- Twitter and Blackstone shares climb on deal reports; Megacap tech stocks gain premarket.

- Oil extends drop; Treasury yields steady before jobs data.

(Oct 7) U.S. equity futures rose with stocks Thursday, bolstered by progress on U.S. debt-ceiling talks and Russia’s offer to ease Europe’s energy crunch. Treasuries were steady ahead of key jobs data.

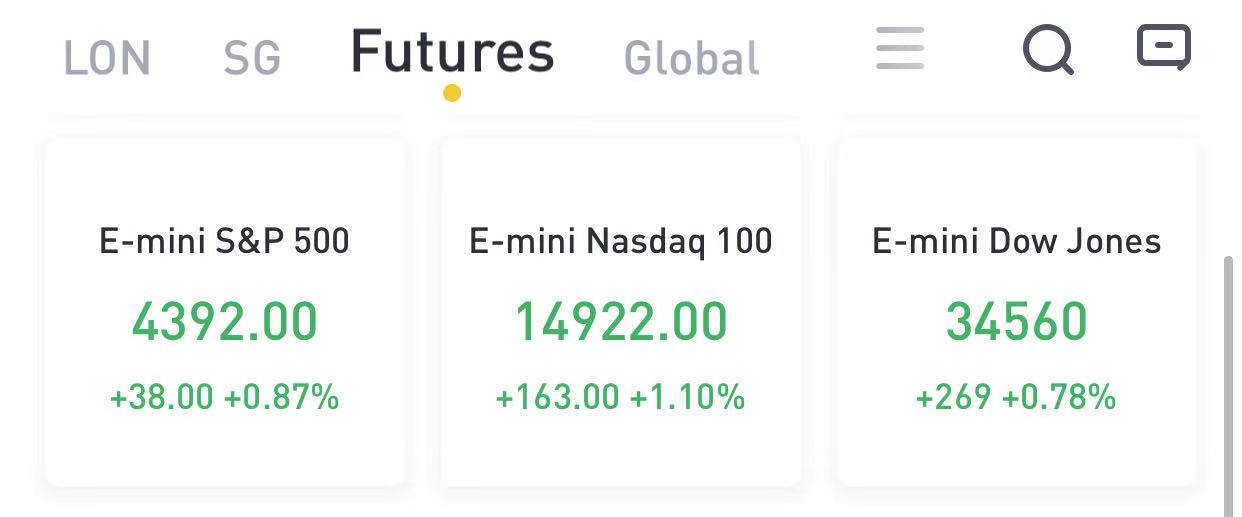

At 7:16 a.m. ET, Dow E-minis were up 269 points, or 0.78%, S&P 500 E-minis gained 38 points, or 0.87% and Nasdaq 100 E-minis rose 163 points, or 1.10%.

Here’s what we’re watching ahead of Thursday’s open:

- Twitter shares rose 2% in premarket trading after the company said it is selling mobile ad firm MoPub toAppLovinAPP4.41%for $1.05 billion in cash. AppLovin jumped more than 9%.

- Private equity giant Blackstone Group LP rose 3.3%. It said it will acquire a majority stake in visa outsourcing services provider VFS Global from EQT, another private equity investor.

- Barry Diller ‘s media conglomerate IAC/InterActiveCorp climbed 4.5% after it reached a $2.7 billion deal to buy Meredith, a magazine publisher with brands such as People and InStyle.

- Megacap tech companies gained premarket as government bond yields edged down.Amazon.com, Google-parent Alphabet and Microsoft all added around 1%. NVIDIA Corp rose 2%.

- Earnings are due from ConAgra, Tilray Inc., Lamb Weston Holdings, Inc. and Helen Of Troy before the opening bell.

- Levi Strauss & Co advanced 4%. The denim company reported higher sales in the third quarter, lifting profits.

- Vaccine makerModernaMRNA-8.94%slipped 1.7%, extending Wednesday’s slide into a second day. The stock has lost over 20% of its value this month so far.

- Oil company shares followed crude prices down. Valero Energy slipped 2.4%,Occidental Petroleum declined 2.3% and Diamondback Energy retreated 2%.

- Accolade, Inc. will report earnings after the close.

- Airline stocks have gained more than 10% over the past month, as broader equity markets tumbled. However, this is merely a partial rebound from a bad summer for aviation shares, including those of plane makers. Only budget-airline stocks currently trade above their pre-Covid levels.