Is it time to buy the dip📈???

Traders have taken advantage of stock market dips in the past week to scoop up US shares, even as questions persist about the new Omicron coronavirus variant and the future direction of monetary policy.

Stocks including Apple, Advanced Micro Devices, Microsoft and TESLA$Tesla Motors(TSLA)$ all benefited from the shifts by retail traders.

Getting more people into investing could be a good thing. Long-term holdings of stocks can be an important wealth generator, and getting a greater share of society involved in financial markets—in a responsible way—could help reduce the wealth gap, giving more people opportunities to save for a home, retire, or afford education. But as social media helps bring in and inform a new wave of traders, a key question is whether they are getting good advice or getting set up for disappointment.

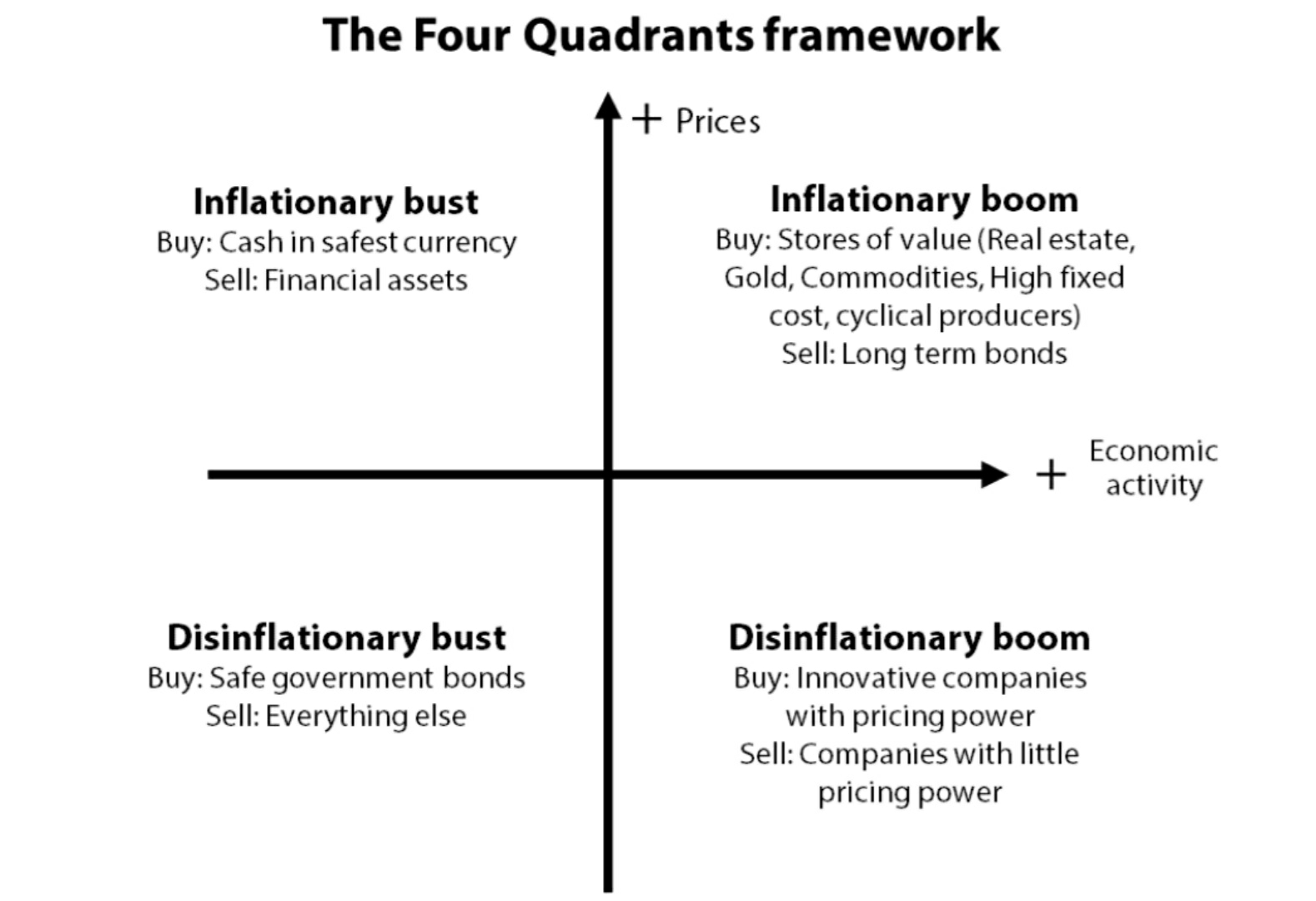

Buying the dip isn’t as straightforward as it sounds. If it takes too long for the market to drop in price, you could end up sitting on cash that’s being eroded by inflation instead of benefitting from a rising market and receiving dividends and coupon payments from stocks and bonds. Just because an asset has fallen in price doesn’t mean it can’t drop even more. An analysis by Northwestern Mutual, a financial services firm, found that getting your money invested right away (lump-sum) usually returns more than robotically spreading it out over time (dollar-cost averaging).

