Tesla Stock Preview: One Week Before Earnings.

One week before Tesla’s Q2 earnings call, here’s what to expect. Tesla will report second-quarter results after the bell on July 26th (next Monday). What do you think of this financial report?$Tesla Motors(TSLA)$

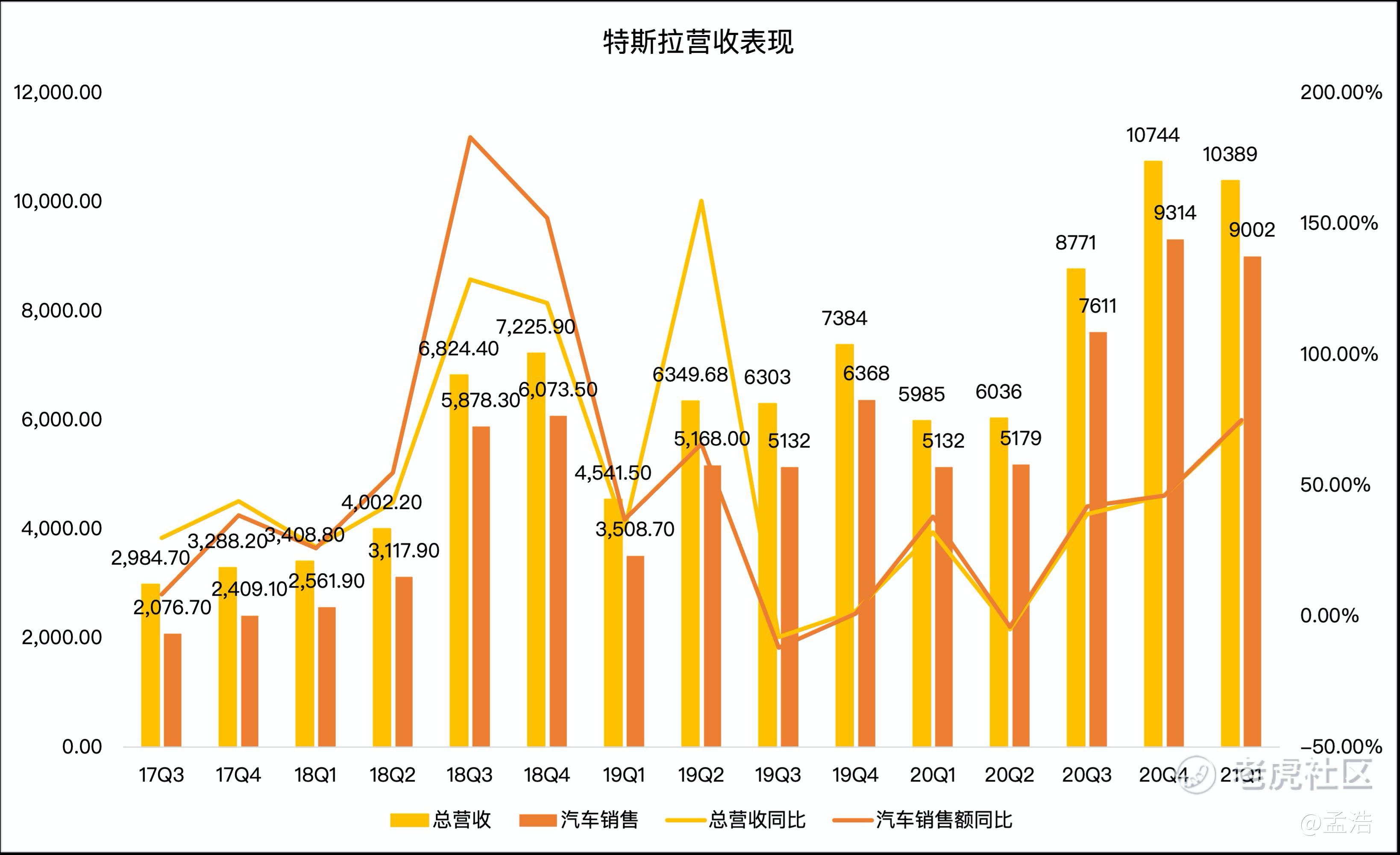

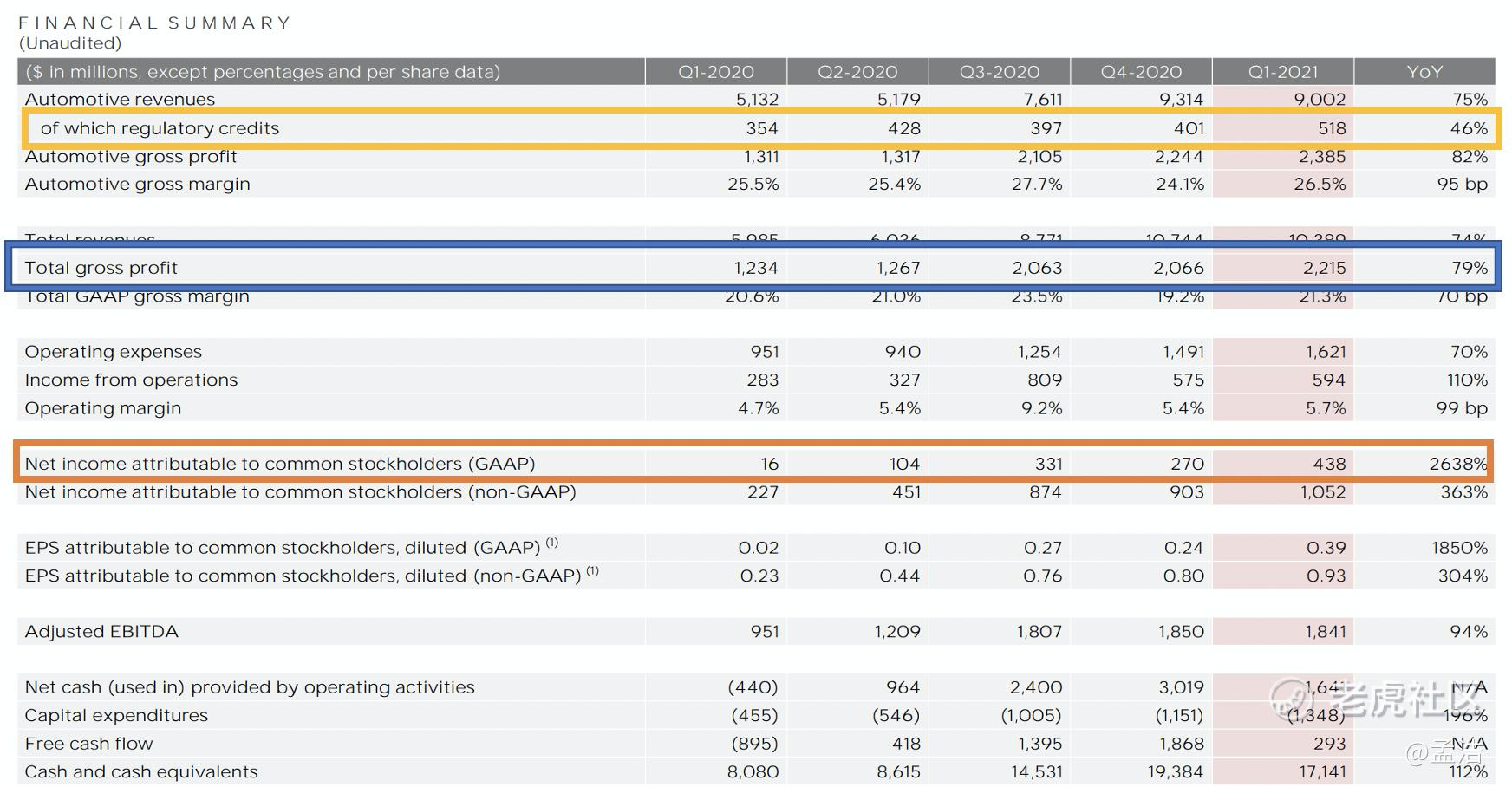

Let's review the Q1 financial report

Tesla beat expectations handily, buoyed by sales of bitcoin and regulatory credits, but the stock dipped after investors digested the numbers.

