(Oct 18) Stock futures fell Monday morning to give back some gains after theS&P 500's best week since July, with investors' concerns over elevated inflation offsetting hopes that more companies will follow the lead of the big banks last week and post strong quarterly earnings results.

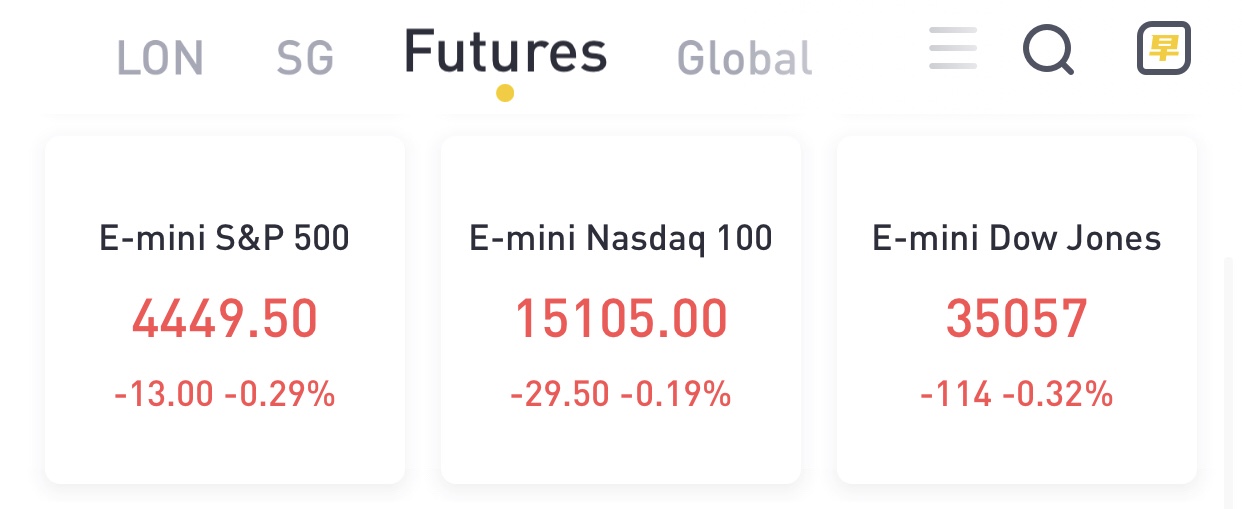

At 07:55 a.m. ET, Dow e-minis were down 114 points, or 0.32%, S&P 500 e-minis were down 13 points, or 0.29%, and Nasdaq 100 e-minis were down 29.5 points, or 0.19%.

Stocks making the biggest moves in the premarket:

- Baidu shares erased earlier losses and climbed as much as 4.3% in Hong Kong, as China debates rules to make hundreds of millions of articles on Tencent’s WeChat messaging app available via search engines like Baidu’s.

- Crypto-related stocks in action as Bitcoin leaps as much as 5.3% and is just shy of a fresh six-month high. Riot Blockchain, Inc., Marathon Digital Holdings Inc and Coinbase Global, Inc. are all up.

- Tesla Motors shares rise 0.2% in premarket trading Monday, poised for 50% rally from a March 8 low, ahead of its third-quarter results on Wednesday.

- Dynavax shares rise as much as 10% in U.S. pre-trading hours after the biopharmaceutical company announced that Valneva reported the trial of inactivated, adjuvanted Covid-19 vaccine candidate VLA2001 met its co-primary endpoints

- Walt Disney drops in premarket trading after Barclays downgrades to equal-weight as the company faces a “tough” task to get to its long-term streaming subscription guidance.

- NetApp slips 2.2% in premarket trading after Goldman Sachs analyst Rod Hall cut the recommendation on NetApp Inc. to sell from neutral.

In FX, the Bloomberg Dollar Spot Index advanced as the dollar traded higher versus all of its Group-of-10 peers Traders pulled forward rate- hike bets after BoE governor Bailey said the central bank “will have to act” on inflation. U.K. money markets now see 36 basis points of BoE rate increases in December and are pricing 15 basis points of tightening next month. Traders are also now betting the BoE’s key rate will rise to 1% by August, from 0.1% currently. The euro struggled to recover after falling below the $1.16 handle in the Asian session; money markets are betting the ECB will hike the deposit rate to -0.4% in September as expectations for global central-bank policy tightening gather pace. Resilience in the spot market and a divergence with rate differentials in the past sessions has resulted in a flatter volatility skew for the euro.

In rates, treasuries were under pressure led by belly of the curve as rate-hike premium continues to increase in global interest rates. Yields, though off session highs, remain cheaper by nearly 5bp in 5-year sector; 2s5s30s fly topped at -12.5bp, cheapest since 2018; 10-year is up 2.8bp around 1.60% vs 3.4bp increase for U.K. 10-year. Belly-led losses flattened U.S. 5s30s by as much as 5.4bp to tightest since April 2020 at around 86.1bp; U.K. 5s30s curve is flatter by ~8bp after its 5-year yield rose as much as 14bp.

Gilts led the move, with U.K. 2-year yield climbing as much as 16.8bp to highest since May 2019 as money markets priced in more policy tightening after Governor Andrew Bailey said the Bank of England “will have to act” on inflation. With latest moves, U.S. swaps market prices in two Fed hikes by the end of 2022.

In commodities, WTI rose 1%, trading just off session highs near $83.20; Brent holds above $85. Spot gold drifts lower near $1,762/oz. Most base metals are in the green with LME lead and tin outperforming.

Looking at today's calendar, we have industrial production, US September industrial production, capacity utilisation, October NAHB housing market index. Fed speakers include Quarles, Kashkari.