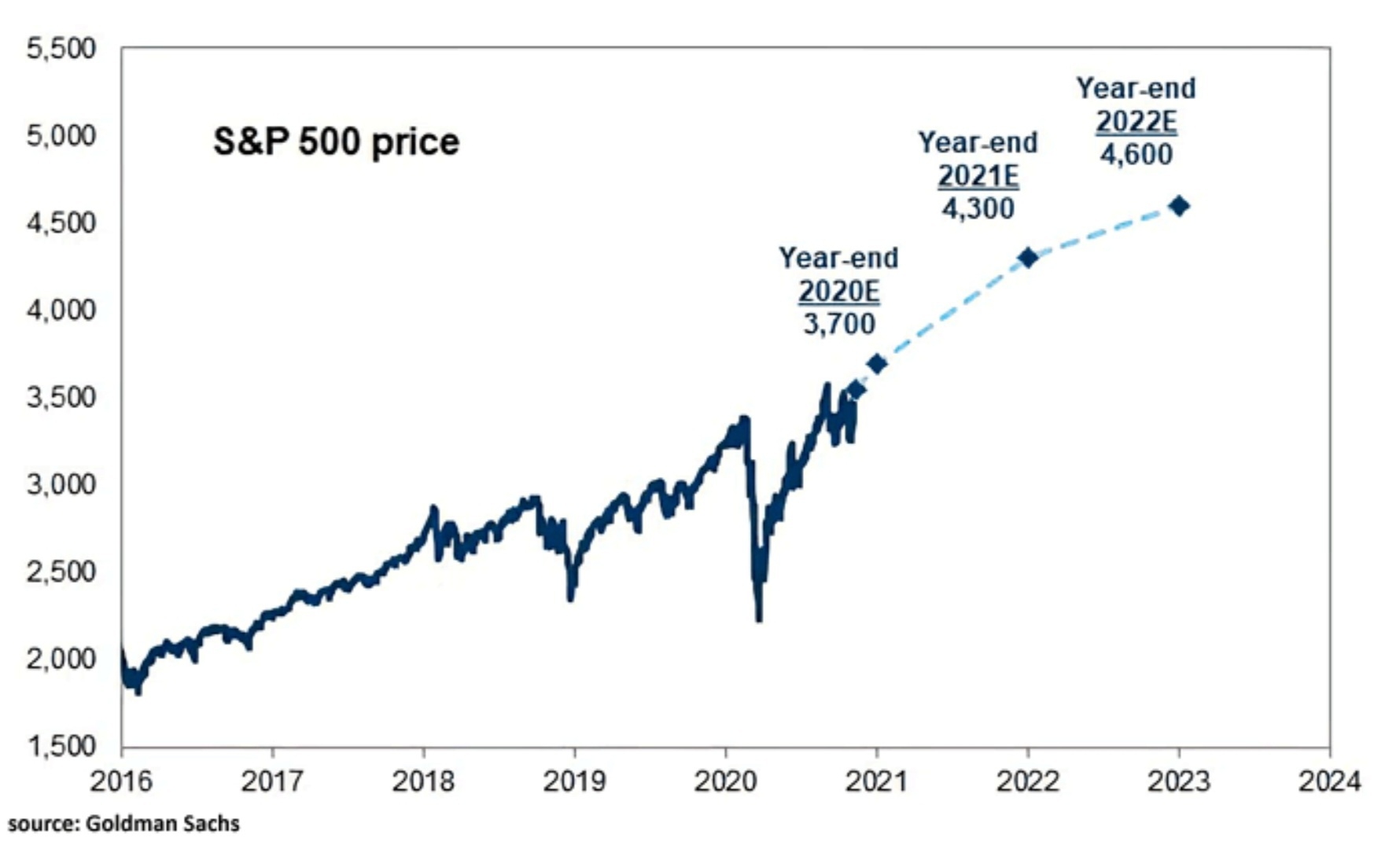

While buying the dip is no sure thing, it might not be so bad if it attracts more people to long-term investing in the US stock market, which has shown itself to be a critical way to build wealth over time.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- TwoDeMoon·2021-12-08Always buy the dip, n continue to ride the uptrend 30yrs of S&P 500 has nvr been wrong that is the key2举报

- Mister Makam·2021-12-19time to buy more in small quantities at lower cost per share点赞举报

- jytock·2021-12-08[Cool]1举报

- dnp·2021-12-08yes1举报