- Earnings: 93 cents per share vs. 79 cents per share expected

- Revenue: $10.39 billion vs. $10.29 billion expected, up 74% from a year ago

Net profit reached a quarterly record of $438 million on a GAAP basis, and the company recorded $518 million in revenue from sales of regulatory credits during the period. It also recorded a $101 million positive impact from sales of bitcoin during the quarter.

Highlights of Q2 financial report

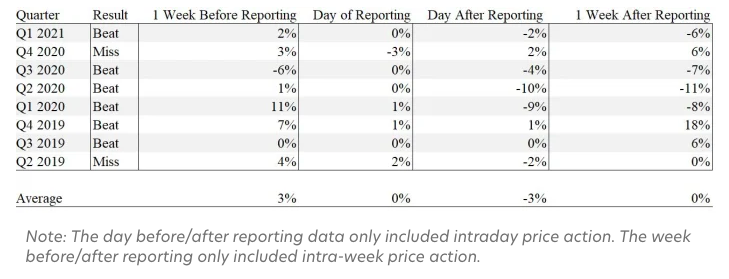

Tesla’s Q2 earnings call is exactly one week away. Historically, Tesla stock has traded positively the week before the earnings call. However, the same cannot be said about the week following despite beating analysts' expectations in six of the last 8 quarters.

