Weekly Market Analysis S&P 500

Market Crash incoming...?[OMG]

Time and time again there will be articles calling the top and expecting a massive market crash in hopes to be right one time. These articles usually come with pictures of someone sad or shocked.[Duh]

Let's take a look at the previous times these articles appear.[Serious]

"A broken clock is right twice every 24 hours."

Instead of predicting the top, they have been accurately calling the bottom of corrections/retracements more often than not.[Helpless]

Technical Analysis

- $S&P500 ETF(SPY)$ Weekly Chart

As we can see, $S&P500 ETF(SPY)$ is still in an uptrend and progressing well in the rising channel. While a small correction is plausible, a market crash is unlikely.[Happy]

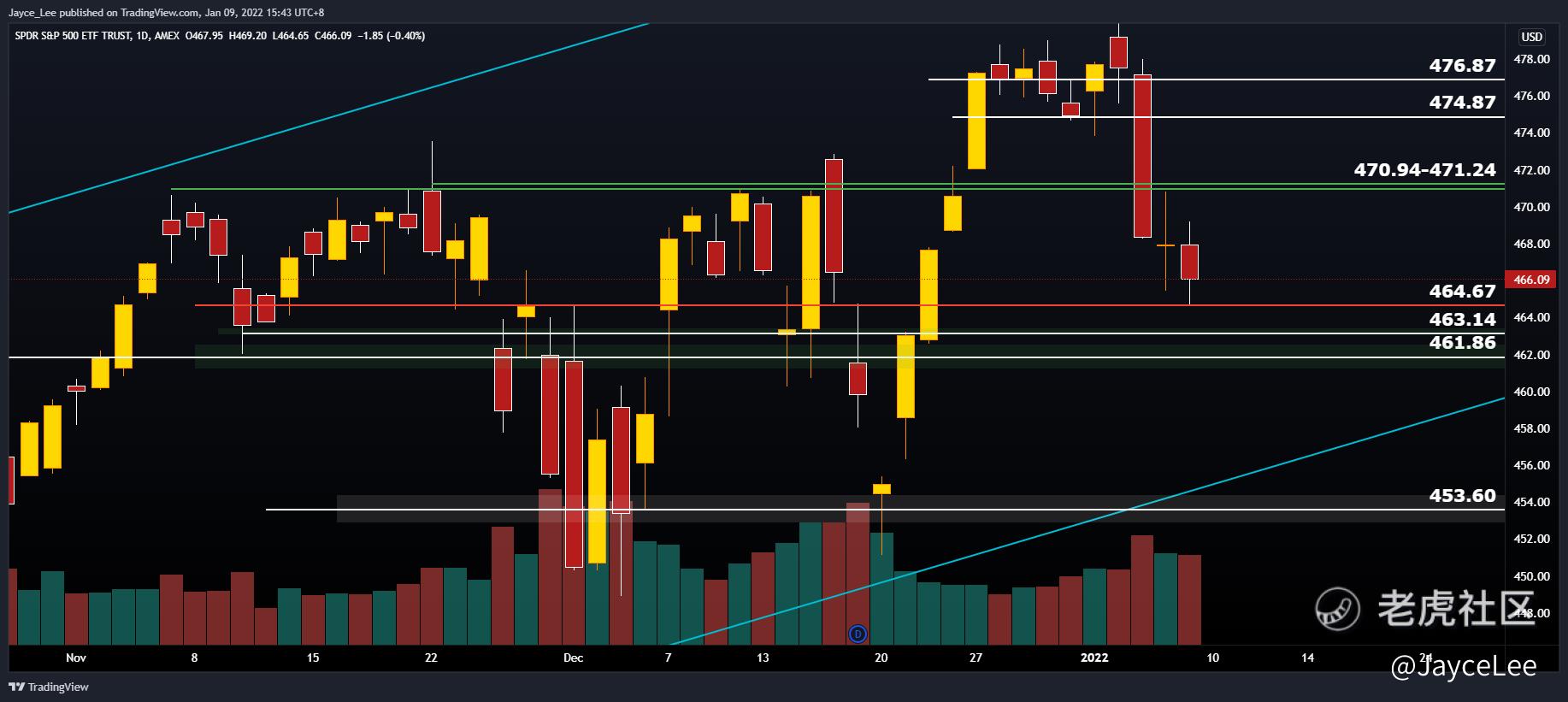

- $S&P500 ETF(SPY)$ Daily Chart

Zooming into the daily chart, a breakthrough and hold above 470.94-471.24 is a bullish sign with targets at 474.87 and 476.87. A breakdown and hold below 464.67 is bearish and my targets will be 463.14 and 461.86. If it breakdowns and fail to hold above 461.86, we can potentially test 453.60.[Blush]

What to do now?

For short-term traders, we can use the levels as guidelines to enter or exit our trades.[Miser]

For long-term investors, we can slowly accumulate more shares of companies we believe in at cheaper prices while the market dips.[Eye]

Disclaimer: The levels given are my own opinions and not investment advice. If you choose to follow the trade, do note that you are responsible for your own money. Prioritise your own risk management, expel emotions & focus on your trading plan.

Intraday trade strategy/guide:

Long-Term investing strategy/guide:

@TigerStars Have an idea to share? Feel free to comment below.[Smart]

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- huuou·2022-01-09Retail investors are lambs waiting to be slaughtered. It's really hard to make money in the stock market.5举报

- maroketo·2022-01-09In my opinion, the rise of U.S. stocks for many years in a row means that a deep adjustment may occur at any time.The Federal Reserve has already released the signal that it will raise interest rates in 2022. If we don't choose to sell high-valued stocks now, we will only have huge losses on the books.4举报

- letgo09·2022-01-09No matter from the point of view of technology or the attitude of the Federal Reserve, the decline of the United States is imperative, but it may not be a plunge.5举报