NASA ranks the lack of gravity as a top 5 risk of human space travel.

But gravity also has emerged as a concern for soaring U.S. stocks, bond prices and other financial assets as the force of extreme fiscal stimulus, meant to get the U.S. economy to the other side of the pandemic, begins to ease up.

After a stunning first-half, the rest of 2021 could be poised for a slower pace of U.S. economic expansion and for the rate of inflation to come back down to earth.

A bit more grounding wouldn't entirely be a bad thing for financial markets either, according to investors and analysts who spoke with MarketWatch about what to expect in the year's second half, as the dust settles with the American economy recovering and trillions of dollars worth of Washington fiscal stimulus fading into the background.

"It is very possible that we have seen peak everything," said Giorgio Caputo, head of the multi-asset team at J O Hambro Capital Management. "But that doesn't mean we can't have very solid continued growth in the recovery."

Like the pace of "revenge travel growth forecast for GDP in the second-quarter.

"In terms of GPD numbers, it will be hard to have year-over-year growth rates that rival what the second quarter of 2021 is expected to look like, relative to the second-quarter of 2020, when the whole world was shut down," Caputo said.

"But you've still got monetary policy that's incredibly accommodative, and will be for a long time."

A lofty perch

The major U.S. stock indexes finished the first week of the third quarter at all-time highs , after the S&P 500 booked the best five quarters of percentage gains since the second-quarter of 1936, according to Dow Jones Market Data.

Supply of U.S. corporate bonds $(LQD)$ -- and even demand in the sleepy municipal-bond market of the post-2008 financial crisis era.

Issuance of U.S. investment-grade corporate bonds hit $860 billion in the year's first half, the second-highest tally ever, after last year's $1.2 trillion boom, according to BofA Global analysts.

"Companies still carry sizable cash war chests accumulated last year," the BofA team wrote, in a weekly note. "On the other hand demand creates supply, and the combination of historically low yields and spreads at post-crisis tights may attract opportunistic issuance."

It isn't only U.S. companies sitting on extra pandemic cash. The rate of U.S. personal saving tumbled to a still-elevated 12.4% in May from its highest on record at 33.7% in April 2020, as households squirreled away extra government aid. Unleashing that cash may sustain economic growth this year.

Still, the bond market has been signaling potential trouble ahead for the U.S. economy, in terms of the Federal Reserve reaching its 2% inflation target over the longer run, with the 10-year Treasury yield at1.434% Friday, its lowest since March 2.

"That is spurring some desire to have growth stocks," said Robert Pavlik, senior portfolio manager, Dakota Wealth Management, of the thinking that Fed support could be harder to dial back if the economy struggles to grow.

The S&P 500 ended the week up 1.7%, and 15.9% higher on the year thus far, while its growth segment rose1.6% and 14.3%, respectively. The Dow swept to a 1%weekly gain, advancing 13.7% since Jan. 1, and the Nasdaq Composite powered 1.9%higher for the week and 13.6% on the year.

Back on Earth

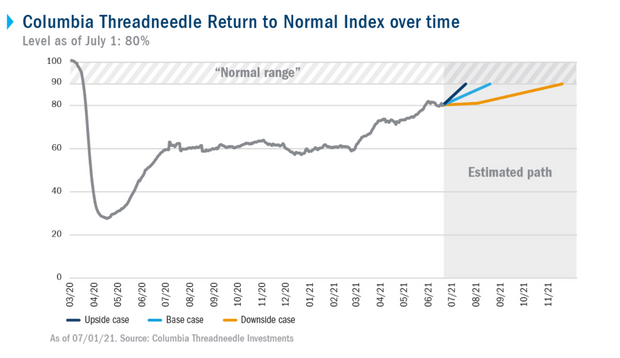

Daily life in the U.S. already has returned 80% "back to normal" according to this chart from Columbia Threadneedle, which measures things that include domestic travel, the return to offices and schools, as well as bricks-and-mortar shopping and dining out.

Friday's strong jobs report also pointed to continued healing in the U.S. labor market in June , but at a pace that may require more than a year for employment to return to pre-COVID levels.

"What the Fed cleverly did is shift the onus to the jobs market way from inflation," said George Goncalves, head of U.S. macro strategy at MUFG Securities Americas, referring to when the central bank might tweak its easy-money policies.

"If we are doing a hand off, getting back to normal business active, not just depending on stimulus, then companies have to hire and put more people back to work," he told MarketWatch. "It is super critical."

This week will be a short week though, with the U.S. July 4 holiday and markets closed Monday. But there will be updates on service sector activity in June on Tuesday from both IHS Markit and ISM, followed by May job openings data and minutes from the Fed's latest Federal Open Market Committee on Wednesday.

"We are eyes wide open," said Caputo at J O Hambro, adding that European markets could still push higher, given that the region remains in an earlier stage of recovery than the U.S. and with its approval last week of sweeping a climate law , dubbed the European Green Deal.

"The crisis brought Europe together."