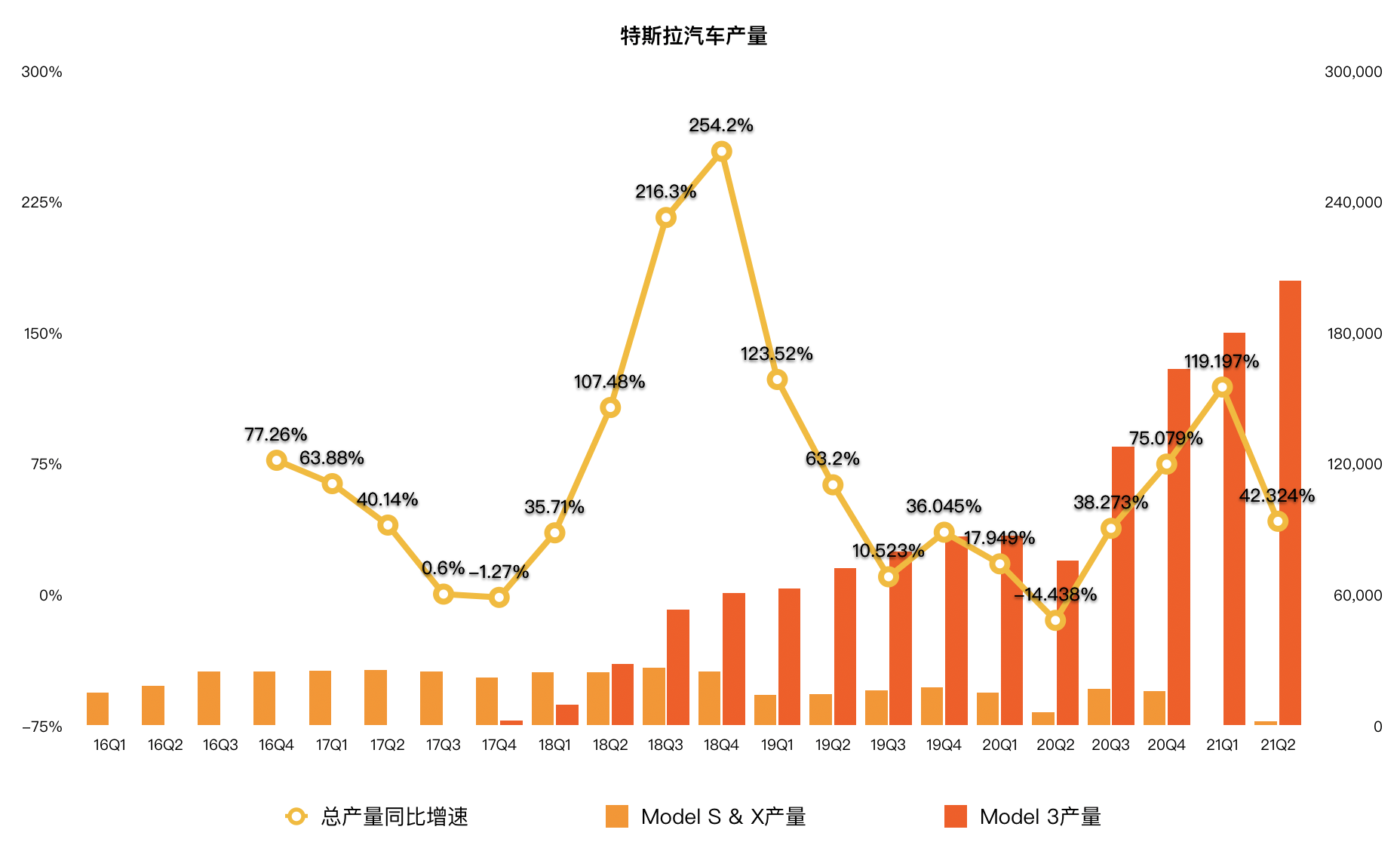

Let's talk about the Q2 financial report that everyone is most concerned about. In fact, electric vehicle companies usually announce the delivery data before the financial report, so it is not difficult to calculate the revenue data. For Tesla Motors, the possible variables are Bitcoin sales and carbon points data.

