Roku's 19% surge just beginning? Youtube Deal shall be the best break point

One of the reasons that $Roku Inc(ROKU)$ stock price plunged recently, is the concerningof losing Youtube TV App after receiving anticompetitive demands from $Alphabet(GOOG)$ including requests for preferential treatment.

It has sunk 22% in one month before last trading day.

However, on Dec.8th, the two companies has competed in a number of areas and their carriage agreement. The new three-year deal could be beneficial for both companies given the large runway within connected TV (CTV) and their potential to take market share by aggregating hundreds of channels and premium content, offering a better user experience vs linear TV.

Why this deal means that much?

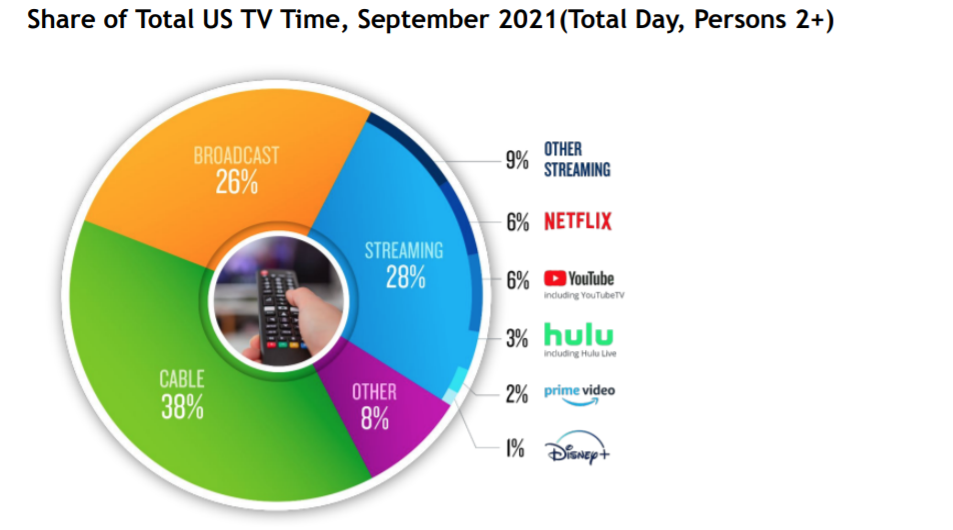

Youtube is different from other streaming platform, it's the largest UGC or PUGC content community in the world. It has already been the most "time-spent" app, together with $Netflix(NFLX)$ except from linear ones, according to Nielson's research.

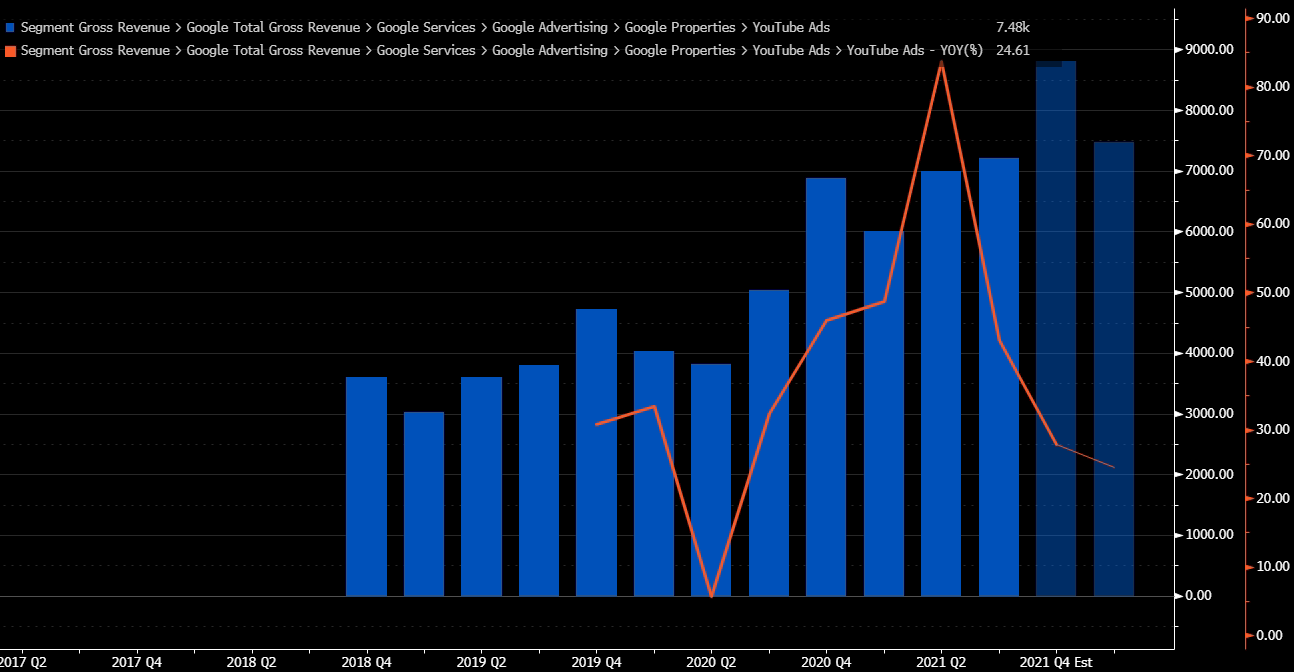

As we all known, Youtube is one of the growth engines for Google, and the YoY growth rate reached 40%+ these two years. it made 7.2 billion dollars in the last season (21Q3)

Since Roku's dominant cash flow is from the CTV ads, you can understand why Roku is so desperately eager to argue more benefits from YouTube.

