(June 2) UP Fintech Holding Limited(NASDAQ:TIGR) shareholders will have a reason to smile today, with China Renaissance making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 25% to US$22.21 in the last 7 days.

Following the upgrade, arget Price For UP Fintech Holding Limited is $38.5 vs $30 days ago.

HK license acquisition to boost overall business. Tiger submitted its Hong Kong brokerage license application to the Securities and Futures Commission (SFC) in late February and expects feedback around three months after the submission. We believe getting a HK brokerage license will help Tiger: 1) generate additional user growth in Hong Kong’s retail market (we have not factored in HK client adds in our model yet); 2) improve monetization in HK retail IPO distribution, with direct access to IPO allocation and financing; and 3) save costs on HK stock clearing. For its overseas expansion, we estimate Tiger acquired over 60k paying clients in Singapore in 1Q21, which exceeded new adds from mainland China, and we expect this momentum should continue given its trading app ranks top among finance apps in Singapore app stores. Tiger achieved net margin of 29% in 1Q21 (vs. 16% in 2020) and we see further upside potential. This compares with 53% net margin for Futu in the same quarter. Tiger’s current market cap is only 16% of Futu’s while its client assets are 36% of Futu’s as of 1Q21. Tiger is now our preferred pick in the online broker sector and we view the HK license acquisition as the key upside catalyst.

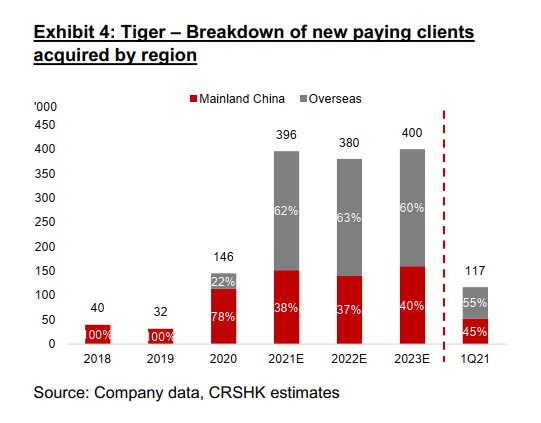

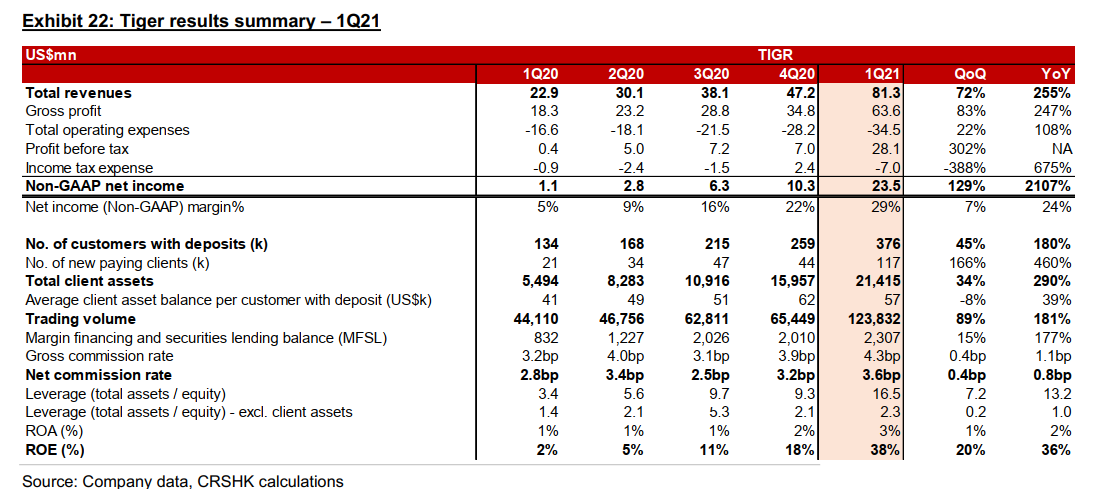

1Q21 results highlights. In 1Q21, Tiger added 117k new paying clients with over 50% from overseas markets, and total paying clients reached 376k, up 180% YoY. Total client assets grew 290% YoY (34% QoQ) to US$21bn and average paying client account balance was US$57k. Trading volume was US$124bn, up 181% YoY (89% QoQ) with annualized trading velocity of 27x. Tiger participated in 14 IPOs and underwrote eight of them. It added 41 Employee Stock Ownership Plan (ESOP) clients in 1Q21 (total recorded now 165). The company achieved non-GAAP net profit of US$23mn in 1Q21, up 21x YoY, and net margin rose to 29% from 22% in 4Q20 and 5% in 1Q20.