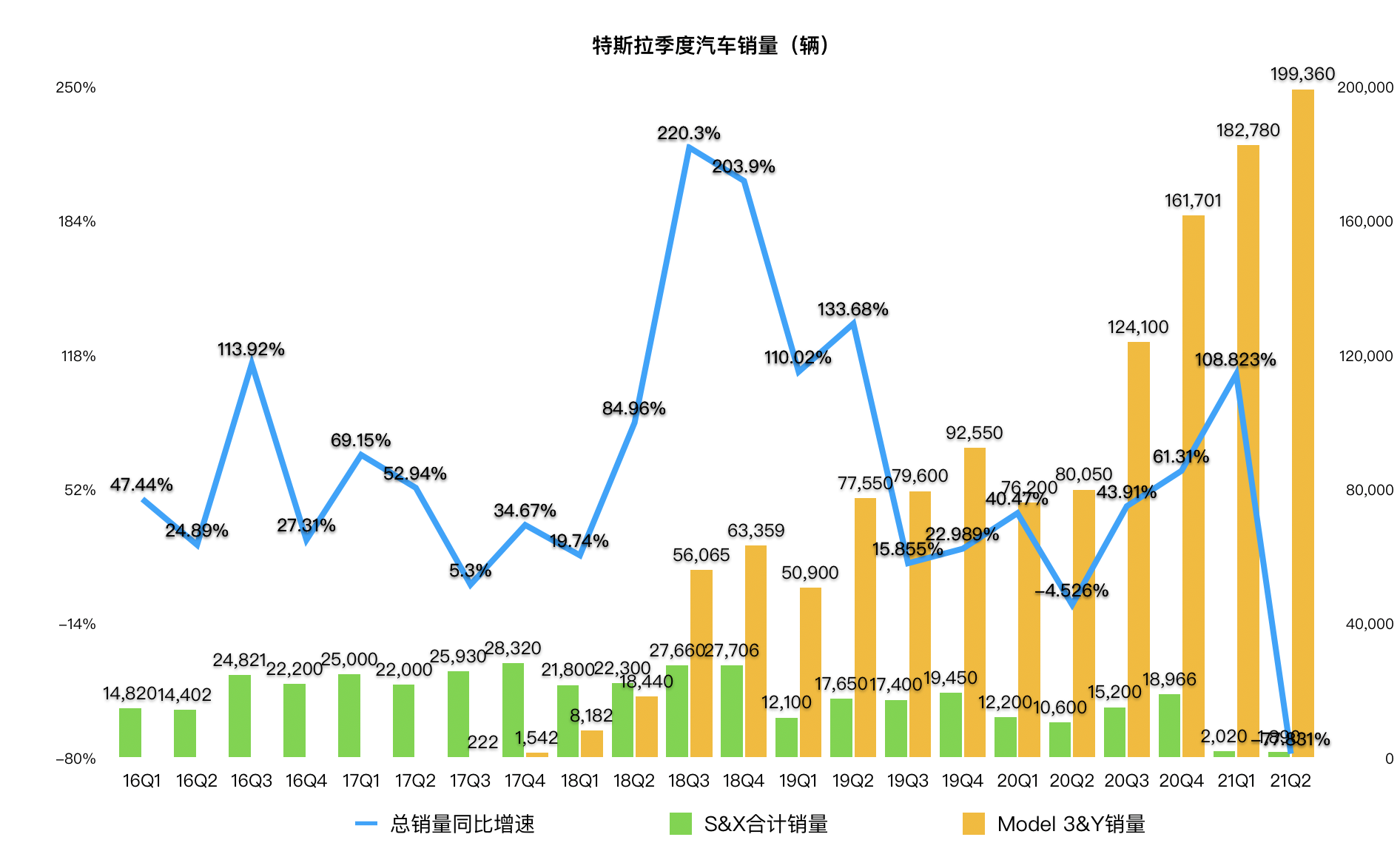

Let's take a look at the delivery data first. Despite the shortage of auto parts, Tesla Motors's delivery of electric vehicles increased significantly in the second quarter.According to Tesla's figures, it delivered 1,890 Model S and Model X vehicles, which left the vast majority of deliveries to the Model 3 and Model Y. The two more affordable EVs tallied 199,360 deliveries in Q2, despite multiple price increases throughout the year amid supplier difficulties. Total vehicles built in the quarter topped 206,421 cars.

In the first half of this year, the total number of Tesla delivery data reached 386,000. Last year, Tesla Motors delivered nearly 500,000 electric vehicles. According to Tesla Motors's forecast ,Tesla Motors's delivery volume is expected to increase by more than 50% in 2021 compared with last year, which means that Tesla Motors will deliver at least 750,000 electric vehicles this year.

If we assume ASP is 50,000, delivery data is 206,421, vehicle revenue is roughly at 10.3 billion. In addition, according to historical data, the income from energy and maintenance services is about 1 billion, which adds up to about 11.3 billion.

In addition to automobile sales revenue, Tesla Motors's carbon credits revenue is also worth looking forward to in these quarters, and carbon credits have played a very important role in helping Tesla Motors's revenue and net profit increase greatly. Carbon credits, as its name implies, sell carbon emission credits to rival car companies, and Tesla Motors earns revenue by selling Zero Emission Vehicle (ZEV) credits and Greenhouse Gas Emission (GHG) credits to other car manufacturers. These manufacturers use the purchase credits to meet market requirements instead of making their own electrified or energy-efficient vehicles.

According to historical data, Tesla Motors's regulatory credits in the first four quarters of 2020 were 354 million, 428 million , 397 million and 401 million respectively,and the regulatory credits revenue in the last quarter was 518 million US dollars. If we assume regulatory credits revenue is 500 mililion, and the total revenue will be 11.8 billion,which will beat expectations.

Besides revenue, what other issues should Tesla Motors pay attention to?

