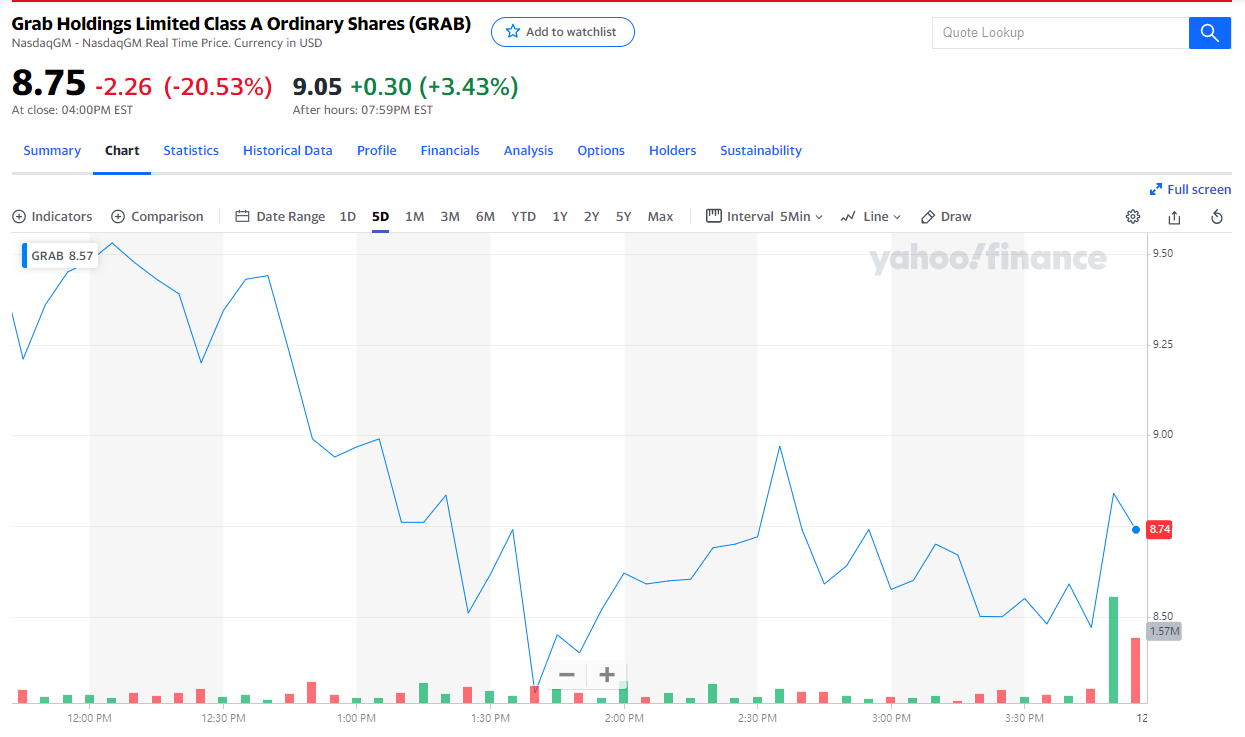

Why Grab Shares Tumble in Trading Debut After SPAC Deal

Hey Tigers!

Grab attract a lot of attention and interest in the market!

Grab, a Singapore-based “super app,” started out as a ride-hailing platform in 2012, but branched into everything from food delivery to digital payments and investments. The “super app” of Southeast Asia — also known as the Uber of Southeast Asia — was valued at a whopping $40 billion in pre-market.

However,$Grab Holdings(GRAB)$ opened 19% higher, then reversed course.

Grab hasn’t turned a profit yet, but its SPAC deal also involved a $4.5 billion private investment in public equity. However, by midday today GRAB shares crumbled 20%, erasing a fifth of its value post-merger.

Anthony Tan, Grab Holdings’ Co-Founder and CEO, shared:“Regardless of the stock price, our focus is on the super app [business model] and that is resilient in spite of COVID.”

Why did GRAB's stock price plummet after its listing?

Why did GRAB's stock price plummet after its listing?

Tell us what you think about it! Leave your analysis!

You may be rewarded with Tiger Coins💸💸💸

Don't forget I am the richest tiger in this community😎😎

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

2. Didi as shareholder will delist from nyse

3. High expection

I will keep watching on this SG ‘s super app [Miser]