In October, Roku suggested, "We have not asked for a single change in the financial terms of our existing agreement. In fact, Roku does not earn a single dollar from YouTube’s ad supported video sharing service today, whereas Google makes hundreds of millions of dollars from the YouTube app on Roku. Google required a preference for YouTube over other providers".

We don't know exactly whether Google agreed to share the Ads cash flow to Roku, But the 56.4 million active accounts seems the Roku's biggest bargaining chip.

Anyway, the agreement benefits both of them.

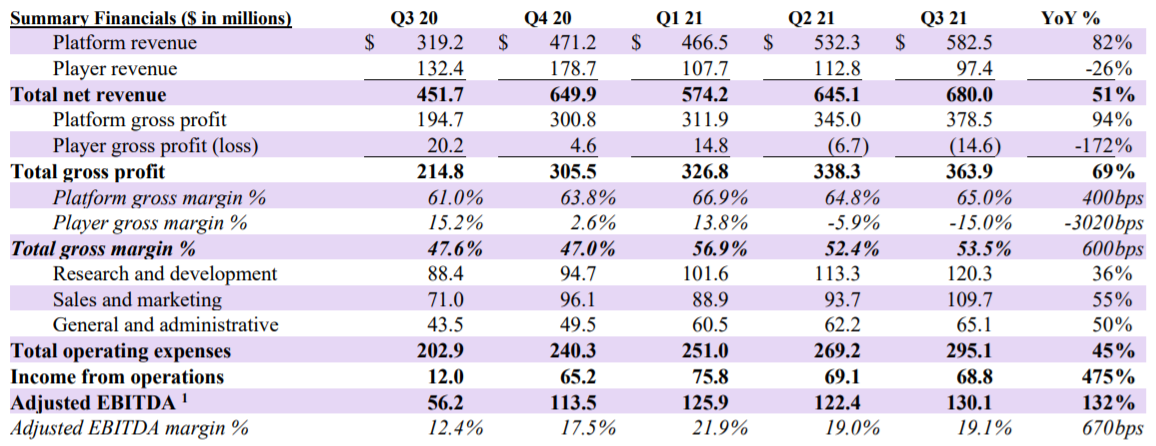

While on 21Q3, Roku missed on revenues, the media company nevertheless enjoyed strong revenue growth and improving user monetization in Q3'21. Roku's third quarter revenues soared 51% year-over-year to a record $680M while gross profits surged at an even faster rate of 69% year-over-year to $363.9M. Platform margins remained high, at 65%, and Roku's income from operations increased by a factor of 5.7 X year-over-year.

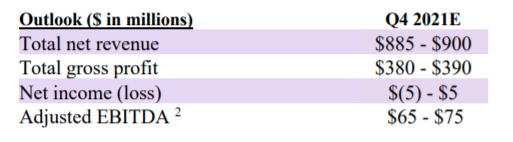

For Roku, if real cash flow comes from YouTube ads, it will definitely accelerate it's monetization, and help the company beat the undervalued guidance.

That's the main reason of the optimism for Roku last night.

We shall keep an eye on it.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- waipoin·2021-12-09Oversold rebound. In my opinion, Roku has no investment value. Lack of market-leading core products is a serious injury. What is the difference between Roku's products and competitors' products? The share price of this company rose last year, mainly because the epidemic kept people at home. Now that the epidemic is coming to an end, the weak growth of users has already appeared, and the fundamentals have completely changed. How can the stock price rise?1举报

- qingg123·2021-12-09Though Roku's revenues soared 51% year-over-year in Q3, still miss Wall Street's consensus. For companies that continue to lose money, the decline in revenue growth is dangerous.5举报

- LeilaLynch·2021-12-09Please be patient. Going to need alot more to get back to $300+4举报

- BorisBack·2021-12-09Roku connects users to their favorite streaming content, helps publishers to build and profit from large audiences and giving advertisers unique features to engage consumers. Remermber,there are millions of active accounts,It's worth investing.2举报

- dimsum·2021-12-09There are too many similar products and services of Roku in the market, without differentiation and moat. I'm not very optimistic about this company.3举报

- 陈红禧悦·2021-12-11跌得太猛,心态也趺坏了。2举报

- 86Owh·2021-12-14好1举报

- 吉吉祥祥·2021-12-13好文点赞举报

- ghiblibli43·2021-12-14来来来1举报

- sekuru·2021-12-14beautiful1举报

- 安静的蓝树叶·2021-12-13感谢分享1举报

- 龙城飞将ivy·2021-12-13感谢分享点赞举报

- 蓬莱山熬夜·2021-12-13看看点赞举报

- 小小刀据大树·2021-12-13好1举报

- dingdibg·2021-12-12感谢分享1举报