(Oct 11) The Third-quarter earnings season ramps up in earnest this week with a packed schedule of major financial companies poised to report results. Investors have been anxiously awaiting the start of the latest earnings season and bracing for a deceleration in corporate profit growth after a strong second quarter.

The pace of S&P 500 year-over-year earnings and sales growth reached eye-popping levels for the second quarter due to the easy comparisons with Covid-ravaged 2020 and robust economic growth. The expectations going into this reporting season are more modest, with earnings slated to grow at almost 28% year-over-year.

If history is any guide, the actual performance should still exceed these elevated levels despite a moderation in economic activity. While it will be necessary for earnings to beat expectations, forward guidance will be essential with the current worries about the economic outlook and cost pressures.

There are 20 S&P 500 companies scheduled to report earnings this week, but the primary focus will be on the financials and the banks in particular. According to FactSet, the financials should be around the middle of the pack in earnings growth rates, with consensus year-over-year growth estimates of 17%.

There are a handful of other companies like Delta Air Lines (DAL), Domino’s Pizza (DPZ), Taiwan Semiconductor Manufacturing Company(TSM)on the calendar.

This season, the impact of higher costs and the ability to pass on higher prices to protect profit margins will be closely scrutinized across all companies. Labor costs will be a headwind for companies, with average hourly earnings rising at a 4.6% year-over-year rate in September. Offsetting higher labor costs is that companies have only re-hired 78% of the jobs lost during the Covid-lockdown. Higher commodity costs will also negatively impact most company’s profitability. The increase in commodity prices goes beyond oil, but as an example, the sharp rise in oil prices negatively impacts the costs for many non-energy companies. The energy sector had a loss in the third quarter of 2020, but the expected 53% increase in sales tells the story of the oil price rebound.

Supply chain disruptions remain a significant issue for this earnings season. These disruptions both increased costs for most companies and resulted in lost sales for companies unable to secure the goods demanded by consumers. Increased shipping costs are almost certain to be a familiar refrain by the end of this reporting season. In the end, robust demand and increased productivity should overcome all these challenges and allow the actual third-quarter results to exceed expectations.

Aside from earnings, Congress has reached a deal to raise the debt limit enough to kick the can down the road until December 3 at least. Recall that previously, Congress was able to pass a short-term budget resolution to avoid a government shutdown until this date. This temporary measure should allow enough time for the Democrats, who control all three branches of the federal government, to unilaterally raise the debt ceiling via reconciliation. With the debt ceiling crisis averted until December, Congress will now return to focusing on negotiating the hefty tax and spending bills.

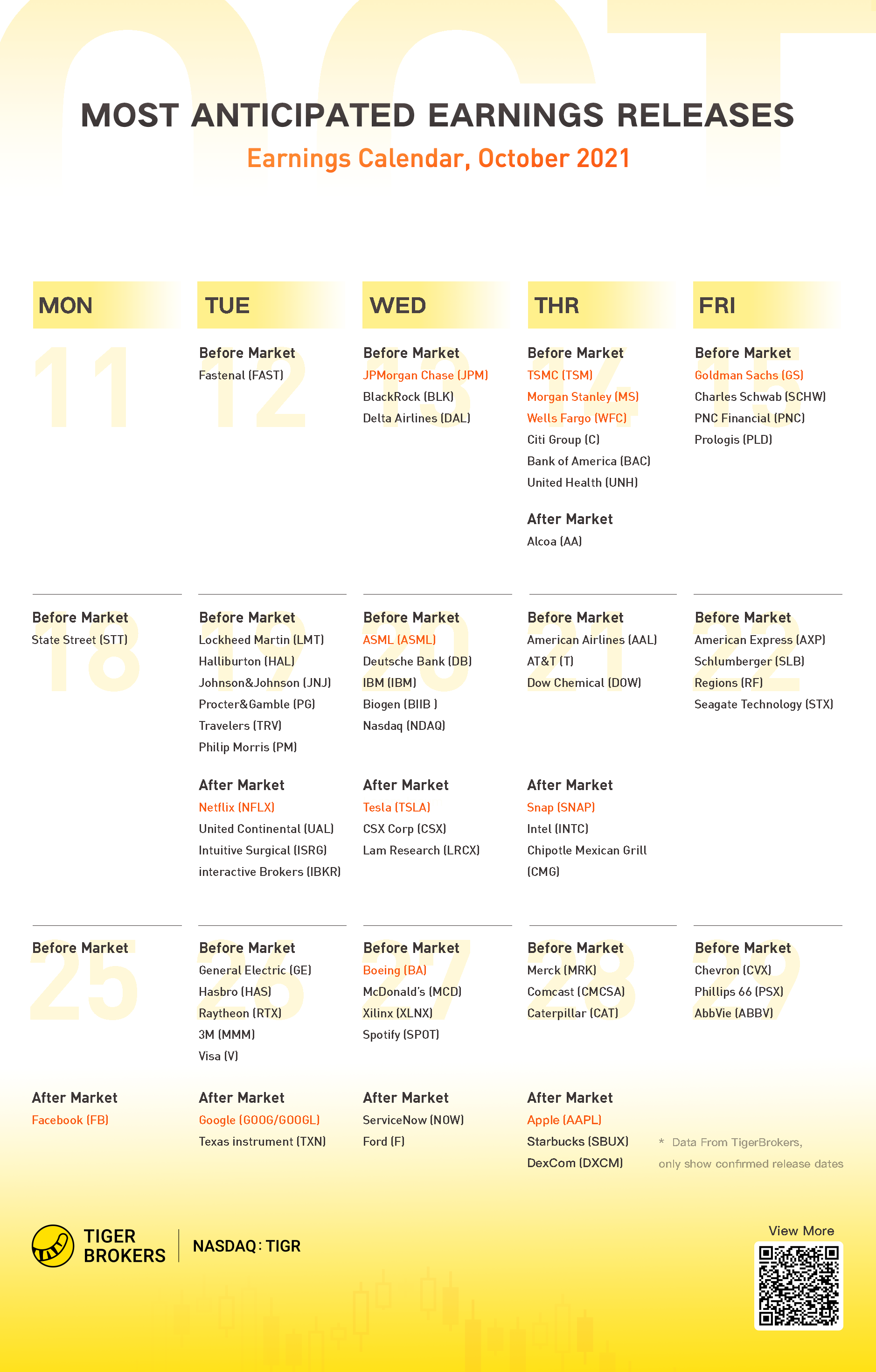

Earnings calendar

- Monday: No notable reports scheduled for release

- Tuesday: Fastenal before market open

- Wednesday: JPMorgan Chase, BlackRock, First Republic Bank , Delta Air Lines before market open

- Thursday: Bank of America , Domino's Pizza , Walgreens Boots Alliance , The Progressive Corp. (PGR), UnitedHealth Group (UNH), US Bancorp (USB), Wells Fargo, Morgan Stanley, Citigroup before market open; Alcoa after market close

- Friday: PNC Financial Services Group Inc, Truist Financial Corp, Coinbase Global, Inc., The Charles Schwab, Goldman Sachs before market open