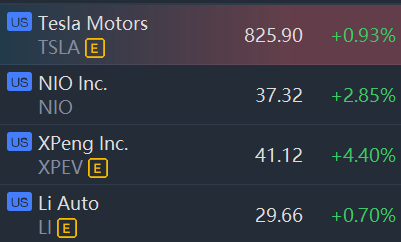

EV stocks rose in morning trading.Tesla,Nio,Xpeng Motors and Li Auto climbed between 1% and 4%.

Tesla edged higher Friday after a Jefferies analyst raised his price target on the electric vehicle maker to $950 from $850.

Analyst Philippe Houchois, who affirmed a buy rating on Tesla, boosted his price target after raising his estimates of earnings before interest and taxes 7% to 9% for 2022-2023, according to the Fly.

Following further analysis of third-quarter data and various sources of information on the soon-to-be launched Berlin facility, the analyst said that he saw a higher capacity ramp and sustained demand.

In addition, Houchois said sees little evidence of legacy automakers closing the gap as Tesla continues to challenge them "at multiple levels."

Chinese electric vehicle maker Nio Inc said it would double the capacity of its Hefei plant to 240,000 vehicles a year, up from 120,000 units.

XPeng published its first ESG report on Thursday. ESG is short for environmental, social and governance and companies publish ESG reports—sometimes called sustainability reports or impact reports—to tell stakeholders how their operations are impacting communities they serve.

Solid ESG reports are one less thing for investors to worry about. That’s good news for XPeng.