Advanced Micro Devices, Inc. (NASDAQ:AMD) announced better-than-expected second-quarter results, thanks to strong Ryzen, graphic processor and EPYC server processor sales as well as higher gaming revenues.

The company issued an upbeat forecast for the third quarter and raised its revenue growth outlook for the full year.

AMD's Key Q2 Metrics: AMD reported second-quarter non-GAAP earnings per share of 63 cents per share, above the consensus estimate of 54 cents per share. The metric also exceeded the year-ago EPS of 18 cents and the previous quarter's 52 cents.

Revenues climbed 99% year-over-year from $1.93 billion to $3.85 billion. In the first quarter, the chipmaker reported revenues of $3.45 billion.

Analysts, on average, estimates revenues of $3.62 billion for the quarter.

Rival Intel, Inc. (NASDAQ:INTC) reported last week above-consensus second-quarter results, with non-GAAP revenues climbing 2% year-over-year to $18.5 billion and non-GAAP EPS increasing from $1.14 to $1.28.

AMD's quarterly gross margin came in at 48% compared to 46% in the previous quarter. Cash, cash equivalents and short-term investments were $3.79 billion at the end of the quarter.

Related Link: AMD Consolidates Ahead Of Earnings Print

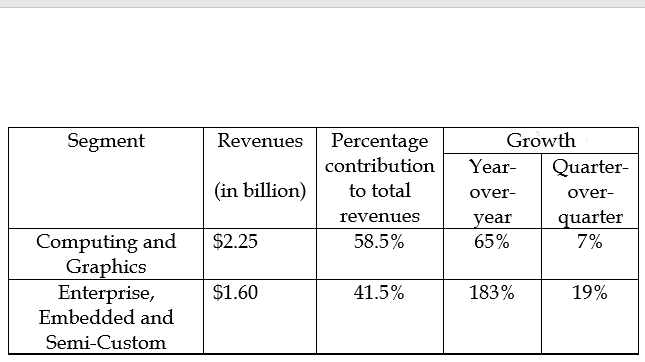

AMD's Segmental Revenue Breakup: AMD's Computing & Graphics segment comprises desktop and notebook processors and chipsets, and GPUs, while the Enterprise, Embedded and Semi-custom segment consists of server and embedded processors, system-on-chip products as well as services and technology for game consoles. Both the segments reported solid revenues growth.

Source: AMD's Earnings Release

The company attributed the strength in the Computing and Graphics segment to higher ASPs for client processors, helped by a higher mix of Ryzen desktop and notebook processor sales. High-end graphic product sales, including data center GPU sales, boosted GPU ASP.

The increases in Enterprise, Embedded and Semi-Custom segment revenue, according to the company, were driven by higher EPYC processor revenue and semi-custom product sales.

Alphabet, Inc.'s (NASDAQ:GOOGL) Google Cloud and Hewlett Packard Enterprise Company (NASDAQ:HPE) were among the companies that have begun using AMD's EPYC processors.

AMD announced a $4 billion stock buyback program in May.

AMD's Forward Outlook: AMD guided second-quarter revenues to $4.1 billion, plus or minus $100 million. This compares to the Street estimate of $3.82 billion. The company attributed a strong year-over-year increase to growth across all business, while the sequential growth is driven by data center and gaming business.

Non-GAAP gross margin is estimated at 48%. The company lifted its full-year revenue growth forecast from 50% to 60%.

With Intel going on the offensive with its aggressive new roadmap that aims at achieving performance and efficiency improvements through 2025 and beyond, AMD has to be on guard to preserve the gains it has made over its rival.

AMD Stock: AMD's shares peaked at $99.23 on Jan. 11 and then began to trade in a range. In early March, the stock moved below this trading range, coinciding with the tech sell-off.

The stock was locked in the $73-$85 trading range until late June. Since then, AMD has picked up some momentum. For the second quarter, the stock was up about 24%, although it is down marginally for the year-to-date period.

AMD shares closed Tuesday's trading down 0.86% at $91.03. In after-hours trading, the stock was shedding an incremental 0.52% at $90.56.