Bed Bath & Beyond stock plunged 13.4% in premarket trading after profit and sales miss, weak guidance.

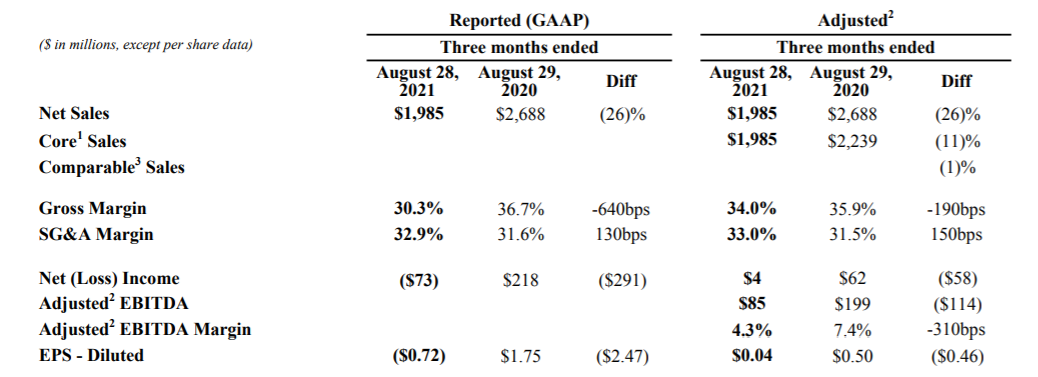

Bed Bath & Beyond Inc. today reported financial results for the second quarter of fiscal 2021 ended August 28, 2021.

Q2 Highlights

- Comparable Sales decline of (1)% versus Q2 2020 primarily driven by slower than expected traffic trends in August across stores and digital

- Bed Bath & Beyond banner Comparable Sales decline of (4)%; buybuy BABY banner growth of high-teens percentage

- Core Sales decline of (11)%, primarily due to the impact of fleet optimization

- Gross Margin of 30.3% and Adjusted2 Gross Margin of 34.0%

- Adjusted Gross Margin reflects 170 bps of higher merchandise margin versus last year, that was more than offset by freight cost increases of 360 bps and which were greater than anticipated, particularly at the end of the quarter

- SG&A expense in-line with expectations

- Adjusted EBITDA of $85 million as a result of Net Sales and Adjusted2 Gross Margin performance

- Guidance outlook for 2021 third quarter established

- Revised full fiscal year 2021 guidance outlook to reflect year-to-date performance

Mark Tritton, Bed Bath & Beyond’s President and CEO said, “While our results this quarter were below expectations, we remain confident in our multi-year transformation. Following solid growth in June, we saw unexpected, external disruptive forces towards the end of the quarter that impacted our outcome. In August, the final and largest month of our second fiscal period, traffic slowed significantly and, therefore, sales did not materialize as we had anticipated. As COVID-19 fears re-emerged amid the on-going Delta variant, we experienced a challenging environment. This was particularly evident in large, key states such as Florida, Texas and California, which represent a substantial portion of our sales. Furthermore, unprecedented supply chain challenges have been impacting the industry pervasively, and we saw steeper cost inflation escalating by month, especially later in the quarter, beyond the significant increases that we had already anticipated. This outpaced our plans to offset these headwinds. These factors impacted sales and gross margin."

Tritton added, "Encouragingly, we've continued to make progress against the fundamentals of our three-year transformation strategy. Our buybuy BABY banner continued to build on its positive momentum from the past several quarters, growing double digits due to strength in apparel and travel gear and increasing market share for the period. We also celebrated the July re-opening of our Bed Bath & Beyond banner's NYC flagship store in Chelsea as part of our comprehensive store remodel program, which is exceeding our expectations. Our higher margin Owned Brands are outperforming our penetration goals across the overall chain, and even stronger in remodeled stores. As a group, we continued to leverage our enhanced digital channel, with significant growth above 2019 at nearly double the proportion of sales. Operationally, we entered the next phase of our supply chain modernization through our partnership with Ryder which is instrumental to our strategy. We are committed to executing over the short, mid and long term, especially during these early stages of our multi-year plan."

"Our financial foundation is strong. We generated positive operating cash flow during the quarter. Our cash balance, coupled with our recently amended asset-based revolving credit facility, provides us on-going capital and liquidity strength of $2.0 billion. We are well positioned to continue our planned investments in our business and pave the way towards a more profitable future. We have the plan, the team and the resources to unlock our potential."

Fiscal 2021 Third Quarter Outlook

The Company expects fiscal 2021 third quarter Net Sales of between $1.96 billion to $2.0 billion, which only reflects sales from the Company's Core businesses. Net Sales also includes planned sales reductions from divestitures and the Company's store fleet optimization program. On a Comparable Sales basis, the Company expects to be approximately flat compared to the prior year period.

The Company expects to achieve Adjusted Gross Margin in the range of 34% to 35%. This guidance reflects the impact of anticipated greater global supply chain challenges

The Company expects Adjusted EBITDA between $80 million to $85 million and Adjusted2 EPS in the range of $0.00 to $0.05 per diluted share for the fiscal 2021 third quarter.

Fiscal Year 2021 Outlook

Based on its year-to-date performance in the fiscal first half of the year, as well as current expectations for the fiscal third quarter, the Company is revising its fiscal year 2021 guidance outlook.

The Company now expects higher fiscal year 2021 Net Sales of $8.1 billion to $8.3 billion. The Company expects comparable sales of flat to up slightly for the second through fourth quarters of fiscal 2021.

Adjusted Gross Margin is now anticipated to be in a range of 34.0% to 35.0% and Adjusted SG&A is expected to be approximately 32%.

The Company now expects Adjusted EBITDA to be in the range of $425 million to $465 million and Adjusted EPS range of $0.70 to $1.10 per diluted share.