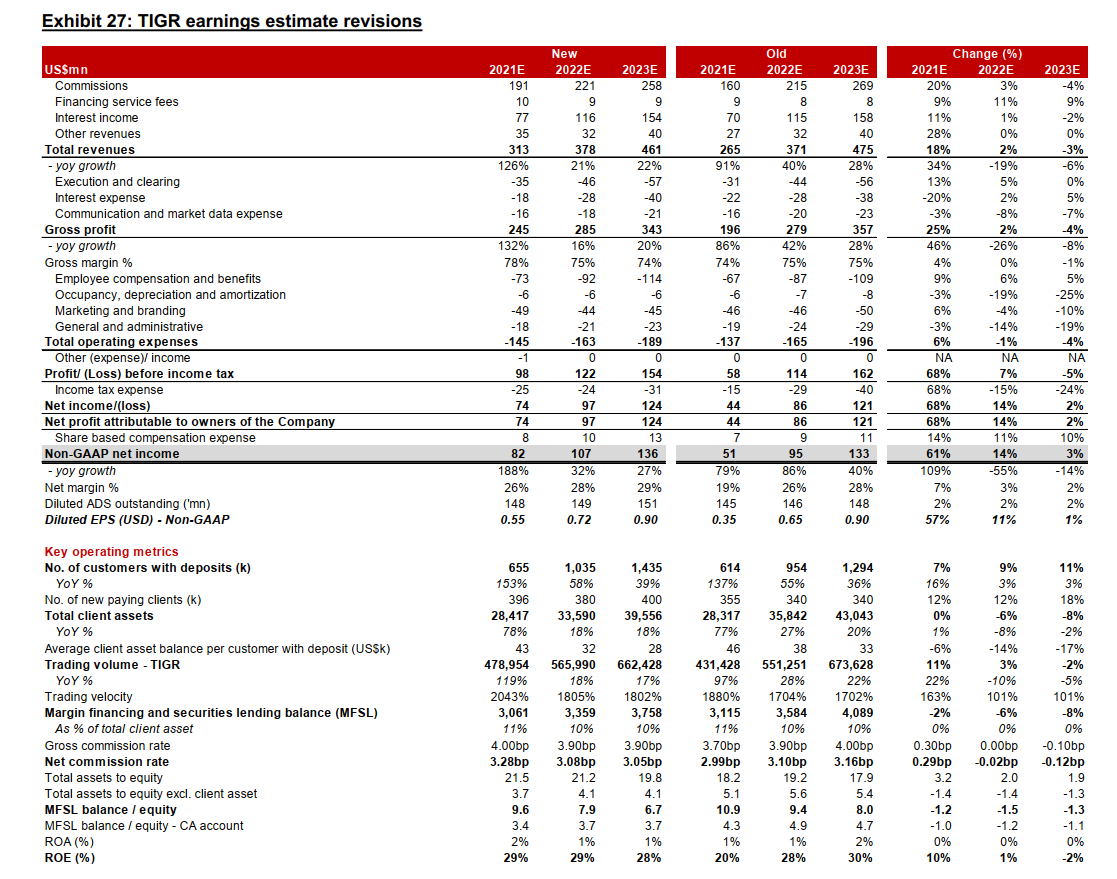

Model update. We increase non-GAAP net profit for 2021E/22E/23E by 61%/14%/3% to reflect: 1) higher paying client growth with faster overseas expansion; 2) higher client trading velocity offset by a lower average client asset balance; and 3) downward-trending effective tax rate. We forecast Tiger’s non-GAAP net profit to record an 83% CAGR in 2020-23E, without factoring in potential benefits to accrue from obtaining a HK license.

Reiterate BUY and lift TP to US$38.50 (from US$30.00), based on 60x 2021E-22E average P/E (unchanged) and our revised earnings forecasts.Risks include:1) Market downturn; 2) intensifying competition; 3) tighter capital controls in China; and 4) the need to raise capital