(Update: June 24, 2021 at 08:31 a.m. ET)

- U.S. weekly jobless claims total 411,000, vs 380,000 estimate.

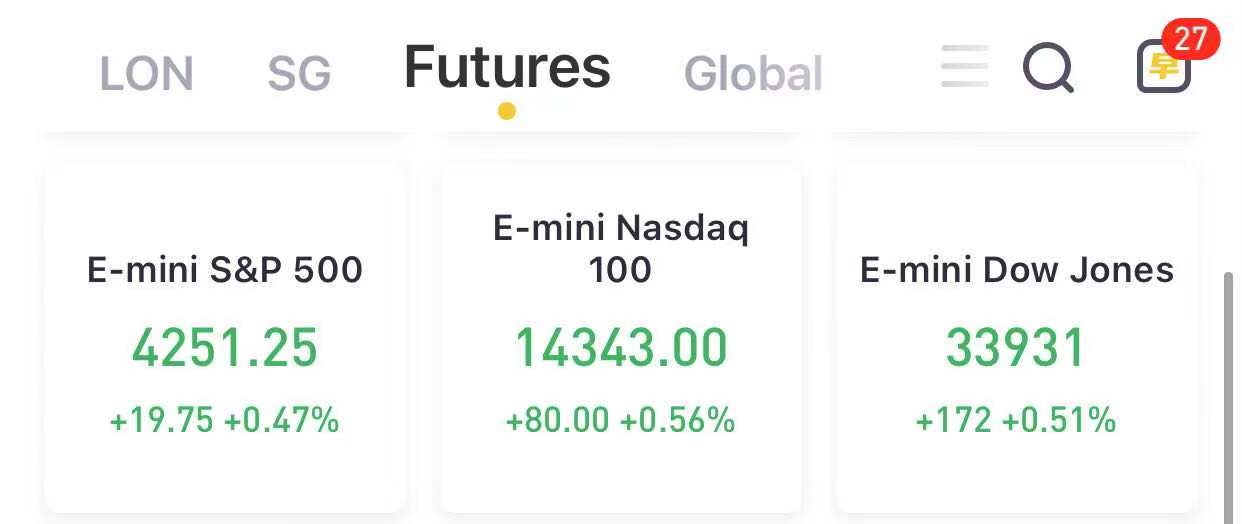

- Futures jump to all time highs ahead of Fed Speaker, Econ Data frenzy.

- Stock volatility hits fresh pandemic low.

- Eli Lilly stock jumps, Biogen drops on Alzheimer's treatment approval.

- Biogen shares dropped over 5% in premarket trading.

- Eli Lilly, Accenture, Rite Aid & more made the biggest moves in the premarket.

(June 24) Initial claims for unemployment insurance remained elevated last week as employers struggled to fill a record amount of job openings.

First-time filings totaled 411,000 for the week ended June 19, a slight decrease from the previous total of 418,000 and worse than the 380,000 Dow Jones estimate, the Labor Department reported Thursday.

Stocks rose with U.S. futures Thursday as traders weighed the outlook for recovery and policy support ahead of a slew of economic reports. The pound fell.

U.S. contracts signaled the S&P 500 Index may regain some momentum after a lull. Eli Lilly & Co. jumped in premarket trading after speeding up its plan to file an application for its Alzheimer’s disease therapy and Accenture Plc rose after boosting its earnings forecast.

At 7:43 a.m. ET, Dow E-minis were up 172 points, or 0.51%, S&P 500 E-minis rose 19.75 points, or 0.47% and Nasdaq 100 E-minis gained 80 points, or 0.56%.

Big banks Wells Fargo, Bank of America, Morgan Stanley, Goldman Sachs and JPMorgan Chase & Co added between 0.5% and 1.0%ahead of the Fed's latest stress test results to be revealed at 430pm ET today.Tesla rose 2.7% after Elon Musk said he would list SpaceX’s space internet venture, Starlink, when its cash flow is reasonably predictable, adding that Tesla shareholders could get preference in investing. First Solar climbed as the U.S. was said to be on the verge of barring some solar products made in China’s Xinjiang region. Mega-cap tech names Alphabet, Nvidia, Microsoft, Netflix and Facebook also gained between 0.4% and 0.6%, setting the Nasdaq for a record open. MGM Resorts International rose 2.7% after Deutsche Bank upgraded the casino operator’s stock to “buy” from “hold”.

Here are some of the biggest U.S. movers today:

- Retail trader favorites gain in premarket trading with Clover Health (CLOV) rising 5.5% and Sundial (SNDL) gaining 6%.

- Daqo New Energy (DQ) drops 6.8% and JinkoSolar (JKS) slides 1.5% with the U.S. poised to block some solar products made in China’s Xinjiang region.

- Information technology services provider DHI Group (DHX) surges 18% after the company’s board authorized a stock buyback program of up to $12 million.

- India Globalization Capital (IGC) rallies 35% after announcing it completed the final cohort of its Phase 1 clinical trial on its tetrahydrocannabinol drug, intended to alleviate Alzheimer’s disease symptoms.

So far this week, the value index, which includes economy-linked energy, financial and industrial stocks, and its tech-heavy growth counterpart are both up almost 1.8% following the Federal Reserve’s hawkish forecast from a week ago.

On Wednesday, Dallas Fed President Robert Kaplan said the economy will likely meet the Fed’s threshold for tapering asset purchases sooner than people think, while his Atlanta peer Raphael Bostic said the central bank could decide to slow such purchases in the next few months. Despite the ongoing hawkish commentary, markets pushed higher realizing that the Fed can never again let stocks drop or else the entire ponzi scheme risks collapsing.