Let's talk about bitcoin revenue first

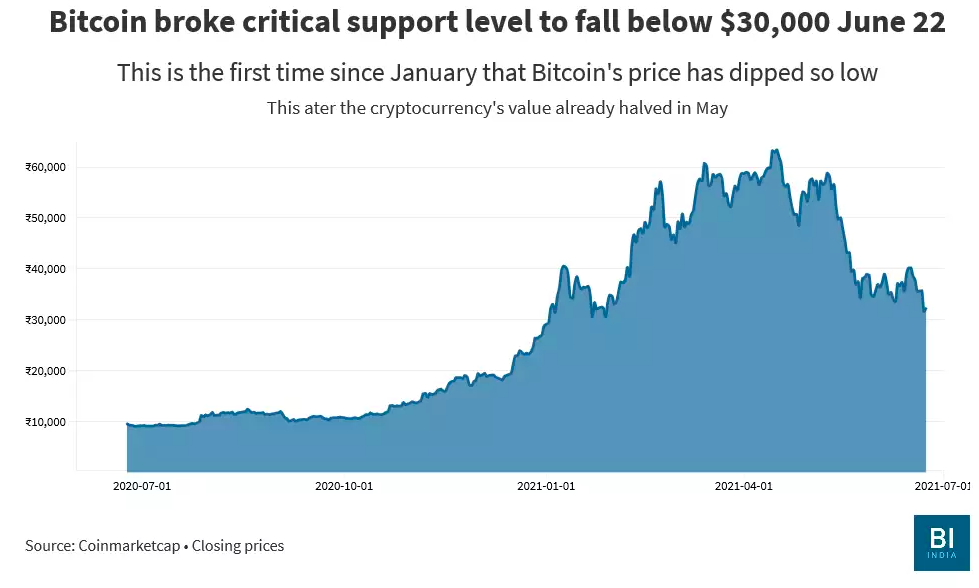

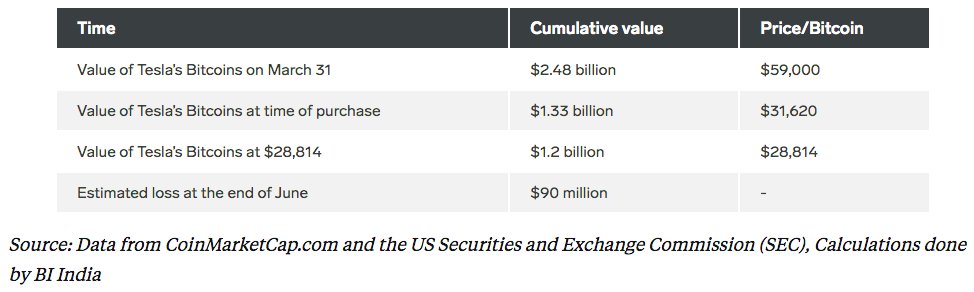

Tesla beat expectations handily, buoyed by sales of bitcoin and regulatory credits, but the stock dipped after investors digested the numbers. Tesla Motors's Bitcoin cash outflow was US $1.2 billion, and it obtained US $101 million by selling Bitcoin. However, Bitcoin's performance in the second quarter may not be as satisfactory as t in the first quarter.

Bitcoin's price sank below 30,000, its lowest level since the early hours of January 2, and 55% off its all-time record of $64,863 achieved just ten weeks ago. This is bad news for all crypto investors, but especially so for BTC's chief influencer, Tesla CEO Elon Musk. The reason: Musk likely bought every Bitcoin on Tesla's books at a higher price. The upshot is that in Q2, Tesla will be taking a substantial write-down on the celebrated wager that helped launch the bull run that's turned into a freefall.

Tesla may be sitting on a loss of $90 million with Bitcoin’s value dipping to below $30,000 . And, even if the cryptocurrency’s price manages to recover by the end of June, Tesla will still have to show the loss on its books. Tesla, has its own Bitcoin holdings — ones that are not personally held by Musk, but on the company’s balance sheets affecting its profit and loss.The company’searningsfor the first quarter show that Tesla’s Bitcoin holdings amounted to a sum total of $2.84 billion on March 31. At the time, the cryptocurrency’s price was around $59,000, which means Tesla owns an estimated 42,000 Bitcoins.So, when it bought these Bitcoins for $1.33 billion, they were valued at $31,620 a piece.

This means thatTesla, as of March 31, had total realized and unrealized gains exceeding $1.2 billion — a return of more than 80% on its investment within the span ofeleven weeks.However, since Bitcoin’s price dipped to $28,814 on Wednesday, Tesla’s books will now reflect a loss of $90 million, provided Musk hasn’t already sold off its holdings.

Ok, that's all. Are you optimistic about Tesla Motors's financial report this time?$Tesla Motors(TSLA)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。