart

Unity chart has been in a very nice up trending channel since May 2021. The volume since Feb till June 2021, seems to suggest accumulation phase. The breakout in Aug 2021, was pivotal for Unity to continue the quite aggressive up moves. It is very likely the price will challenge all time high $175, if the upcoming Q3 2021 earnings result is positive.

Else, price may drop back to $140 region.

Conclusion

Unity does have a bright future ahead. With hardware such as GPU, AR and VR enabled devices getting more common, the demand for RT3D applications will continue to surge. The pandemic also in a way pointed a direction towards metaverse. The potential is endless but as an investor, do take note of risks as Unity has yet to make money.

Eagerly waiting for Q3 2021 earning results…

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- PagRobinson·2021-11-12The prospect of meta is very good, so it is a very good thing for Unity. However, the fact that the company is not profitable should not be ignored. If its competitors are profitable and it doesn't. This will be dangerous.1举报

- MurrayBulwer·2021-11-11Meta is a new opportunity and challenge for all technology companies. This requires companies to quickly improve their technical level and strengthen their layout in this regard.2举报

- PorterLamb·2021-11-12Although the company hasn't started to make profits, I'm still optimistic about it. Profitability is only a matter of time. It's not a big problem for me.2举报