Indeed, stock buyers have shaken off the hawkish turn by the Federal Reserve and are now viewing it as a way to bring inflation under control, according to Sebastien Galy, a Luxembourg-based strategist at Nordea Investment Funds.

"The interesting development over the past few days suggests that the markets are in a temporary stasis buying on dips as the fear of missing out prevails,"said Sebastien Galy, senior macro strategist at Nordea Asset Management. “This is evident in the rotation into growth stocks which makes little sense in a time of likely rising interest rates as they are quite leveraged, though not all." Still, Galy concluded that “we expect equity markets to continue to rebound in the coming weeks."

Stocks making the biggest moves in the premarket: Eli Lilly, Accenture, Rite Aid & more:

1) Eli Lilly(LLY) – The drugmaker's shares surged 8.7% in the premarket after Lilly's Alzheimer's treatment received "breakthrough therapy" designation from the Food and Drug Administration. The designation means the treatment may show substantial improvement over existing therapies and qualifying it for expedited development and approval.

2) Accenture(ACN) – The consulting firm beat estimates by 17 cents a share, with quarterly profit of $2.40 per share. Revenue topped Street forecasts as well. Accenture saw increasing demand for digital transformation services, with more companies moving to adapt to a hybrid work model. Accenture also raised its full-year forecast, and its stock jumped 4.3% in premarket trading.

3) Rite Aid(RAD) – The drugstore chain reported quarterly earnings of 38 cents per share, 16 cents a share above estimates. Revenue came in slightly short of Wall Street forecasts, however, and its shares fell 6% in the premarket.

4) Darden Restaurants(DRI) – The parent of Olive Garden and other restaurant chainsearned $2.03 per sharefor its latest quarter, compared to a $1.79 a share consensus estimate. Darden's same-restaurant sales surge 90.4% compared to the mid-pandemic year-ago quarter.

5) KB Home(KBH) – KB Home reported quarterly earnings of $1.50 per share, 18 cents a share above estimates. The home builder’s revenue missed Wall Street forecasts, however, despite a selling price increase of 13% and a 145% surge in new orders. KB Home shares lost 4% premarket action.

6) Visa(V) – Visa struck a deal to buy European banking platform Tinkfor about $2.2 billion. The move to acquire the financial data sharing company comes after Visa terminated its planned $5.3 billion acquisition of Plaid following a government lawsuit.

7) Comcast(CMCSA) – The parent of NBCUniversal and CNBC is mulling various ways to dominate video streaming, according to The Wall Street Journal. The paper said CEO Brian Roberts is mulling ideas like a tie-up withViacomCBS(VIAC) or an acquisition ofRoku(ROKU). Comcast told CNBC the story is “pure speculation.” The stock added 1.6% in the premarket.

8) Beyond Meat(BYND) – Some Dunkin’ locations have dropped Beyond Meat’s “Beyond Sausage” breakfast sausage, according to a J.P. Morgan analyst, and a Goldman analyst said a wrap featuring the sausage is likely to suffer the same fate. Dunkin’ told CNBC it continues to have a strong relationship with Beyond Meat and continues to explore new plant-based menu items. Beyond Meat fell 1.3% in the premarket.

9) Steelcase(SCS) – Steelcase surged 5.2% in premarket trading after it reported a smaller-than-expected loss for its latest quarter. The office furniture maker’s revenue also beat Wall Street estimates. The company said revenue will improve on a sequential basis as more workers return to their offices.

10) MGM Resorts(MGM) – MGM Resorts was upgraded to “buy” from “hold” at Deutsche Bank, which said the hotel and casino operator is likely to exceed its targets for profit margin improvement. MGM shares rose 2.3% in premarket trading.

11) Dollar Tree(DLTR) – Dollar Tree was downgraded to “neutral” from “overweight” at Piper Sandler. The firm said the discount retailer will be impacted by rising freight and wage costs that it won’t be able to pass through to customers. The stock fell 1.3% in the premarket.

US Event Calendar

- 8:30am: May Durable Goods Orders, est. 2.8%, prior -1.3%; Less Transportation, est. 0.7%, prior 1.0%

- 8:30am: 1Q GDP Annualized QoQ, est. 6.4%, prior 6.4%

- 8:30am: June Initial Jobless Claims, est. 380,000, prior 412,000; Continuing Claims, est. 3.46m, prior 3.52m

- 8:30am: May Advance Goods Trade Balance, est. -$87.5b, prior -$85.2b, revised -$85.7b

- 8:30am: May Retail Inventories MoM, est. -0.5%, prior -1.6%, revised -1.8%; Wholesale Inventories MoM, est. 0.8%, prior 0.8%

- 11am: June Kansas City Fed Manf. Activity, est. 24, prior 26

- 430pm: Federal Reserve releases latest stress test results with all big six banks expected to pass paving the way for increased dividends and share buybacks.

Central Bank Speakers

- 9am: Fed’s Barkin Speaks During Virtual Event

- 9:30am: Fed’s Bostic and Harker Speak on Monetary Policy Panel

- 11am: Fed’s Williams Takes Part in Moderated Discussion

- 1pm: Fed’s Kaplan Discusses Economy

- 1pm: Fed’s Bullard Discusses Outlook for Economy and Monetary...

- 4pm: Fed’s Barkin Speaks During Virtual Event